Kinnevik Results Presentation Deck

Intro

Net Asset Value

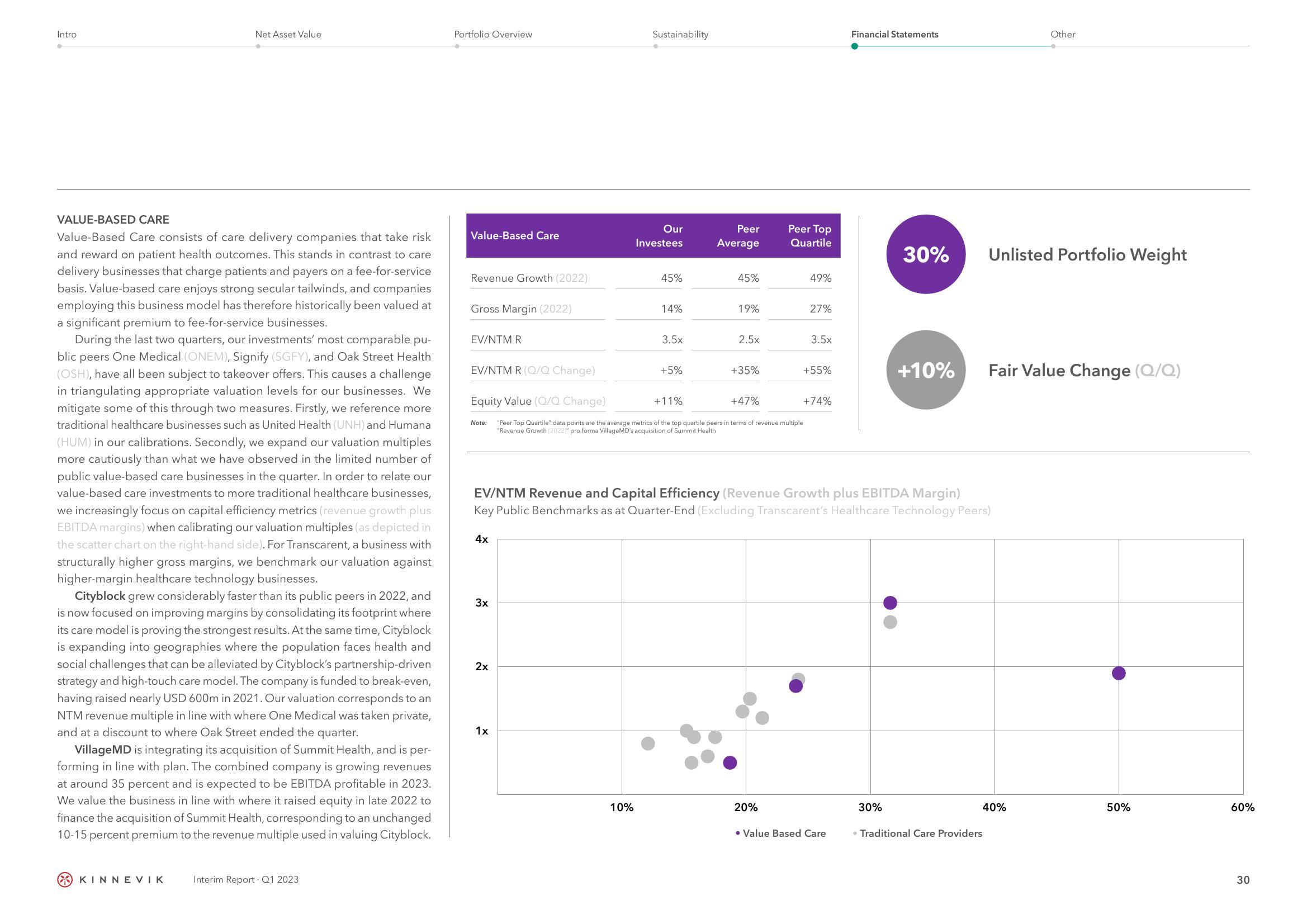

VALUE-BASED CARE

Value-Based Care consists of care delivery companies that take risk

and reward on patient health outcomes. This stands in contrast to care

delivery businesses that charge patients and payers on a fee-for-service

basis. Value-based care enjoys strong secular tailwinds, and companies

employing this business model has therefore historically been valued at

a significant premium to fee-for-service businesses.

During the last two quarters, our investments' most comparable pu-

blic peers One Medical (ONEM), Signify (SGFY), and Oak Street Health

(OSH), have all been subject to takeover offers. This causes a challenge

in triangulating appropriate valuation levels for our businesses. We

mitigate some of this through two measures. Firstly, we reference more

traditional healthcare businesses such as United Health (UNH) and Humana

(HUM) in our calibrations. Secondly, we expand our valuation multiples

more cautiously than what we have observed in the limited number of

public value-based care businesses in the quarter. In order to relate our

value-based care investments to more traditional healthcare businesses,

we increasingly focus on capital efficiency metrics (revenue growth plus

EBITDA margins) when calibrating our valuation multiples (as depicted in

the scatter chart on the right-hand side). For Transcarent, a business with

structurally higher gross margins, we benchmark our valuation against

higher-margin healthcare technology businesses.

Cityblock grew considerably faster than its public peers in 2022, and

is now focused on improving margins by consolidating its footprint where

its care model is proving the strongest results. At the same time, Cityblock

is expanding into geographies where the population faces health and

social challenges that can be alleviated by Cityblock's partnership-driven

strategy and high-touch care model. The company is funded to break-even,

having raised nearly USD 600m in 2021. Our valuation corresponds to an

NTM revenue multiple in line with where One Medical was taken private,

and at a discount to where Oak Street ended the quarter.

VillageMD is integrating its acquisition of Summit Health, and is per-

forming in line with plan. The combined company is growing revenues

at around 35 percent and is expected to be EBITDA profitable in 2023.

We value the business in line with where it raised equity in late 2022 to

finance the acquisition of Summit Health, corresponding to an unchanged

10-15 percent premium to the revenue multiple used in valuing Cityblock.

KINNEVIK

Interim Report Q1 2023

Portfolio Overview

Value-Based Care

Revenue Growth (2022)

Gross Margin (2022)

EV/NTM R

EV/NTM R (Q/Q Change)

Note:

4x

3x

2x

Sustainability

1x

Our

Investees

10%

45%

14%

3.5x

+5%

Peer

Average

45%

Equity Value (Q/Q Change)

+11%

+47%

"Peer Top Quartile" data points are the average metrics of the top quartile peers in terms of revenue multiple

"Revenue Growth (2022)" pro forma Village MD's acquisition of Summit Health

19%

2.5x

+35%

Peer Top

Quartile

20%

49%

27%

3.5x

+55%

+74%

EV/NTM Revenue and Capital Efficiency (Revenue Growth plus EBITDA Margin)

Key Public Benchmarks as at Quarter-End (Excluding Transcarent's Healthcare Technology Peers)

Financial Statements

• Value Based Care

30%

30%

+10%

Unlisted Portfolio Weight

. Traditional Care Providers

Other

Fair Value Change (Q/Q)

40%

50%

60%

30View entire presentation