Embracer Group Results Presentation Deck

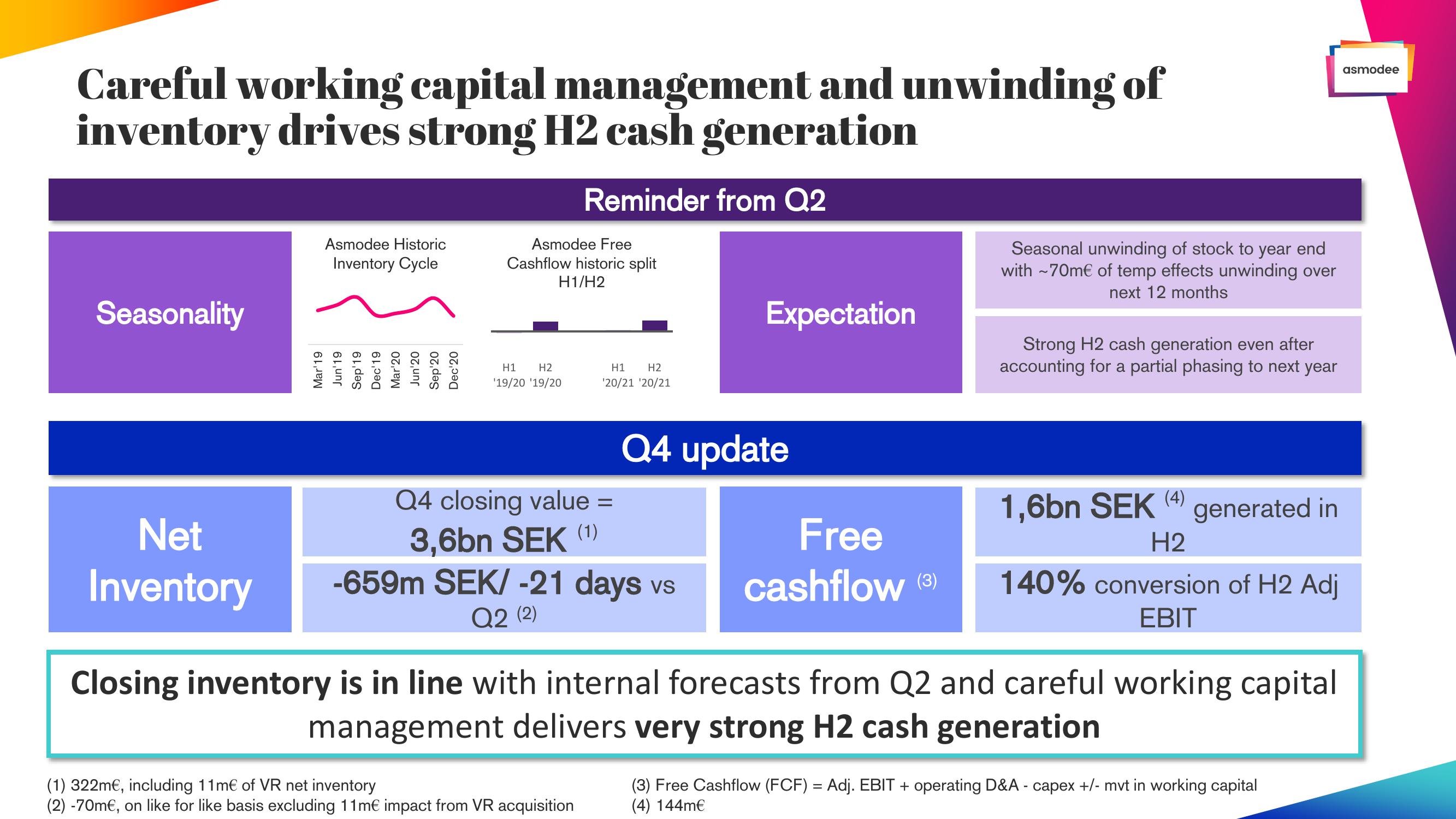

Careful working capital management and unwinding of

inventory drives strong H2 cash generation

Reminder from Q2

Seasonality

Net

Inventory

Asmodee Historic

Inventory Cycle

Mar' 19

Jun'19

Sep 19

Dec'19

Mar 20

Jun'20

Sep'20

Dec 20

Asmodee Free

Cashflow historic split

H1/H2

H1 H2

'19/20 '19/20

H1 H2

'20/21 '20/21

Q4 closing value =

3,6bn SEK (¹)

-659m SEK/ -21 days vs

Q2 (2)

(1) 322m€, including 11m€ of VR net inventory

(2) -70m€, on like for like basis excluding 11m€ impact from VR acquisition

Expectation

Q4 update

Free

cashflow (3)

Seasonal unwinding of stock to year end

with ~70m€ of temp effects unwinding over

next 12 months

Strong H2 cash generation even after

accounting for a partial phasing to next year

1,6bn SEK (4) generated in

H2

140% conversion of H2 Adj

EBIT

Closing inventory is in line with internal forecasts from Q2 and careful working capital

management delivers very strong H2 cash generation

(3) Free Cashflow (FCF) = Adj. EBIT + operating D&A - capex +/- mvt in working capital

(4) 144m€

asmodeeView entire presentation