Lyft Results Presentation Deck

Change to our Non-GAAP Financial Measures

What's new?

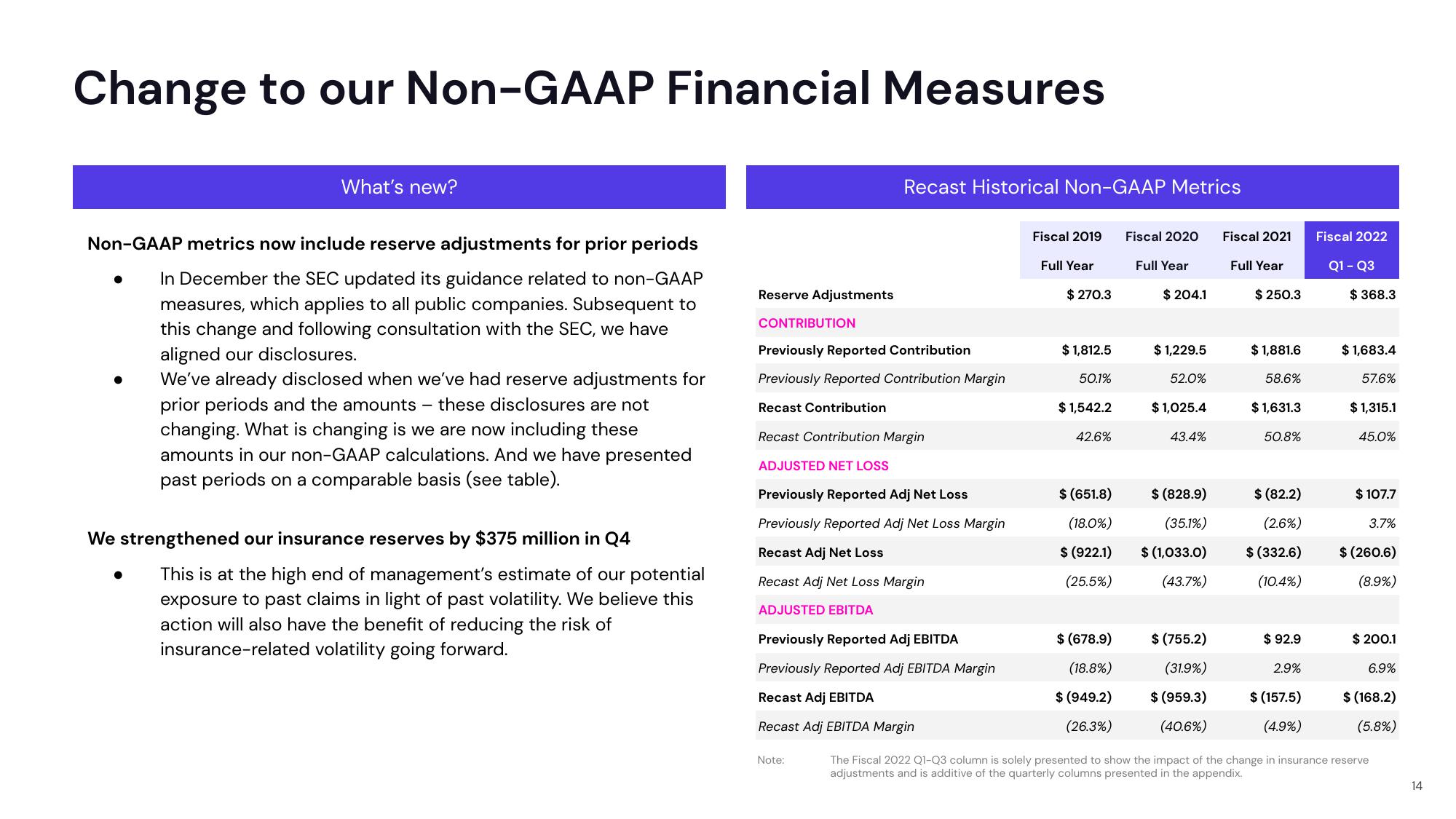

Non-GAAP metrics now include reserve adjustments for prior periods

In December the SEC updated its guidance related to non-GAAP

measures, which applies to all public companies. Subsequent to

this change and following consultation with the SEC, we have

aligned our disclosures.

We've already disclosed when we've had reserve adjustments for

prior periods and the amounts - these disclosures are not

changing. What is changing is we are now including these

amounts in our non-GAAP calculations. And we have presented

past periods on a comparable basis (see table).

We strengthened our insurance reserves by $375 million in Q4

This is at the high end of management's estimate of our potential

exposure to past claims in light of past volatility. We believe this

action will also have the benefit of reducing the risk of

insurance-related volatility going forward.

Reserve Adjustments

CONTRIBUTION

Recast Historical Non-GAAP Metrics

Previously Reported Contribution

Previously Reported Contribution Margin

Recast Contribution

Recast Contribution Margin

ADJUSTED NET LOSS

Previously Reported Adj Net Loss

Previously Reported Adj Net Loss Margin

Recast Adj Net Loss

Recast Adj Net Loss Margin

ADJUSTED EBITDA

Previously Reported Adj EBITDA

Previously Reported Adj EBITDA Margin

Recast Adj EBITDA

Recast Adj EBITDA Margin

Note:

Fiscal 2019

Full Year

$ 270.3

$1,812.5

50.1%

$ 1,542.2

42.6%

$ (651.8)

(18.0%)

$ (922.1)

(25.5%)

$ (678.9)

(18.8%)

$ (949.2)

(26.3%)

Fiscal 2020

Full Year

$ 204.1

$1,229.5

52.0%

$ 1,025.4

43.4%

$ (828.9)

(35.1%)

$ (1,033.0)

(43.7%)

$ (755.2)

(31.9%)

$ (959.3)

(40.6%)

Fiscal 2021

Full Year

$250.3

$1,881.6

58.6%

$ 1,631.3

50.8%

$ (82.2)

(2.6%)

$ (332.6)

(10.4%)

$ 92.9

2.9%

$ (157.5)

(4.9%)

Fiscal 2022

Q1-Q3

$368.3

$1,683.4

57.6%

$ 1,315.1

45.0%

$ 107.7

3.7%

$ (260.6)

(8.9%)

$ 200.1

6.9%

$ (168.2)

(5.8%)

The Fiscal 2022 Q1-Q3 column is solely presented to show the impact of the change in insurance reserve

adjustments and is additive of the quarterly columns presented in the appendix.

14View entire presentation