Deutsche Bank Results Presentation Deck

Funding and liquidity

In € bn, unless stated otherwise

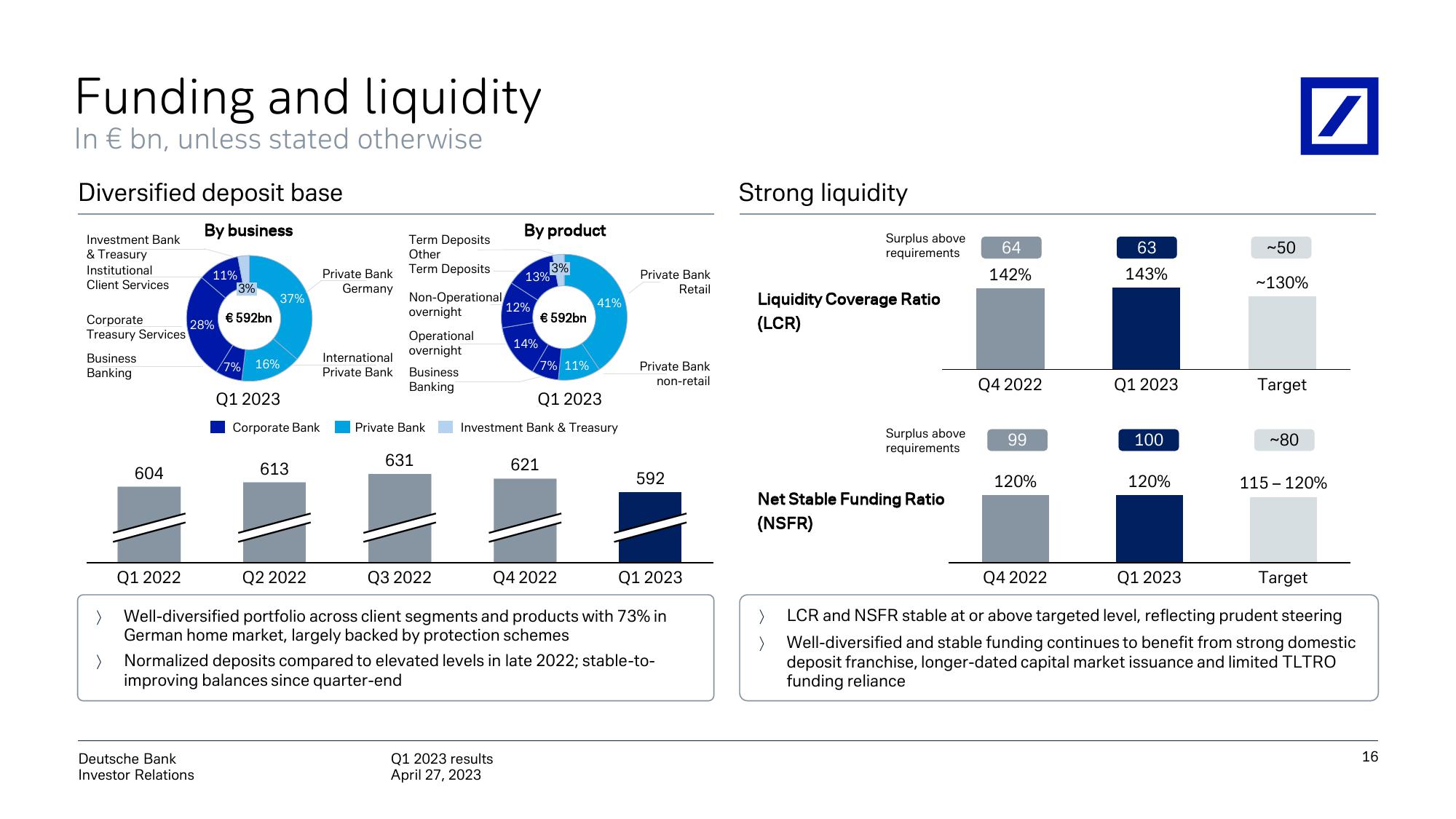

Diversified deposit base

By business

Investment Bank

& Treasury

Institutional

Client Services

Corporate

Treasury Services

Business

Banking

>

604

Q1 2022

11%

28%

3%

Deutsche Bank

Investor Relations

€ 592bn

7% 16%

Q1 2023

37%

Corporate Bank

613

Private Bank

Germany

International

Private Bank

Term Deposits

Other

Term Deposits

Non-Operational

overnight

Operational

overnight

Business

Banking

Private Bank

631

By product

13%

12%

Q1 2023 results

April 27, 2023

14%

3%

€ 592bn

/7% 11%

621

Q1 2023

Investment Bank & Treasury

41%

Private Bank

Retail

Private Bank

non-retail

Q2 2022

Q3 2022

Q4 2022

Q1 2023

Well-diversified portfolio across client segments and products with 73% in

German home market, largely backed by protection schemes

592

> Normalized deposits compared to elevated levels in late 2022; stable-to-

improving balances since quarter-end

Strong liquidity

Surplus above

requirements

Liquidity Coverage Ratio

(LCR)

>

Surplus above

requirements

Net Stable Funding Ratio

(NSFR)

64

142%

Q4 2022

99

120%

63

143%

Q1 2023

100

120%

~50

~130%

Target

~80

/

115 - 120%

Q4 2022

Q1 2023

Target

LCR and NSFR stable at or above targeted level, reflecting prudent steering

Well-diversified and stable funding continues to benefit from strong domestic

deposit franchise, longer-dated capital market issuance and limited TLTRO

funding reliance

16View entire presentation