Baird Investment Banking Pitch Book

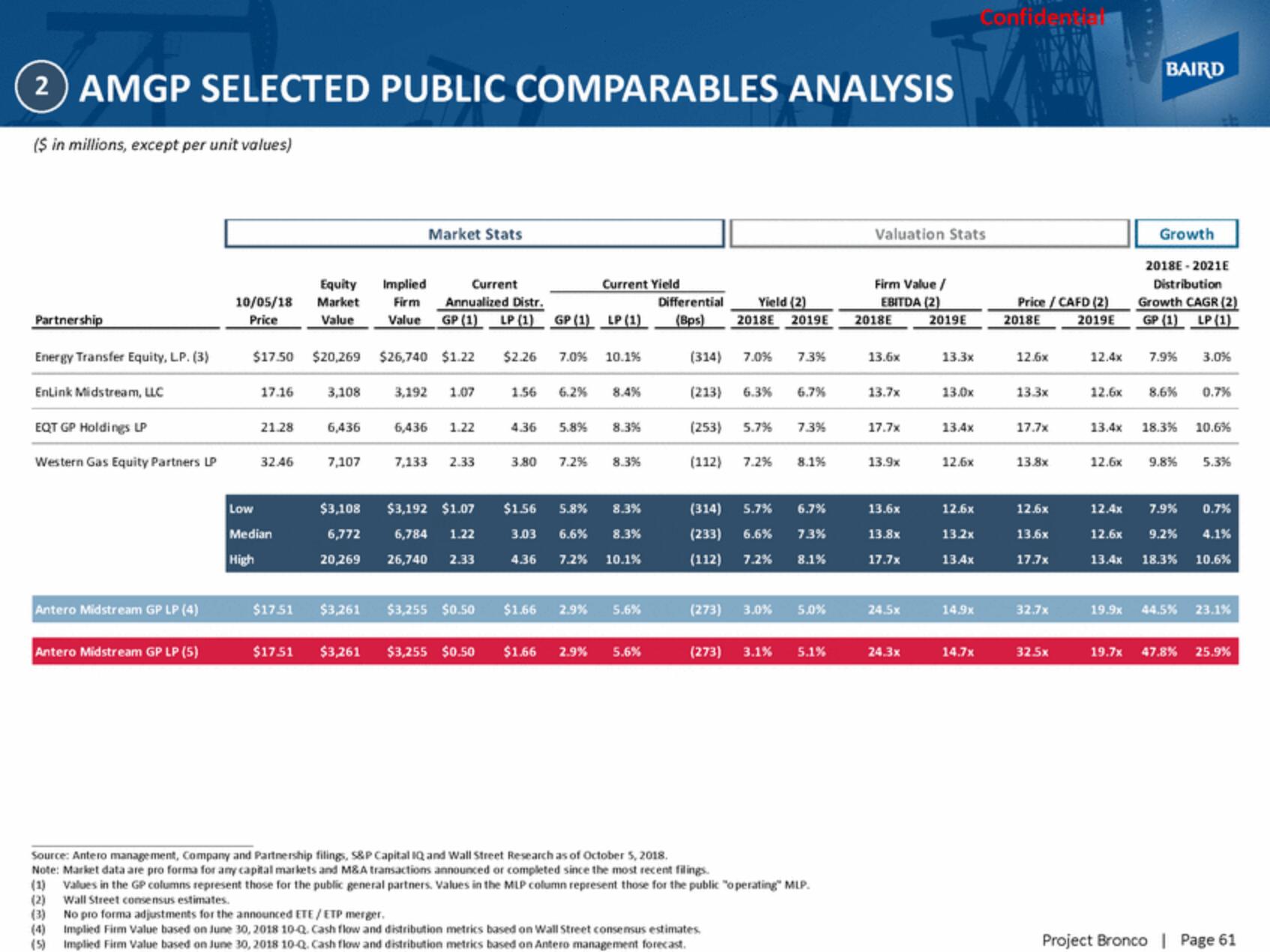

2) AMGP SELECTED PUBLIC COMPARABLES ANALYSIS

($ in millions, except per unit values)

Partnership

Energy Transfer Equity, LP. (3)

EnLink Midstream, LLC

EQT GP Holdings LP

Western Gas Equity Partners LP

Antero Midstream GP LP (4)

Antero Midstream GP LP (5)

Equity

10/05/18 Market

Price

Value

(2)

(3)

$17.50

17.16

21.28

32.46

Low

Median

High

$20,269

3,108

6,436

7,107

$3,108

6,772

20,269

Market Stats

Implied

Current

Firm Annualized Distr.

Value GP (1) LP (1) GP (1) LP (1)

$26,740 $1.22

3,192 1.07

6,436 1.22

7,133 2.33

$3,192 $1.07

6,784 1.22

26,740 2.33

$2.26

7.0%

1.56 6.2%

Current Yield

3.80 7.2%

10.1%

8.4%

4.36 5.8% 8.3%

8.3%

$1.56 5.8% 8.3%

3.03 6.6% 8.3%

4.36 7.2% 10.1%

$17.51 $3,261 $3,255 $0.50 $1.66 2.9% 5.6%

$17.51 $3,261 $3,255 $0.50 $1.66 2.9% 5.6%

Differential

(Bps)

(4)

(5) Implied Firm Value based on June 30, 2018 10-Q. Cash flow and distribution metrics based on Antero management forecast.

Yield (2)

2018E 2019E

(314)

(213) 6.3% 6.7%

(253) 5.7%

(112)

7.0% 7.3%

7.3%

7.2% 8.1%

(314) 5.7% 6.7%

(233) 6.6% 7.3%

(112) 7.2% 8.1%

(273) 3.0% 5.0%

Source: Antero management, Company and Partnership filings, S&P Capital IQ and Wall Street Research as of October 5, 2018.

Note: Market data are pro forma for any capital markets and M&A transactions announced or completed since the most recent filings.

(1) Values in the GP columns represent those for the public general partners. Values in the MLP column represent those for the public "operating" MLP.

Wall Street consensus estimates.

No pro forma adjustments for the announced ETE/ETP merger.

Implied Firm Value based on June 30, 2018 10-Q. Cash flow and distribution metrics based on Wall Street consensus estimates.

Valuation Stats

Firm Value /

EBITDA (2)

2019E

2018E

13.6x

13.7x

17.7x

13.9x

13.6x

13.8x

17.7x

24.5×

(273) 3.1% 5.1% 24.3x

13.3x

13.0x

13.4x

12.6x

12.6x

13.2x

13.4x

14.9x

Confidential

14.7x

Price/CAFD (2)

2019E

2018E

12.6x

13.3x

17.7x

13.8x

12.6x

13.6x

17.7x

32.7x

32.5x

12.4x

BAIRD

13.4x

Growth

2018E-2021E

Distribution

Growth CAGR (2)

GP (1) LP (1)

7.9%

12.6x 8.6%

18.3%

3.0%

0.7%

10.6%

12.6x 9.8% 5.3%

12.4x 7.9% 0.7%

12.6x 9.2% 4.1%

13.4x 18.3% 10.6%

19.9x 44.5% 23.1%

19.7x 47.8% 25.9%

Project Bronco | Page 61View entire presentation