Main Street Capital Fixed Income Presentation Deck

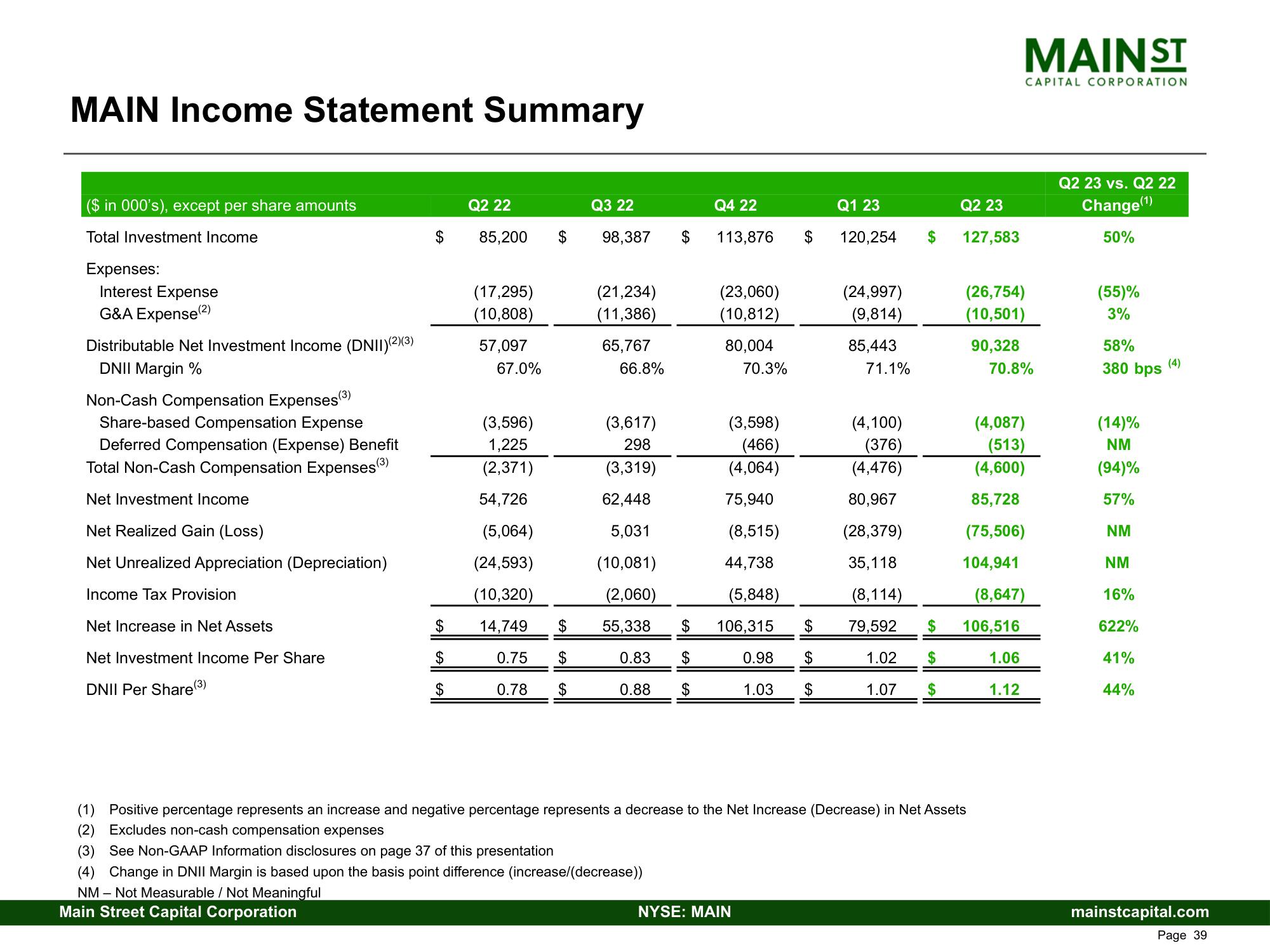

MAIN Income Statement Summary

($ in 000's), except per share amounts

Total Investment Income

Expenses:

Interest Expense

G&A Expense (2)

Distributable Net Investment Income (DNII)(2)(3)

DNII Margin %

Non-Cash Compensation Expenses (³)

Share-based Compensation Expense

Deferred Compensation (Expense) Benefit

Total Non-Cash Compensation Expenses(³)

Net Investment Income

Net Realized Gain (Loss)

Net Unrealized Appreciation (Depreciation)

Income Tax Provision

Net Increase in Net Assets

Net Investment Income Per Share

DNII Per Share (³)

$

$

$

Q2 22

85,200

(17,295)

(10,808)

57,097

67.0%

$

Q3 22

98,387

(21,234)

(11,386)

65,767

66.8%

$

(3,596)

(3,617)

1,225

298

(2,371)

(3,319)

54,726

62,448

(5,064)

5,031

(24,593)

(10,081)

(2,060)

(10,320)

14,749 $ 55,338 $

0.75 $

0.83

0.78 $

0.88 $

(3) See Non-GAAP Information disclosures on page 37 of this presentation

(4) Change in DNII Margin is based upon the basis point difference (increase/(decrease))

NM Not Measurable / Not Meaningful

Main Street Capital Corporation

Q4 22

113,876

(23,060)

(10,812)

80,004

70.3%

$

(3,598)

(466)

(4,064)

75,940

(8,515)

44,738

(5,848)

106,315

0.98 $

1.03 $

NYSE: MAIN

Q1 23

120,254

(24,997)

(9,814)

85,443

71.1%

(4,100)

(376)

(4,476)

80,967

(28,379)

35,118

(8,114)

$ 79,592

$

$

1.02 $

1.07 $

Q2 23

127,583

(1) Positive percentage represents an increase and negative percentage represents a decrease to the Net Increase (Decrease) in Net Assets

(2) Excludes non-cash compensation expenses

(26,754)

(10,501)

90,328

MAIN ST

CAPITAL CORPORATION

70.8%

(4,087)

(513)

(4,600)

85,728

(75,506)

104,941

106,516

1.06

1.12

(8,647)

Q2 23 vs. Q2 22

Change (¹)

50%

(55)%

3%

58%

380 bps

(14)%

NM

(94)%

57%

NM

NM

16%

622%

41%

44%

(4)

mainstcapital.com

Page 39View entire presentation