Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

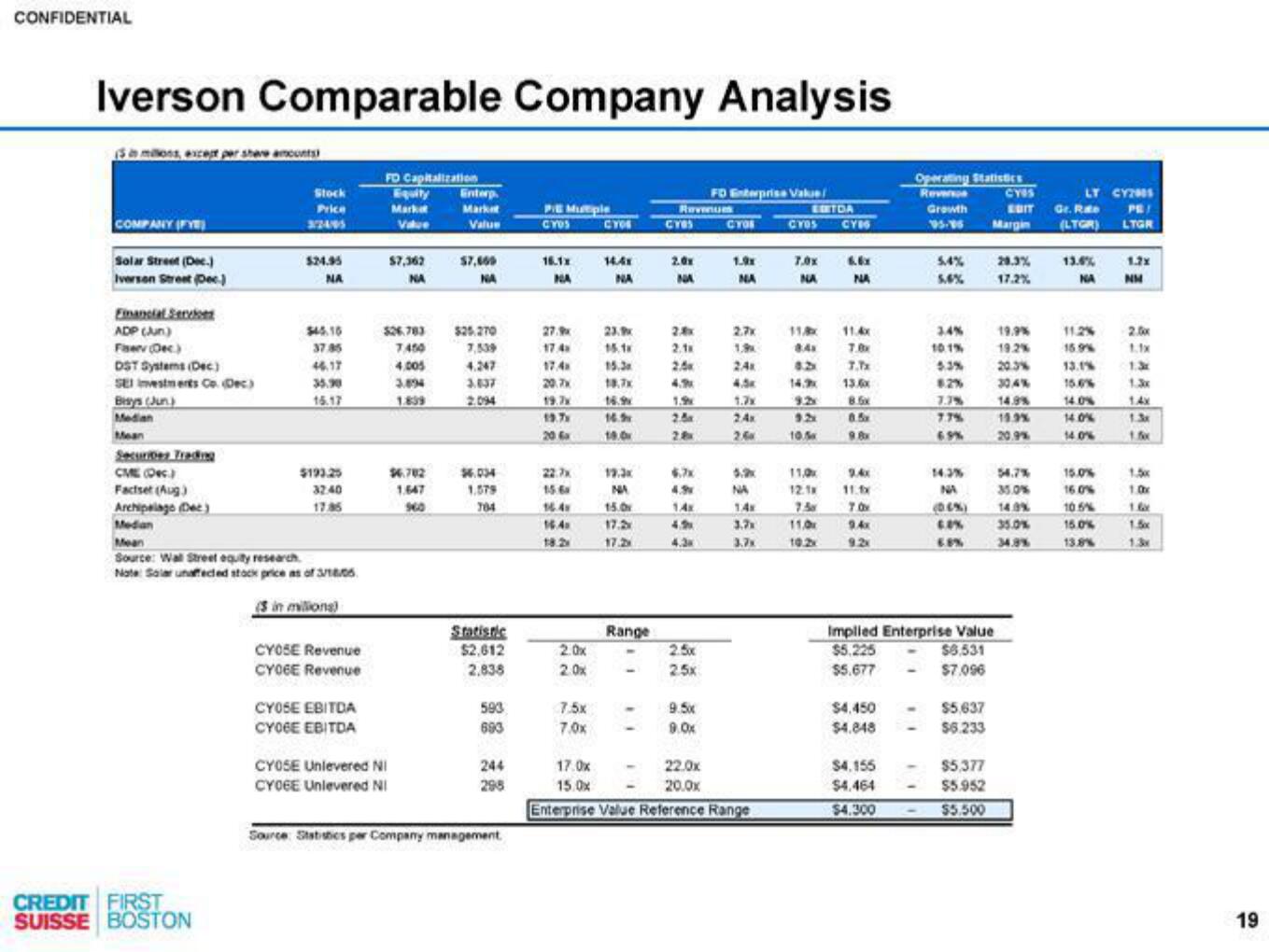

Iverson Comparable Company Analysis

(5 millons, except per share acont

COMPANY (FY

Solar Street (Dec.)

Iverson Street (Dec.)

Financial Servi

ADP (Jun)

Fiserv (Dec.)

DST Systems (Dec.)

SE investments Co. (Dec)

Bisys (Jun)

Median

Mean

Securites Trading

CME (Dec.)

Factset (Aug)

Archipelage (Dee)

Median

Stock

Price

3:24/95

CREDIT FIRST

SUISSE BOSTON

$24.95

NA

$45.16

37.85

46.17

35.90

16.17

$193.25

32.40

Source: Wall Street equity research.

Note: Salar unaffected stock price as of 3/18/05

(3 in millions)

CYOSE Revenue

CYOGE Revenue

CYOSE EBITDA

CYOFE EBITDA

FD Capitalization

Equity

Market

Value

$7,362

NA

526.783

7.450

4.005

$6.702

1.647

960

CYOSE Unlevered Ni

CYOGE Unlevered Ni

Enterp

Market

Value

$7,669

NA

$25.270

7,539

4.247

$6.034

1.579

704

Statistic

$2.612

2.838

593

693

244

295

Source Statistics per Company management

PIE Mutiple

CYDS

16.1x

NA

27.9

17.4x

19.7x

19.7x

206

22.7x

15.6

16.4

16.4

18.2

2.0x

2.0x

7.5x

7.0x

CYOS

14.4x

NA

23.9

15.3

18.7x

16.9

16.9

19.0

19.3x

NA

15.0

17.2x

17.2

Range

Revenues

CYBS

2.0x

NA

2.8x

2.11

4.9

1.9

2.5

2.8x

14x

4.9

2.5x

2.5x

FD Enterprise Value

9.5x

9.0x

CYOS

1.9x

NA

24x

4.5k

1.7x

2.4x

2.60

NA

1.4K

3.7x

17.0x

22.0x

15.0x

20.0x

Enterprise Value Reference Range

ESTDA

CYOS CYB

7,0x

NA

8.4x

8.2x

9.2

10.5

11,0x

12.1x

7.5x

11.0

10.2x

6.6x

NA

11.4x

7.8x

7.7x

13.6x

8.5x

8.5x

9.8x

11.fx

7.0M

9.4x

9.2x

$4.450

$4.848

Operating Statistics

Revenge

Growth

95.5

$4.155

$4,464

$4.300

5.4%

5.6%

3.4%

10.1%

5.3%

7.37%

7.7%

14.3%

NA

(0.6%)

6.8%

Implied Enterprise Value

$5.225

$5.677

$8.531

$7,096

$5,637

$6.233

$5,377

$5.952

$5.500

CYSS

EDIT

Margin

20.3%

17.2%

19.9%

19.2%

20.3%

30.4%

14.9%

15.9%

54.7%

35.0%

14.3%

35.0%

34.9%

LT CY2005

PR/

LTGR

Gr. Rate

(LTGR)

13.6%

NA

11.2%

15.9%

13.1%

15.6%

14.0%

14.0%

14.0%

15.0%

16.0%

10.5%

15.0%

13.8%

1.2x

NM

2.0x

1.3

14X

1.3x

1.5x

1.0x

1.6x

1.5x

1.3x

19View entire presentation