Trian Partners Activist Presentation Deck

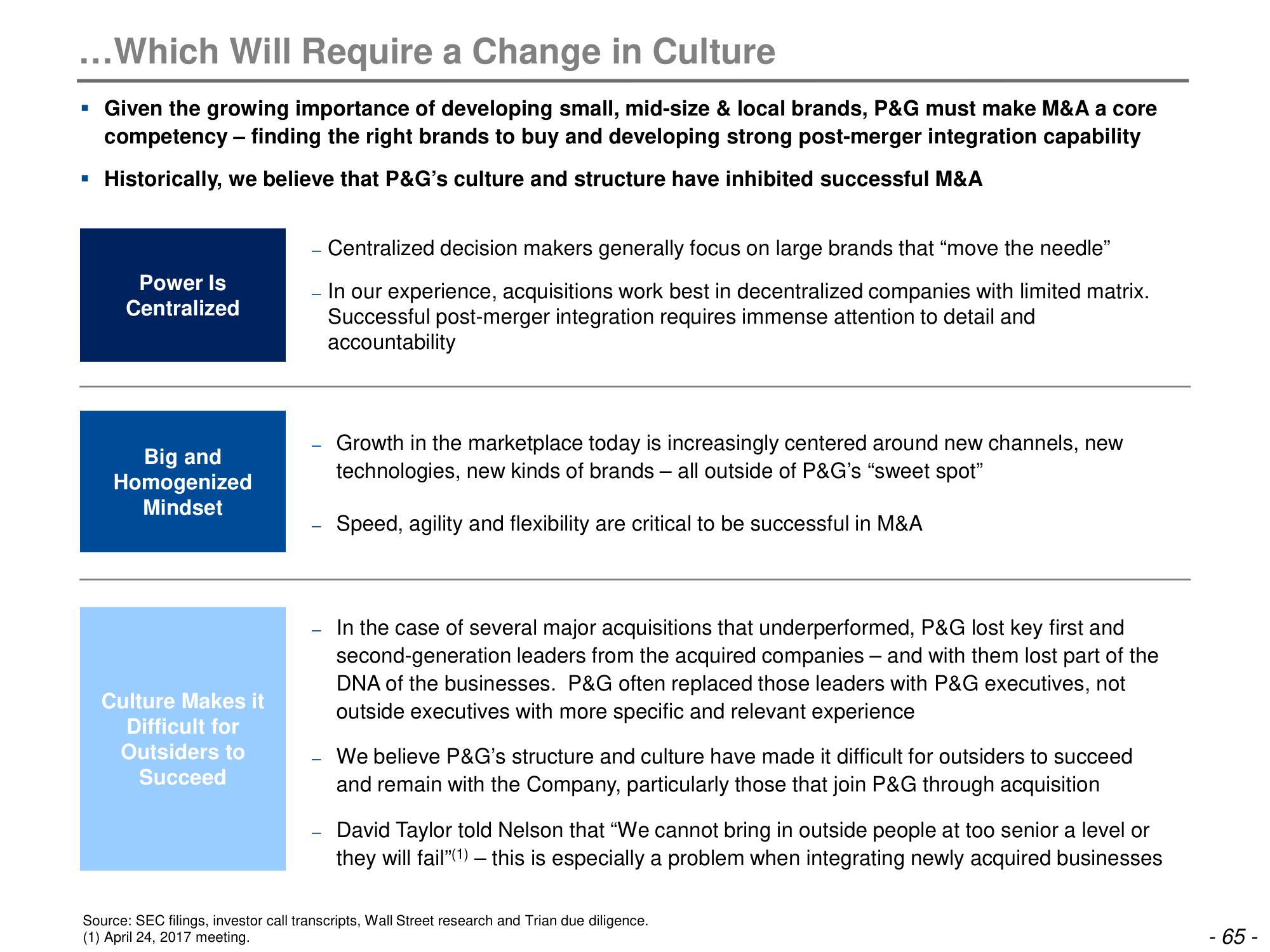

...Which Will Require a Change in Culture

Given the growing importance of developing small, mid-size & local brands, P&G must make M&A a core

competency - finding the right brands to buy and developing strong post-merger integration capability

Historically, we believe that P&G's culture and structure have inhibited successful M&A

M

Power Is

Centralized

Big and

Homogenized

Mindset

Culture Makes it

Difficult for

Outsiders to

Succeed

Centralized decision makers generally focus on large brands that "move the needle"

- In our experience, acquisitions work best in decentralized companies with limited matrix.

Successful post-merger integration requires immense attention to detail and

accountability

-

-

-

-

Growth in the marketplace today is increasingly centered around new channels, new

technologies, new kinds of brands - all outside of P&G's "sweet spot"

Speed, agility and flexibility are critical to be successful in M&A

In the case of several major acquisitions that underperformed, P&G lost key first and

second-generation leaders from the acquired companies and with them lost part of the

DNA of the businesses. P&G often replaced those leaders with P&G executives, not

outside executives with more specific and relevant experience

We believe P&G's structure and culture have made it difficult for outsiders to succeed

and remain with the Company, particularly those that join P&G through acquisition

David Taylor told Nelson that "We cannot bring in outside people at too senior a level or

they will fail"(1) - this is especially a problem when integrating newly acquired businesses

Source: SEC filings, investor call transcripts, Wall Street research and Trian due diligence.

(1) April 24, 2017 meeting.

- 65 -View entire presentation