Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

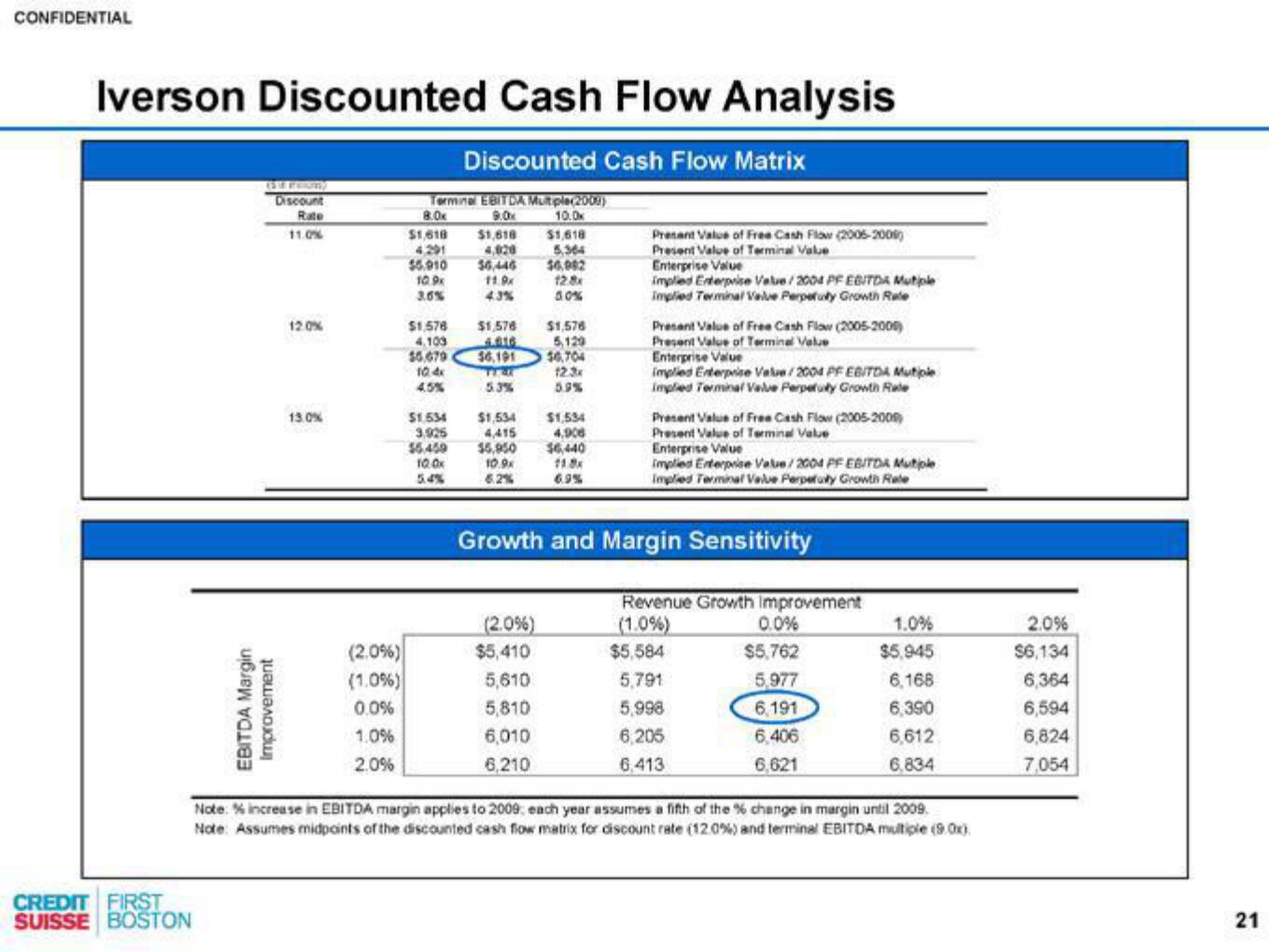

Iverson Discounted Cash Flow Analysis

Discounted Cash Flow Matrix

CREDIT FIRST

SUISSE BOSTON

Discount

Rate

11.0%

12.0%

13.0%

(2.0%)

(1.0%)

0.0%

1.0%

2.0%

Terminal EBITDA Multiple(2009)

8.0x

10.0

9.0x

$1,618 $1,618 $1,618

4,291 4,020

5,364

$5.910 $6,446 $6,902

10.9x 11.9x

3.6%

50%

$1,576

$0,704

12.3x

5.9%

$1,576

4,109

$5,679

10.4x

4.5%

$1,576

4.816

$6,191

TEAK

5.3%

$1.534

$1,534

$1,534

3.925 4,415 4,908

$5,459 $5,950 $6,440

100x 10.9

11.8x

6.2%

6.9%

(2.0%)

$5,410

Present Value of Free Cash Flow (2005-2006)

Present Value of Terminal Value

5,610

5,810

6,010

6,210

Enterprise Value

implied Enterprise Value/2004 PF EBITDA Mutiple

Implied Terminal Valve Perpetuly Growth Rute

Present Value of Free Cash Flow (2005-2009)

Present Value of Terminal Value

Enterprise Value

implied Enterprise Value/2004 PF EBITDA Mutiple

Implied Terminal Valve Perpetuly Growth Rale

Growth and Margin Sensitivity

Present Value of Free Cash Flow (2005-2009)

Present Value of Terminal Value

Enterprise Value

implied Enterprise Value/2004 PF EBITDA Mutiple

Implied Terminal Valve Perpetuty Growth Rate

Revenue Growth Improvement

(1.0%)

$5,584

5,791

5,998

6,205

6.413

0.0%

$5,762

5,977

6,191

6,406

6,621

1.0%

$5,945

6,168

6,390

6,612

6,834

Note: % increase in EBITDA margin applies to 2009: each year assumes a fifth of the % change in margin until 2009.

Note: Assumes midpoints of the discounted cash flow matrix for discount rate ( 12.0%) and terminal EBITDA multiple (90x)

2.0%

$6,134

6,364

6,594

6,824

7,054

21View entire presentation