Bausch+Lomb Results Presentation Deck

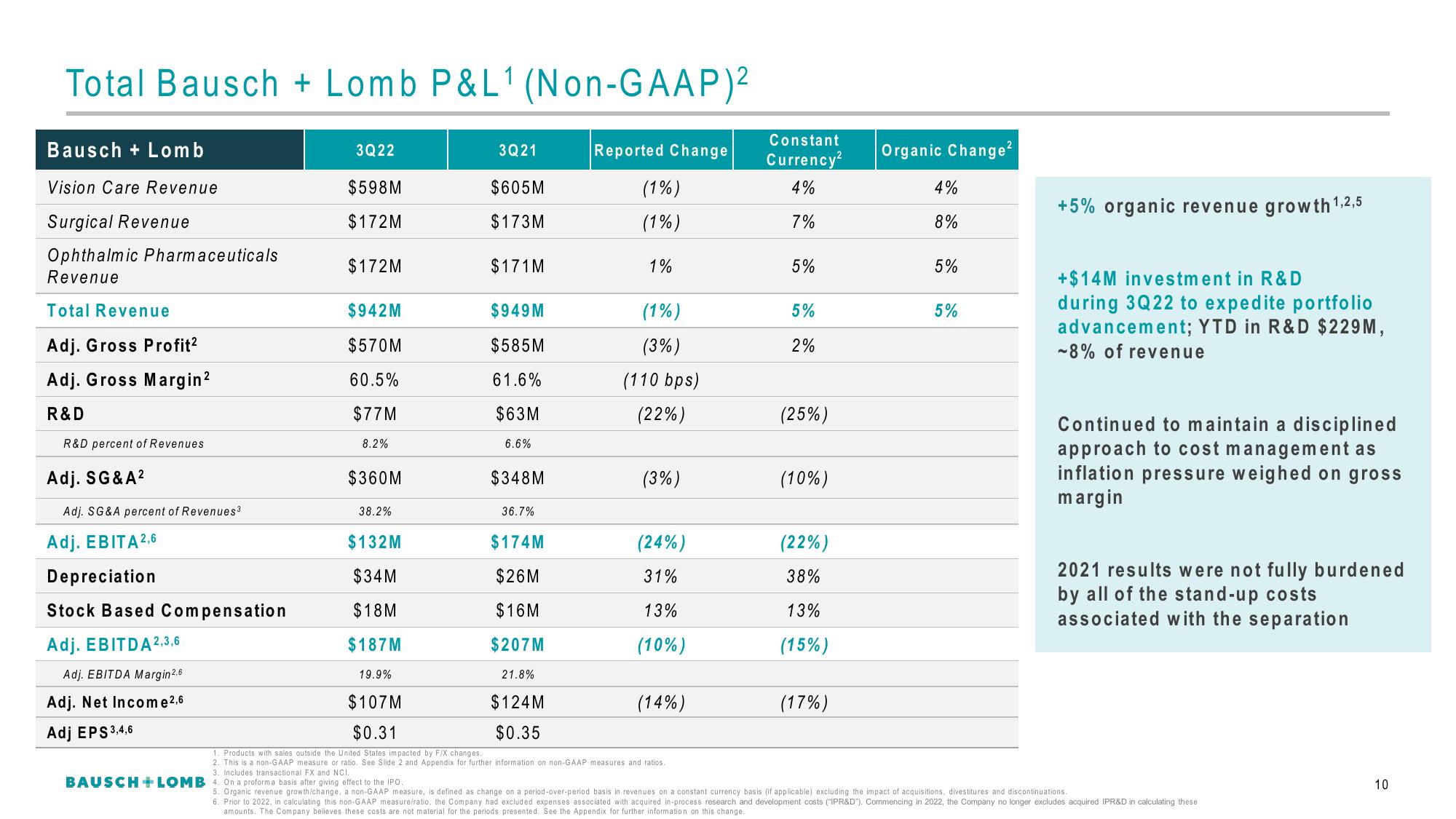

Total Bausch+Lomb P&L¹ (Non-GAAP)²

Bausch + Lomb

Vision Care Revenue

Surgical Revenue

Ophthalmic Pharmaceuticals

Revenue

Total Revenue

Adj. Gross Profit²

Adj. Gross Margin ²

R&D

R&D percent of Revenues

Adj. SG&A²

Adj. SG&A percent of Revenues³

Adj. EBITA 2,6

Depreciation

Stock Based Compensation

Adj. EBITDA 2,3,6

Adj. EBITDA Margin 2,6

Adj. Net Income 2,6

Adj EPS 3,4,6

3Q22

$598M

$172M

$172M

$942M

$570M

60.5%

$77M

8.2%

$360M

38.2%

$132M

$34M

$18M

$187M

3Q21

$605M

$173M

$171M

$949M

$585M

61.6%

$63M

6.6%

$348M

36.7%

$174M

$26M

$16M

$207M

21.8%

$124M

$0.35

Reported Change

(1%)

(1%)

1%

(1%)

(3%)

(110 bps)

(22%)

(3%)

(24%)

31%

13%

(10%)

19.9%

$107M

$0.31

1. Products with sales outside the United States impacted by F/X changes.

2. This is a non-GAAP measure or ratio. See Slide 2 and Appendix for further information on non-GAAP measures and ratios.

3. Includes transactional FX and NCI.

BAUSCH + LOMB 4. On a proforma basis after giving effect to the IPO.

(14%)

Constant

Currency²

4%

7%

5%

5%

2%

(25%)

(10%)

(22%)

38%

13%

(15%)

(17%)

Organic Change²

4%

8%

5%

5%

+5% organic revenue growth 1,2,5

+$14M investment in R&D

during 3Q22 to expedite portfolio

advancement; YTD in R&D $229M,

-8% of revenue

Continued to maintain a disciplined

approach to cost management as

inflation pressure weighed on gross

margin

2021 results were not fully burdened

by all of the stand-up costs

associated with the separation

5. Organic revenue growth/change, a non-GAAP measure, is defined as change on a period-over-period basis in revenues on a constant currency basis (if applicable) excluding the impact of acquisitions, divestitures and discontinuations.

6. Prior to 2022, in calculating this non-GAAP measure/ratio, the Company had excluded expenses associated with acquired in-process research and development costs ("IPR&D"). Commencing in 2022, the Company no longer excludes acquired IPR&D in calculating these

amounts. The Company believes these costs are not material for the periods presented. See the Appendix for further information on this change.

10View entire presentation