Atalaya Risk Management Overview

Asset Income Fund V ("AIF V") Strategy Highlights

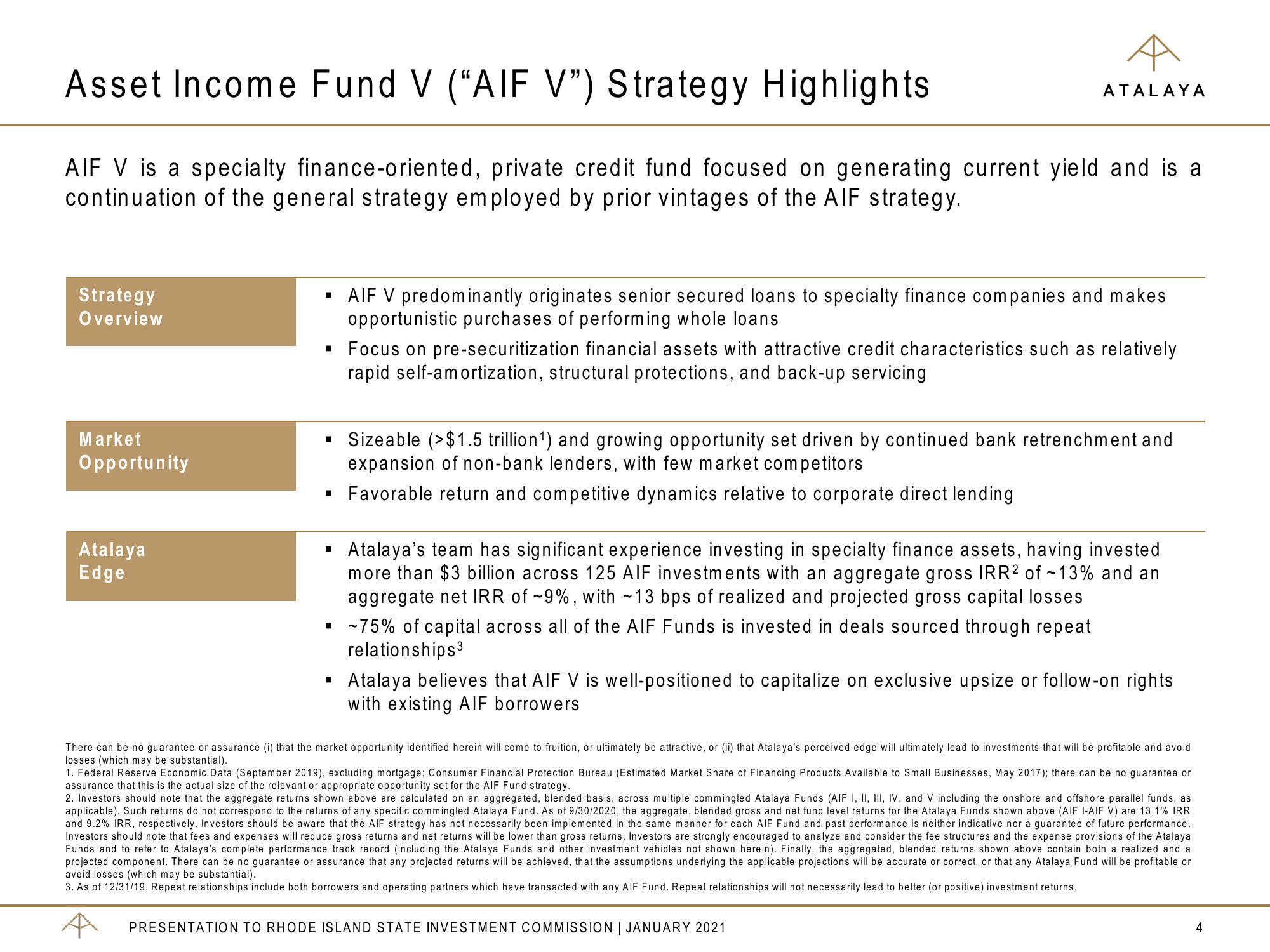

AIF V is a specialty finance-oriented, private credit fund focused on generating current yield and is a

continuation of the general strategy employed by prior vintages of the AIF strategy.

Strategy

Overview

Market

Opportunity

Atalaya

Edge

▪ AIF V predominantly originates senior secured loans to specialty finance companies and makes

opportunistic purchases of performing whole loans

▪ Focus on pre-securitization financial assets with attractive credit characteristics such as relatively

rapid self-amortization, structural protections, and back-up servicing

▪ Sizeable (>$1.5 trillion¹) and growing opportunity set driven by continued bank retrenchment and

expansion of non-bank lenders, with few market competitors

▪ Favorable return and competitive dynamics relative to corporate direct lending

■

ATALAYA

▪ -75% of capital across all of the AIF Funds is invested in deals sourced through repeat

relationships3

■

Atalaya's team has significant experience investing in specialty finance assets, having invested

more than $3 billion across 125 AIF investments with an aggregate gross IRR2 of -13% and an

aggregate net IRR of ~9%, with ~13 bps of realized and projected gross capital losses

Atalaya believes that AIF V is well-positioned to capitalize on exclusive upsize or follow-on rights

with existing AIF borrowers

There can be no guarantee or assurance (i) that the market opportunity identified herein will come to fruition, or ultimately be attractive, or (ii) that Atalaya's perceived edge will ultimately lead to investments that will be profitable and avoid

losses (which may be substantial).

1. Federal Reserve Economic Data (September 2019), excluding mortgage; Consumer Financial Protection Bureau (Estimated Market Share of Financing Products Available to Small Businesses, May 2017); there can be no guarantee or

assurance that this is the actual size of the relevant or appropriate opportunity set for the AIF Fund strategy.

2. Investors should note that the aggregate returns shown above are calculated on an aggregated, blended basis, across multiple commingled Atalaya Funds (AIF I, II, III, IV, and V including the onshore and offshore parallel funds, as

applicable). Such returns do not correspond to the returns of any specific commingled Atalaya Fund. As of 9/30/2020, the aggregate, blended gross and net fund level returns for the Atalaya Funds shown above (AIF I-AIF V) are 13.1% IRR

and 9.2% IRR, respectively. Investors should be aware that the AIF strategy has not necessarily been implemented in the same manner for each AIF Fund and past performance is neither indicative nor a guarantee of future performance.

Investors should note that fees and expenses will reduce gross returns and net returns will be lower than gross returns. Investors are strongly encouraged to analyze and consider the fee structures and the expense provisions of the Atalaya

Funds and to refer to Atalaya's complete performance track record (including the Atalaya Funds and other investment vehicles not shown herein). Finally, the aggregated, blended returns shown above contain both a realized and a

projected component. There can be no guarantee or assurance that any projected returns will be achieved, that the assumptions underlying the applicable projections will be accurate or correct, or that any Atalaya Fund will be profitable or

avoid losses (which may be substantial).

3. As of 12/31/19. Repeat relationships include both borrowers and operating partners which have transacted with any AIF Fund. Repeat relationships will not necessarily lead to better (or positive) investment returns.

PRESENTATION TO RHODE ISLAND STATE INVESTMENT COMMISSION | JANUARY 2021

4View entire presentation