Jefferies Financial Group Investor Presentation Deck

■

■

■

Capital Raising Update

Marketing & Investor Relations team includes 25 professionals (up from 13 in FY 2020), providing global

client coverage

■

Added new team member based in Singapore to enhance coverage of the APAC region which now

includes professionals based in Hong Kong, Tokyo, and Singapore

Despite a challenging capital raising environment, Leucadia's Marketing and Investor Relations Team

has raised over $2.4 billion in LTM Q3'23

Selectively expanding team across functional areas and regions to facilitate optimal support for

clients and affiliated managers

■

Significant commitments into Point Bonita, JAT Capital, FourSixThree, Manteio, and Pearlstone

Point Bonita has reached ~$1.4 billion of overall AUM; the strategy expects to remain closed until

early next year as it builds its portfolio and creates additional capacity

Strong pipeline for remainder of 2023 and H1 2024

Recent strategy additions are gaining marketing momentum (e.g. Pearlstone and StemPoint)

42% of managers still have less than 3-year track record

Long/short hedge funds (e.g. ISO-mts, JAT, Kathmandu, StemPoint, SVI, and 31512 Capital) have

performed well YTD on an absolute / relative basis despite a volatile market environment

Actively marketing private strategies (e.g. Hildene Private Credit Fund, Monashee Growth Equity

Strategy, and Point Bonita)

Supporting the Jefferies Finance platform:

Additionally, our Marketing and Investor Relations team provides support to our Investment Banking

joint venture, Jefferies Finance

Significant commitments including $625 million investment from ADIA into Large-Cap BDC

Actively marketing JCP Middle Market Direct Lending Fund II

See pages 65-70 at the back of this presentation for endnotes.

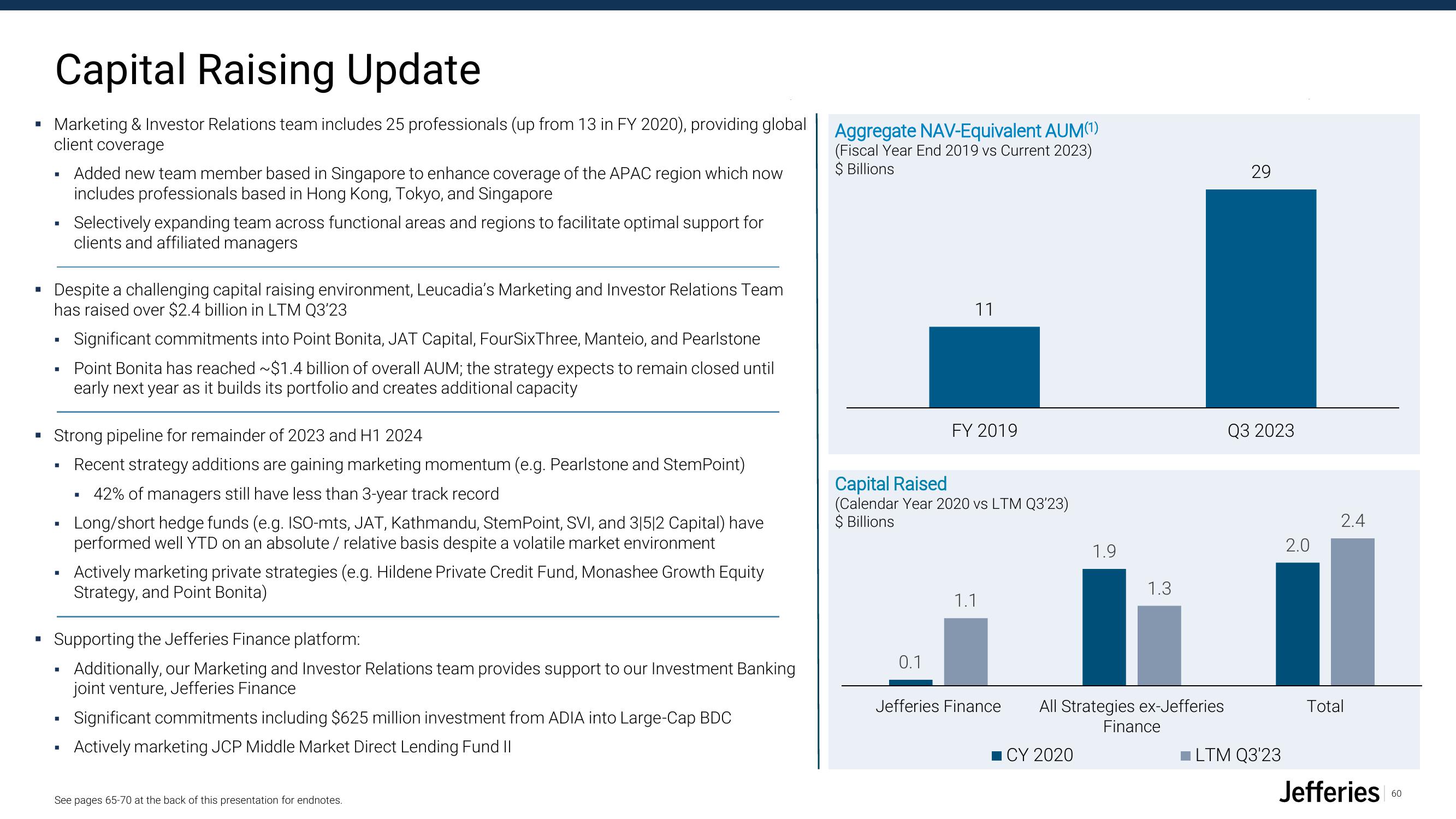

Aggregate NAV-Equivalent AUM(1)

(Fiscal Year End 2019 vs Current 2023)

$ Billions

11

0.1

FY 2019

Capital Raised

(Calendar Year 2020 vs LTM Q3'23)

$ Billions

1.1

Jefferies Finance

1.9

■CY 2020

1.3

All Strategies ex-Jefferies

Finance

29

Q3 2023

LTM Q3'23

2.0

2.4

Total

Jefferies

60View entire presentation