Third Quarter 2022 Earnings Conference Call

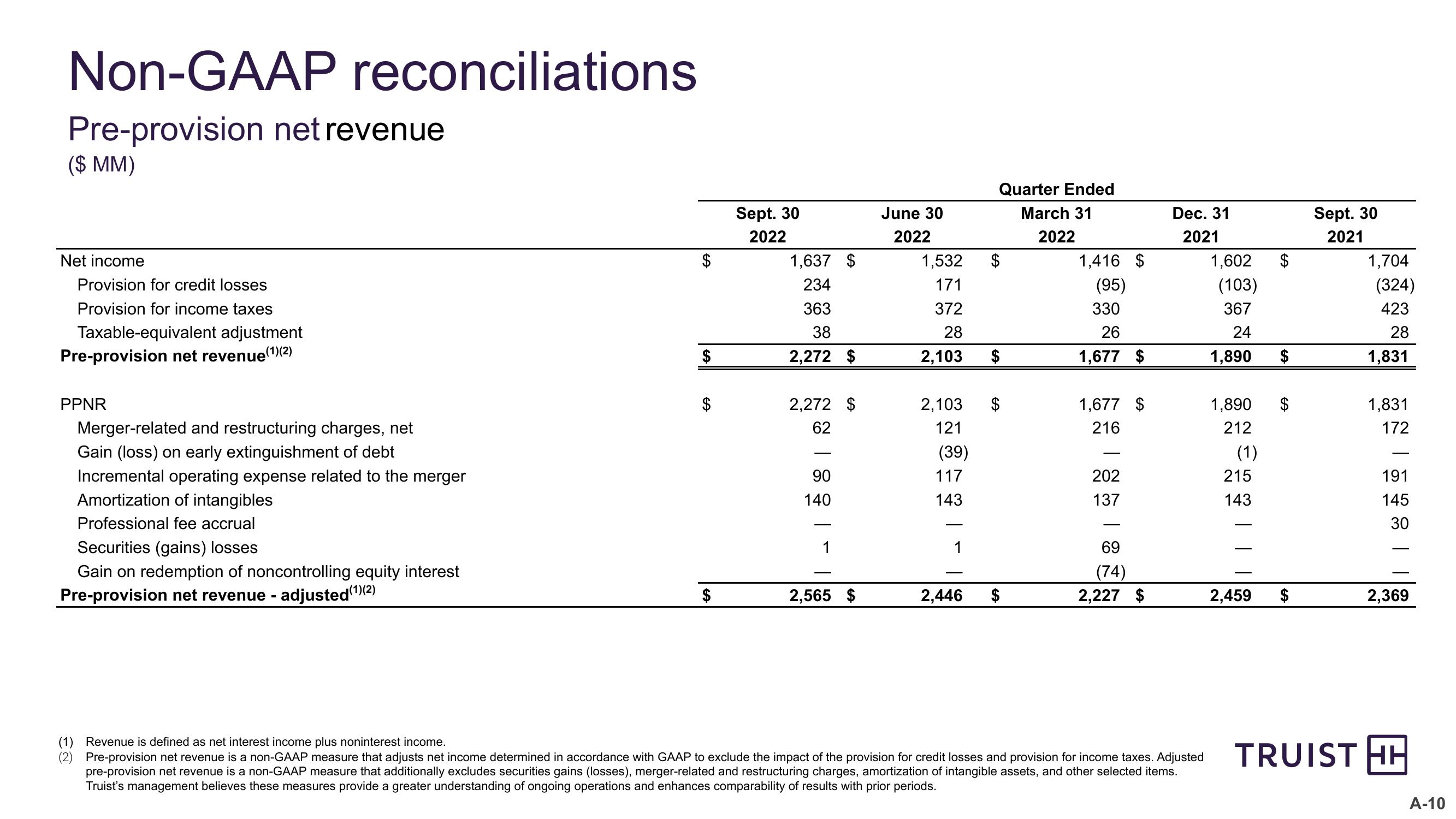

Non-GAAP reconciliations

Pre-provision net revenue

($ MM)

Net income

Provision for credit losses

Provision for income taxes

Taxable-equivalent adjustment

Pre-provision net revenue (1)(2)

PPNR

Merger-related and restructuring charges, net

Gain (loss) on early extinguishment of debt

Incremental operating expense related to the merger

Amortization of intangibles

Professional fee accrual

Securities (gains) losses

Gain on redemption of noncontrolling equity interest

Pre-provision net revenue - adjusted (1)(2)

(1) Revenue is defined as net interest income plus noninterest income.

Quarter Ended

Sept. 30

June 30

March 31

Dec. 31

2022

2022

2022

2021

Sept. 30

2021

$

1,637 $

234

1,532

171

$

1,416 $

1,602

$

1,704

(95)

(103)

(324)

363

372

330

367

423

38

28

26

24

28

$

2,272 $

2,103

$

1,677 $

1,890

1,831

SA

$

2,272 $

2,103

$

1,677 $

1,890

1,831

62

121

216

212

172

(39)

(1)

90

117

202

215

191

140

143

137

143

145

30

1

69

|

(74)

$

2,565 $

2,446

$

2,227 $

2,459

$

2,369

(2) Pre-provision net revenue is a non-GAAP measure that adjusts net income determined in accordance with GAAP to exclude the impact of the provision for credit losses and provision for income taxes. Adjusted

pre-provision net revenue is a non-GAAP measure that additionally excludes securities gains (losses), merger-related and restructuring charges, amortization of intangible assets, and other selected items.

Truist's management believes these measures provide a greater understanding of ongoing operations and enhances comparability of results with prior periods.

TRUIST HH

A-10View entire presentation