Corphousing Group IPO Presentation Deck

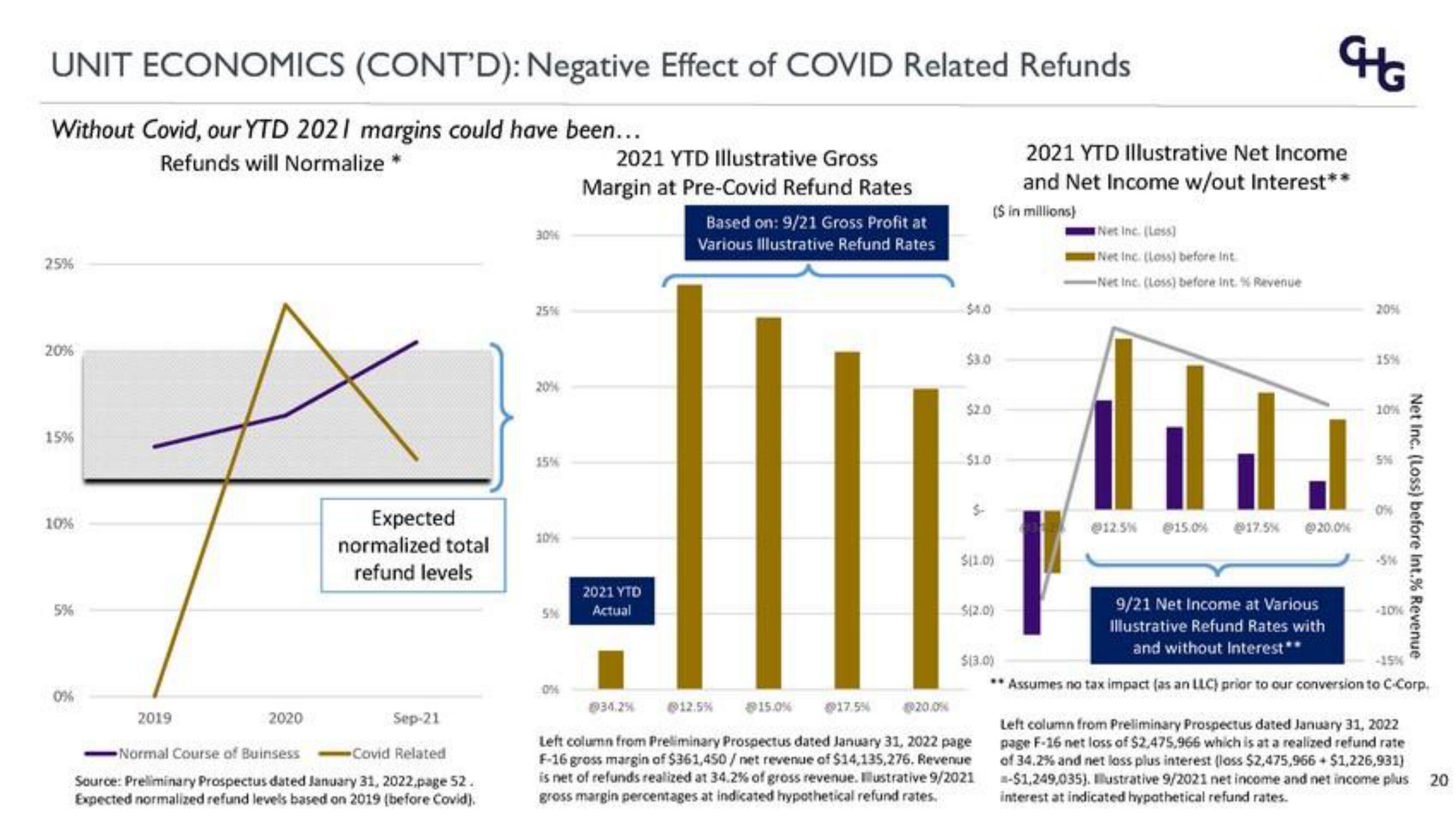

UNIT ECONOMICS (CONT'D): Negative Effect of COVID Related Refunds

Without Covid, our YTD 2021 margins could have been...

Refunds will Normalize *

25%

20%

15%

10%

5%

0%

Expected

normalized total

refund levels

2019

2020

Sep-21

-Covid Related

Normal Course of Buinsess

Source: Preliminary Prospectus dated January 31, 2022,page 52.

Expected normalized refund levels based on 2019 (before Covid).

30%

25%

20%

15%

10%

5%

0%

2021 YTD Illustrative Gross

Margin at Pre-Covid Refund Rates

Based on: 9/21 Gross Profit at

Various Illustrative Refund Rates

2021 YTD

Actual

$3.0

20.0%

$2.0

$1.0

$(1.0)

2021 YTD Illustrative Net Income

and Net Income w/out Interest**

($ in millions)

$(2.0)

@34.2% @12.5% $15.0% @17.5%

Left column from Preliminary Prospectus dated January 31, 2022 page

F-16 gross margin of $361,450/ net revenue of $14,135,276. Revenue

is net of refunds realized at 34.2% of gross revenue. Illustrative 9/2021

gross margin percentages at indicated hypothetical refund rates.

Net Inc. (Less)

Net Inc. (Loss) before Int

-Net Inc. (Loss) before Int. % Revenue

CHG

1

@12.5 % 15.0% 17.5% @20.0%

9/21 Net Income at Various

Illustrative Refund Rates with

and without Interest**

20%

15%

10%

-10%

Net Inc. (Loss) before Int.% Revenue

$13.0)

-15%

** Assumes no tax impact (as an LLC) prior to our conversion to C-Corp.

Left column from Preliminary Prospectus dated January 31, 2022

page F-16 net loss of $2,475,966 which is at a realized refund rate

of 34.2% and net loss plus interest (loss $2,475,966 + $1,226,931)

-$1,249,035). Illustrative 9/2021 net income and net income plus 20

interest at indicated hypothetical refund rates.View entire presentation