LSE Mergers and Acquisitions Presentation Deck

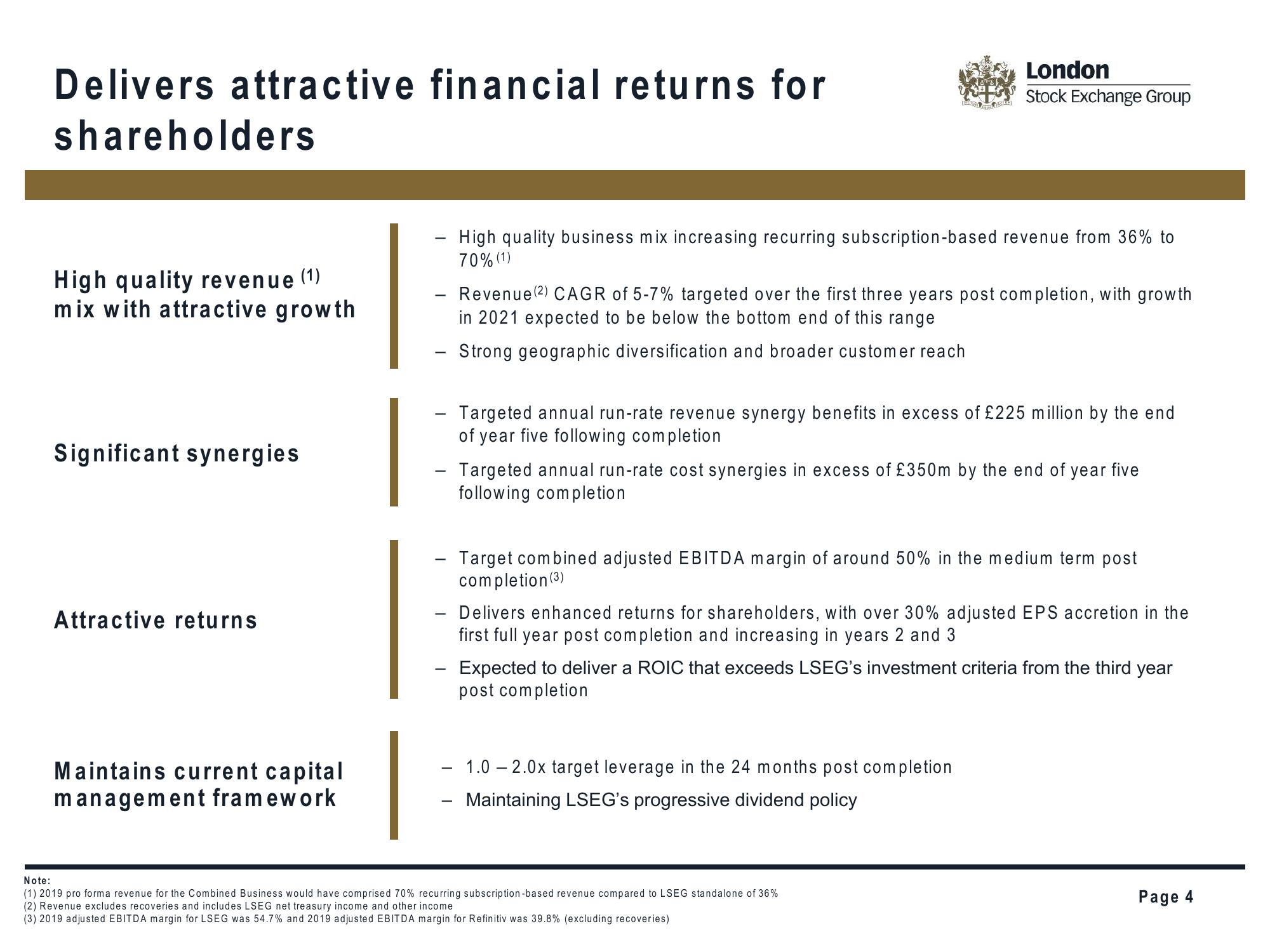

Delivers attractive financial returns for

shareholders

High quality revenue (1)

mix with attractive growth

Significant synergies

Attractive returns

Maintains current capital

management framework

-

High quality business mix increasing recurring subscription-based revenue from 36% to

70% (1)

London

Stock Exchange Group

Rev nue (2) CAGR 7% targeted over the first three years post completion, with growth

in 2021 expected to be below the bottom end of this range

Strong geographic diversification and broader customer reach

-

Targeted annual run-rate revenue synergy benefits in excess of £225 million by the end

of year five following completion

- Targeted annual run-rate cost synergies in excess of £350m by the end of year five

following completion

Target combined adjusted EBITDA margin of around 50% in the medium term post

completion (3)

Delivers enhanced returns for shareholders, with over 30% adjusted EPS accretion in the

first full year post completion and increasing in years 2 and 3

- Expected to deliver a ROIC that exceeds LSEG's investment criteria from the third year

post completion

1.02.0x target leverage in the 24 months post completion

- Maintaining LSEG's progressive dividend policy

Note:

(1) 2019 pro forma revenue for the Combined Business would have comprised 70% recurring subscription-based revenue compared to LSEG standalone of 36%

(2) Revenue excludes recoveries and includes LSEG net treasury income and other income

(3) 2019 adjusted EBITDA margin for LSEG was 54.7% and 2019 adjusted EBITDA margin for Refinitiv was 39.8% (excluding recoveries)

Page 4View entire presentation