OpenText Investor Presentation Deck

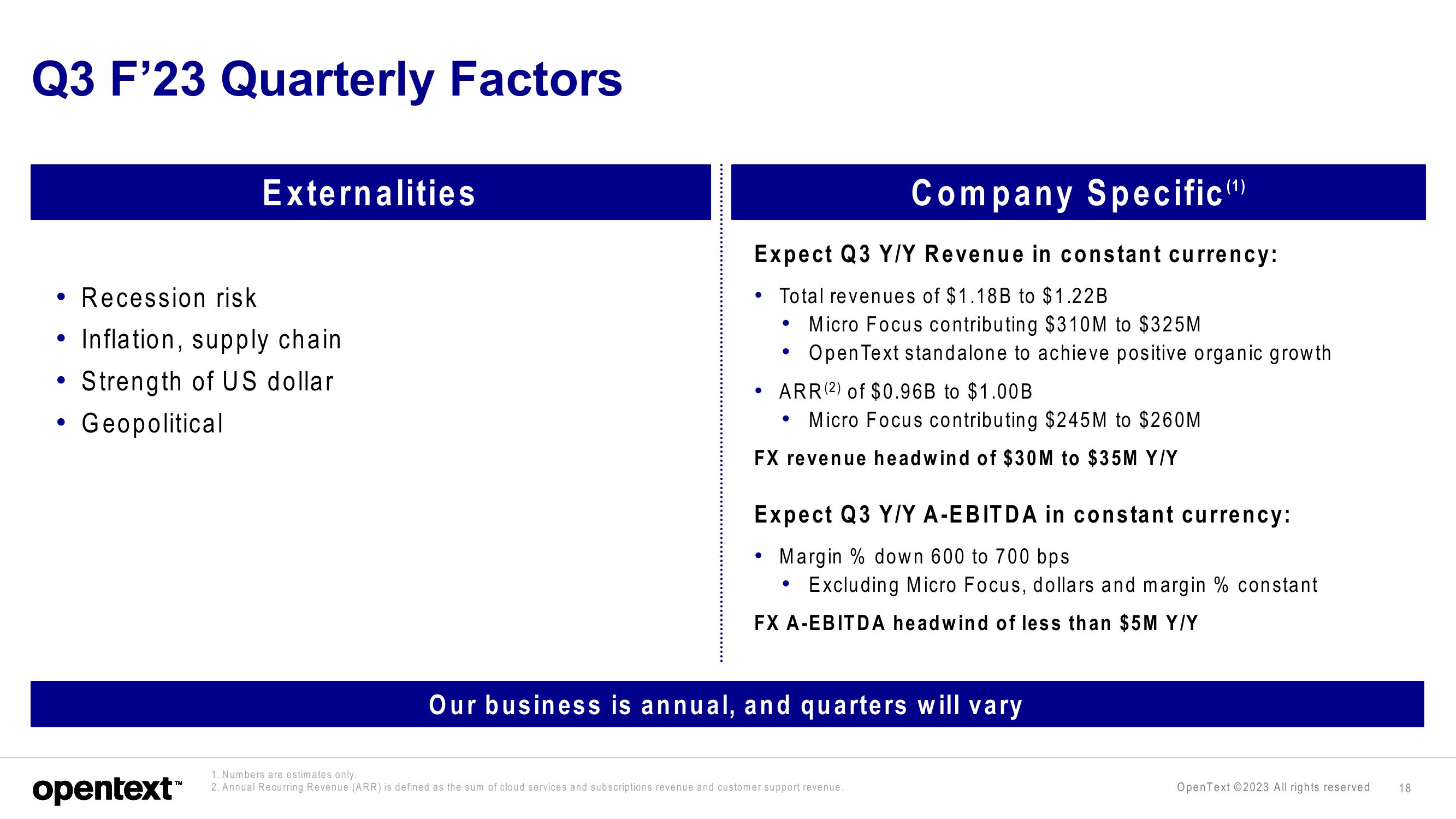

Q3 F'23 Quarterly Factors

●

Recession risk

Inflation, supply chain

●

• Strength of US dollar

Geopolitical

Externalities

opentext™

Company Specific (¹)

Expect Q3 Y/Y Revenue in constant currency:

Total revenues of $1.18B to $1.22B

• Micro Focus contributing $310M to $325M

Open Text standalone to achieve positive organic growth

●

ARR (2) of $0.96B to $1.00B

Micro Focus contributing $245M to $260M

FX revenue headwind of $30M to $35M Y/Y

●

Expect Q3 Y/Y A-EBITDA in constant currency:

Margin % down 600 to 700 bps

Excluding Micro Focus, dollars and margin % constant

●

FX A-EBITDA headwind of less than $5M Y/Y

Our business is annual, and quarters will vary

1. Numbers are estimates only.

2. Annual Recurring Revenue (ARR) is defined as the sum of cloud services and subscriptions revenue and customer support revenue.

OpenText ©2023 All rights reserved

18View entire presentation