Alternus Energy SPAC Presentation Deck

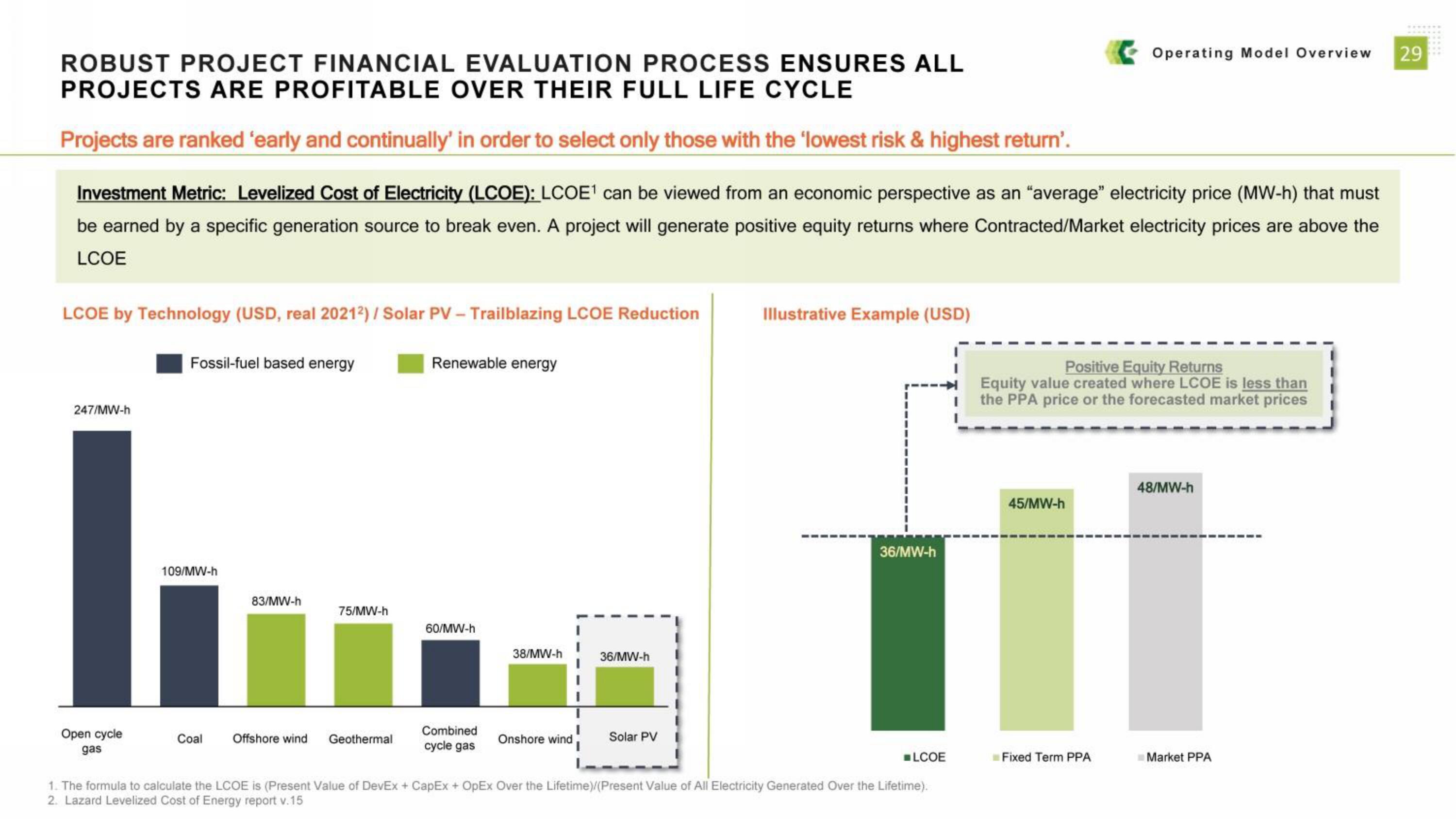

ROBUST PROJECT FINANCIAL EVALUATION PROCESS ENSURES ALL

PROJECTS ARE PROFITABLE OVER THEIR FULL LIFE CYCLE

Projects are ranked 'early and continually' in order to select only those with the 'lowest risk & highest return'.

Investment Metric: Levelized Cost of Electricity (LCOE): LCOE¹ can be viewed from an economic perspective as an "average" electricity price (MW-h) that must

be earned by a specific generation source to break even. A project will generate positive equity returns where Contracted/Market electricity prices are above the

LCOE

LCOE by Technology (USD, real 20212) / Solar PV-Trailblazing LCOE Reduction

247/MW-h

Open cycle

gas

Fossil-fuel based energy

109/MW-h

Coal

83/MW-h

75/MW-h

Offshore wind Geothermal

Renewable energy

60/MW-h

Combined

cycle gas

38/MW-h

36/MW-h

Onshore wind Solar PV

Illustrative Example (USD)

36/MW-h

LCOE

1. The formula to calculate the LCOE is (Present Value of DevEx + CapEx + OpEx Over the Lifetime)/(Present Value of All Electricity Generated Over the Lifetime).

2. Lazard Levelized Cost of Energy report v.15

Operating Model Overview

Positive Equity Returns

Equity value created where LCOE is less than

I the PPA price or the forecasted market prices

45/MW-h

Fixed Term PPA

48/MW-h

Market PPA

29View entire presentation