Atalaya Risk Management Overview

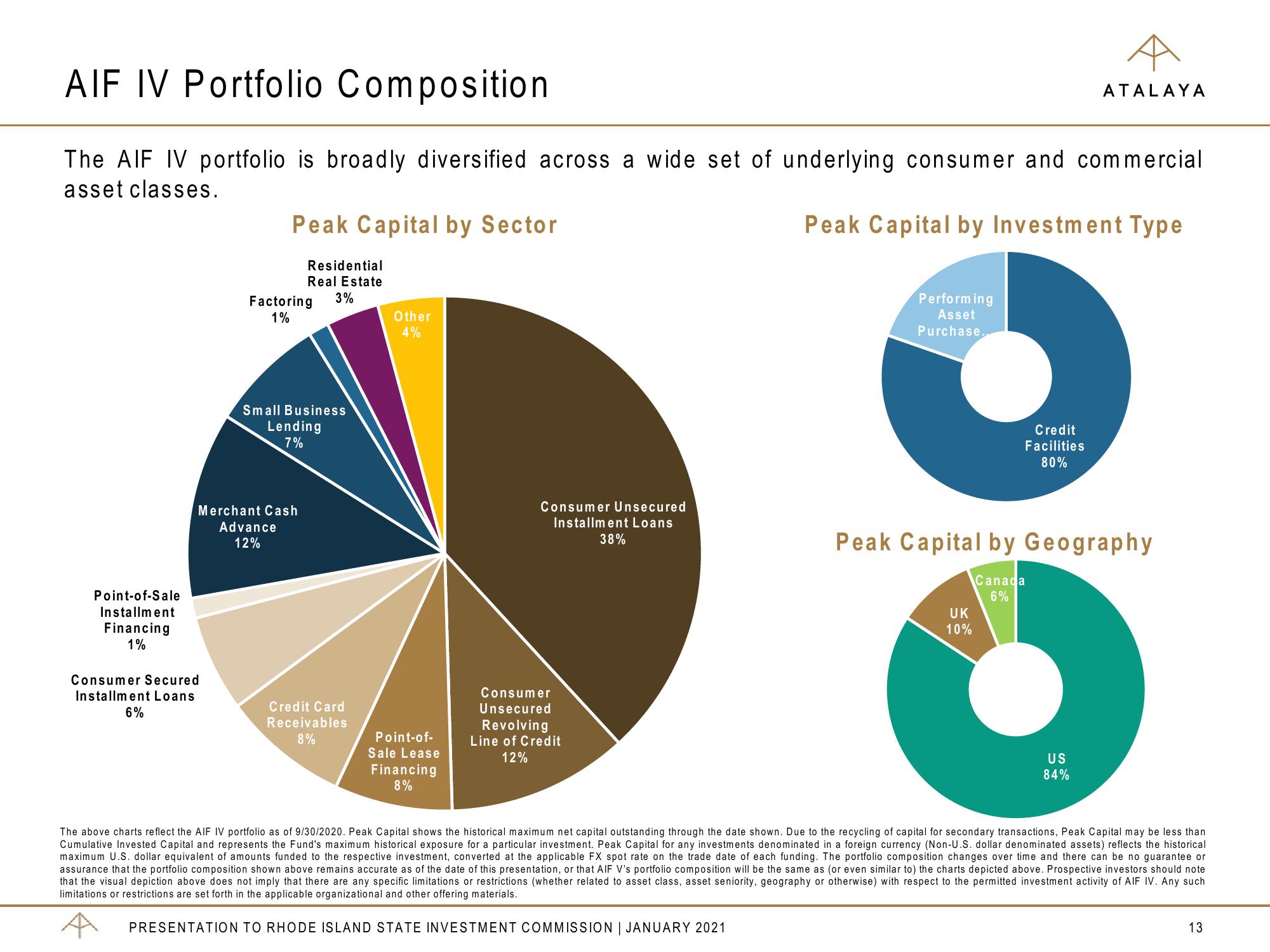

AIF IV Portfolio Composition

The AIF IV portfolio is broadly diversified across a wide set of underlying consumer and commercial

asset classes.

Peak Capital by Investment Type

Point-of-Sale

Installment

Financing

1%

Peak Capital by Sector

Residential

Real Estate

Consumer Secured

Installment Loans

6%

Factoring 3%

1%

Small Business

Lending

7%

Merchant Cash

Advance

12%

Credit Card

Receivables

8%

Other

4%

Point-of-

Sale Lease

Financing

8%

Consumer Unsecured

Installment Loans

38%

Consumer

Unsecured

Revolving

Line of Credit

12%

Performing

Asset

Purchase.

Credit

Facilities

80%

UK

10%

Peak Capital by Geography

Canada

6%

ATALAYA

US

84%

The above charts reflect the AIF IV portfolio as of 9/30/2020. Peak Capital shows the historical maximum net capital outstanding through the date shown. Due to the recycling of capital for secondary transactions, Peak Capital may be less than

Cumulative Invested Capital and represents the Fund's maximum historical exposure for a particular investment. Peak Capital for any investments denominated in a foreign currency (Non-U.S. dollar denominated assets) reflects the historical

maximum U.S. dollar equivalent of amounts funded to the respective investment, converted at the applicable FX spot rate on the trade date of each funding. The portfolio composition changes over time and there can be no guarantee or

assurance that the portfolio composition shown above remains accurate as of the date of this presentation, or that AIF V's portfolio composition will be the same as (or even similar to) the charts depicted above. Prospective investors should note

that the visual depiction above does not imply that there are any specific limitations or restrictions (whether related to asset class, asset seniority, geography or otherwise) with respect to the permitted investment activity of AIF IV. Any such

limitations or restrictions are set forth in the applicable organizational and other offering materials.

PRESENTATION TO RHODE ISLAND STATE INVESTMENT COMMISSION | JANUARY 2021

13View entire presentation