Centrica Results Presentation Deck

A strong balance sheet key to

growing shareholder value

• Robust balance sheet and strong investment grade credit ratings

Triennial pensions review expected to conclude in H1 2022

Seeking to grow operating cash flows over time

Focused cost management

●

●

• Disciplined deployment of capital

●

- Maintenance capital of ~£100m p.a.

- Potential investments in energy transition opportunities

Deliver attractive shareholder returns

-

Restart dividend and grow over time

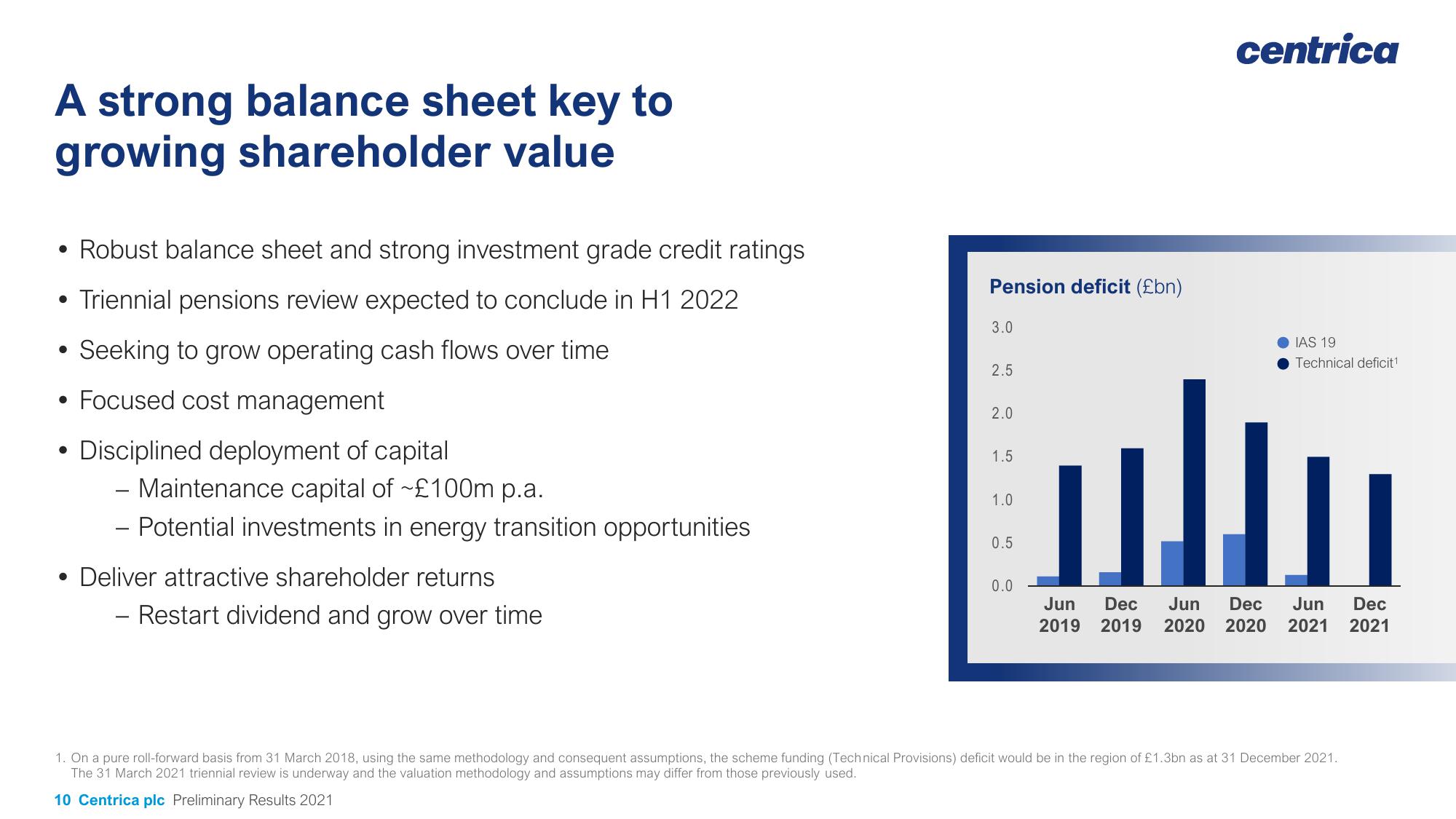

Pension deficit (£bn)

3.0

2.5

2.0

1.5

1.0

0.5

0.0

centrica

IAS 19

Technical deficit¹

رلار

Jun

Dec Jun Dec Jun Dec

2019 2019 2020 2020 2021 2021

1. On a pure roll-forward basis from 31 March 2018, using the same methodology and consequent assumptions, the scheme funding (Technical Provisions) deficit would be in the region of £1.3bn as at 31 December 2021.

The 31 March 2021 triennial review is underway and the valuation methodology and assumptions may differ from those previously used.

10 Centrica plc Preliminary Results 2021View entire presentation