Trian Partners Activist Presentation Deck

China Diapers Case Study

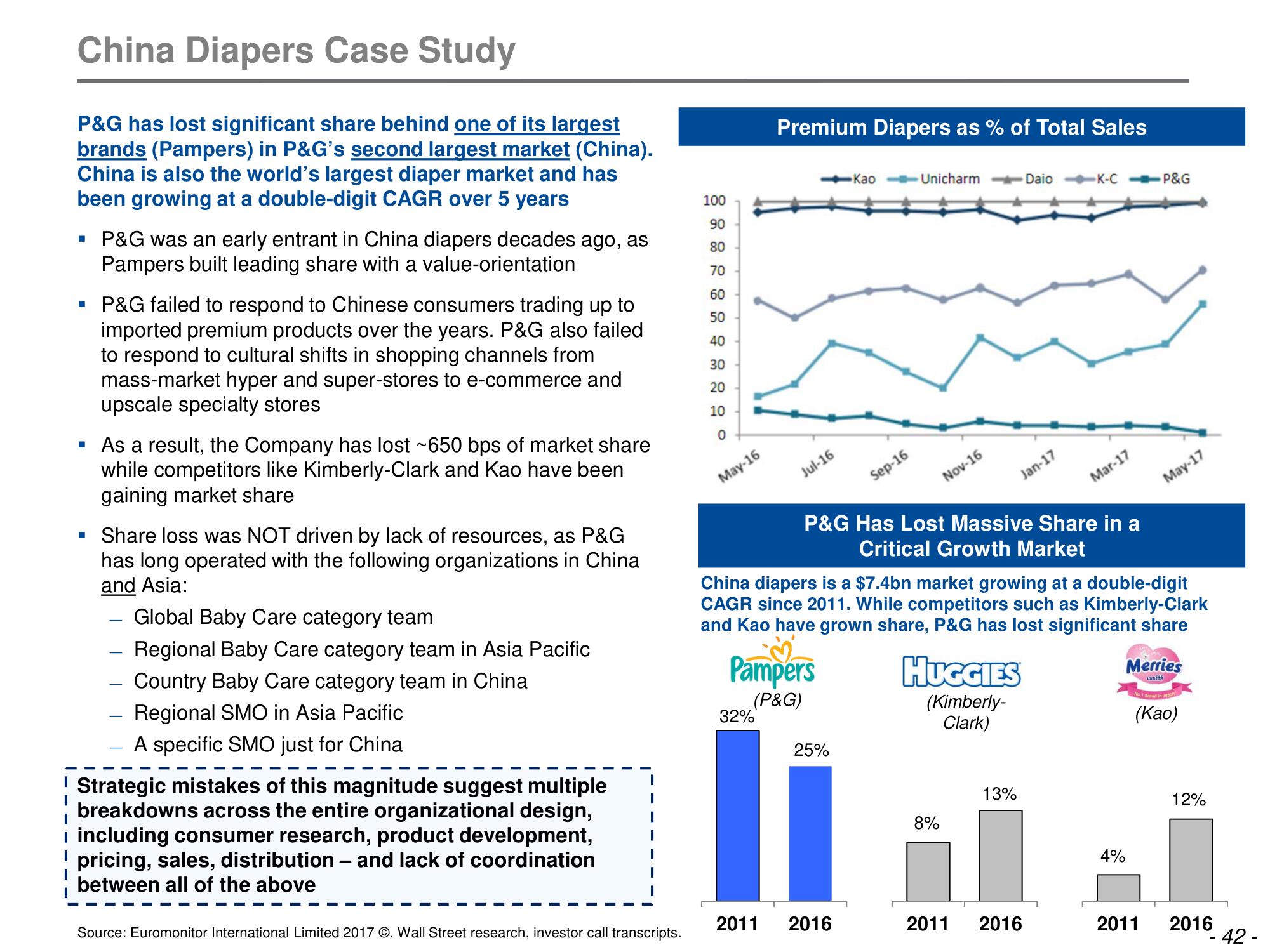

P&G has lost significant share behind one of its largest

brands (Pampers) in P&G's second largest market (China).

China is also the world's largest diaper market and has

been growing at a double-digit CAGR over 5 years

▪ P&G was an early entrant in China diapers decades ago, as

Pampers built leading share with a value-orientation

- P&G failed to respond to Chinese consumers trading up to

imported premium products over the years. P&G also failed

to respond to cultural shifts in shopping channels from

mass-market hyper and super-stores to e-commerce and

upscale specialty stores

▪ As a result, the Company has lost ~650 bps of market share

while competitors like Kimberly-Clark and Kao have been

gaining market share

▪ Share loss was NOT driven by lack of resources, as P&G

has long operated with the following organizations in China

and Asia:

Global Baby Care category team

Regional Baby Care category team in Asia Pacific

Country Baby Care category team in China

Regional SMO in Asia Pacific

A specific SMO just for China

Strategic mistakes of this magnitude suggest multiple

breakdowns across the entire organizational design,

I including consumer research, product development,

pricing, sales, distribution - and lack of coordination

between all of the above

Source: Euromonitor International Limited 2017 ⒸO. Wall Street research, investor call transcripts.

100

90

80

70

60

50

40

30

20

10

0

May-16

Premium Diapers as % of Total Sales

32%

Jul-16

2011

Pampers

(P&G)

Kao

25%

Sep-16

2016

Unicharm

Nov-16

P&G Has Lost Massive Share in a

Critical Growth Market

China diapers is a $7.4bn market growing at a double-digit

CAGR since 2011. While competitors such as Kimberly-Clark

and Kao have grown share, P&G has lost significant share

8%

HUGGIES

(Kimberly-

Clark)

Jan-17

2011

Daio

13%

K-C

2016

Mar-17

4%

P&G

May-17

Merries

Loft

2011

No.1 Brand in

(Kao)

12%

2016

-

42-View entire presentation