Allwyn SPAC

Expected strong balance sheet

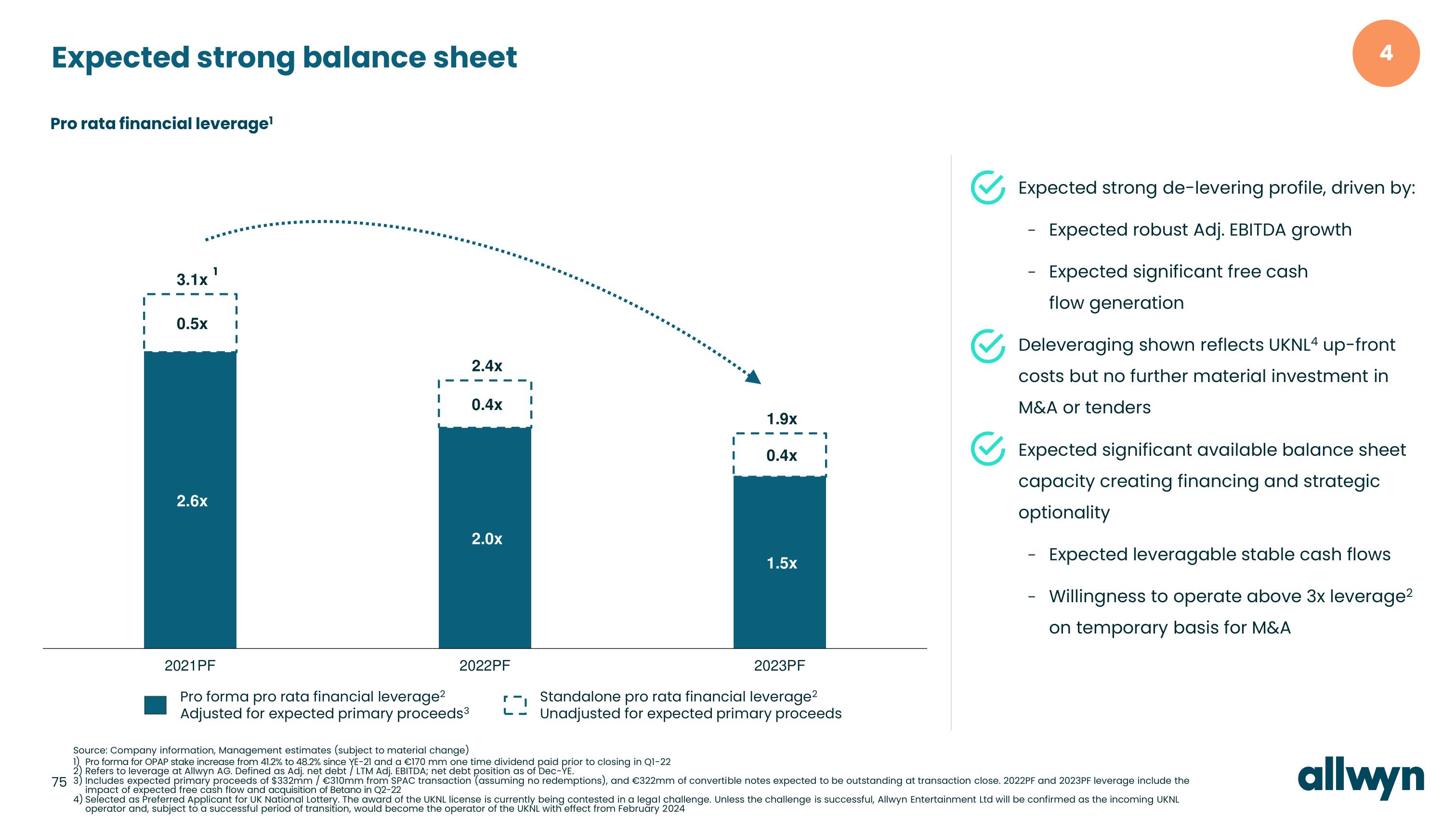

Pro rata financial leverage¹

3.1x¹

0.5x

2.6x

2021PF

Pro forma pro rata financial leverage²

Adjusted for expected primary proceeds ³

2.4x

0.4x

2.0x

2022PF

20

1.9x

0.4x

1.5x

2023PF

Standalone pro rata financial leverage²

Unadjusted for expected primary proceeds

4

Expected strong de-levering profile, driven by:

- Expected robust Adj. EBITDA growth

Expected significant free cash

flow generation

Deleveraging shown reflects UKNL4 up-front

costs but no further material investment in

M&A or tenders

Expected significant available balance sheet

capacity creating financing and strategic

optionality

Expected leveragable stable cash flows

Willingness to operate above 3x leverage²

on temporary basis for M&A

Source: Company information, Management estimates (subject to material change)

Pro forma for OPAP stake increase from 41.2% to 48.2% since YE-21 and a €170 mm one time dividend paid prior to closing in Q1-22

Refers to leverage at Allwyn AG. Defined as Adj. net debt / LTM Adj. EBITDA; net debt position as of Dec-YE.

75 3) Includes expected primary proceeds of $332mm / €310mm from SPAC transaction (assuming no redemptions), and €322mm of convertible notes expected to be outstanding at transaction close. 2022PF and 2023PF leverage include the

impact of expected free cash flow and acquisition of Betano in Q2-22

4) Selected as Preferred Applicant for UK National Lottery. The award of the UKNL license is currently being contested in a legal challenge. Unless the challenge is successful, Allwyn Entertainment Ltd will be confirmed as the incoming UKNL

operator and, subject to a successful period of transition, would become the operator of the UKNL with effect from February 2024

allwynView entire presentation