J.P.Morgan Results Presentation Deck

Corporate & Investment Bank1

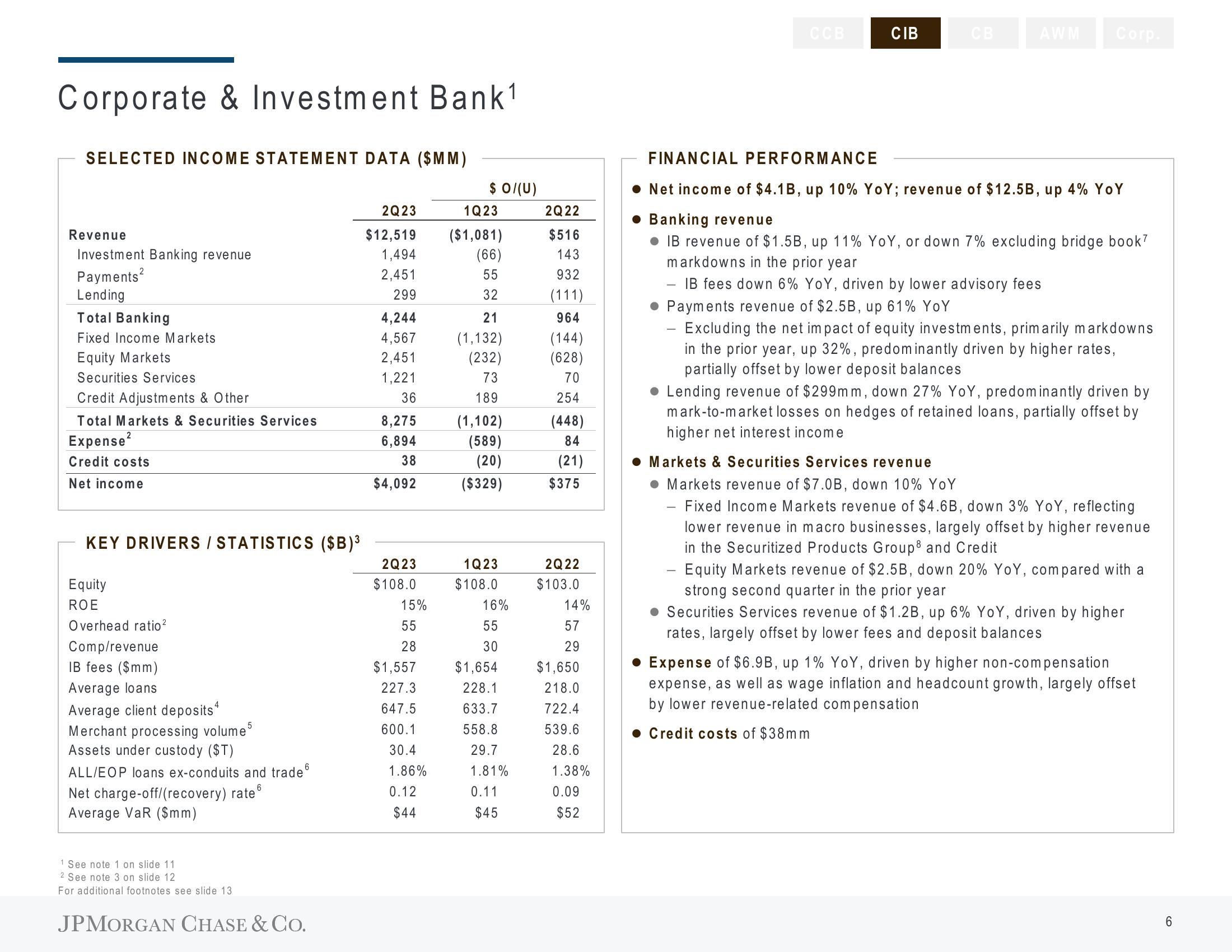

SELECTED INCOME STATEMENT DATA ($MM)

Revenue

Investment Banking revenue

Payments²

Lending

Total Banking

Fixed Income Markets

Equity Markets

Securities Services.

Credit Adjustments & Other

Total Markets & Securities Services

Expense²

Credit costs

Net income

KEY DRIVERS / STATISTICS ($B)³

Equity

ROE

Overhead ratio²

Comp/revenue

IB fees ($mm)

Average loans

Average client deposits

Merchant processing volume

Assets under custody ($T)

ALL/EOP loans ex-conduits and trade

Net charge-off/(recovery) rate

Average VaR ($mm)

1 See note 1 on slide 11

2 See note 3 on slide 12

For additional footnotes see slide 13.

5

6

JPMORGAN CHASE & CO.

2Q23

$12,519

1,494

2,451

299

4,244

4,567

2,451

1,221

36

8,275

6,894

38

$4,092

2Q23

$108.0

15%

55

28

$1,557

227.3

647.5

600.1

30.4

1.86%

0.12

$44

$ 0/(U)

1Q23

($1,081)

(66)

55

32

21

(1,132)

(232)

73

189

(1,102)

(589)

(20)

($329)

1Q23

$108.0

16%

55

30

$1,654

228.1

633.7

558.8

29.7

1.81%

0.11

$45

2Q22

$516

143

932

(111)

964

(144)

(628)

70

254

(448)

84

(21)

$375

2Q22

$103.0

14%

57

29

$1,650

218.0

722.4

539.6

28.6

1.38%

0.09

$52

CCB

CIB

CB

AWM Corp.

FINANCIAL PERFORMANCE

Net income of $4.1B, up 10% YoY; revenue of $12.5B, up 4% YoY

Banking revenue

• IB revenue of $1.5B, up 11% YoY, or down 7% excluding bridge book?

markdowns in the prior year

IB fees down 6% YoY, driven by lower advisory fees

Payments revenue of $2.5B, up 61% YoY

Excluding the net impact of equity investments, primarily markdowns

in the prior year, up 32%, predominantly driven by higher rates,

partially offset by lower deposit balances

Lending revenue of $299mm, down 27% YoY, predominantly driven by

mark-to-market losses on hedges of retained loans, partially offset by

higher net interest income

Markets & Securities Services revenue

• Markets revenue of $7.0B, down 10% YoY

Fixed Income Markets revenue of $4.6B, down 3% YoY, reflecting

lower revenue in macro businesses, largely offset by higher revenue

in the Securitized Products Group and Credit

- Equity Markets revenue of $2.5B, down 20% YoY, compared with a

strong second quarter in the prior year

Securities Services revenue of $1.2B, up 6% YoY, driven by higher

rates, largely offset by lower fees and deposit balances

Expense of $6.9B, up 1% YoY, driven by higher non-compensation

expense, as well as wage inflation and headcount growth, largely offset

by lower revenue-related compensation

Credit costs of $38mm

6View entire presentation