Benson Hill Investor Presentation Deck

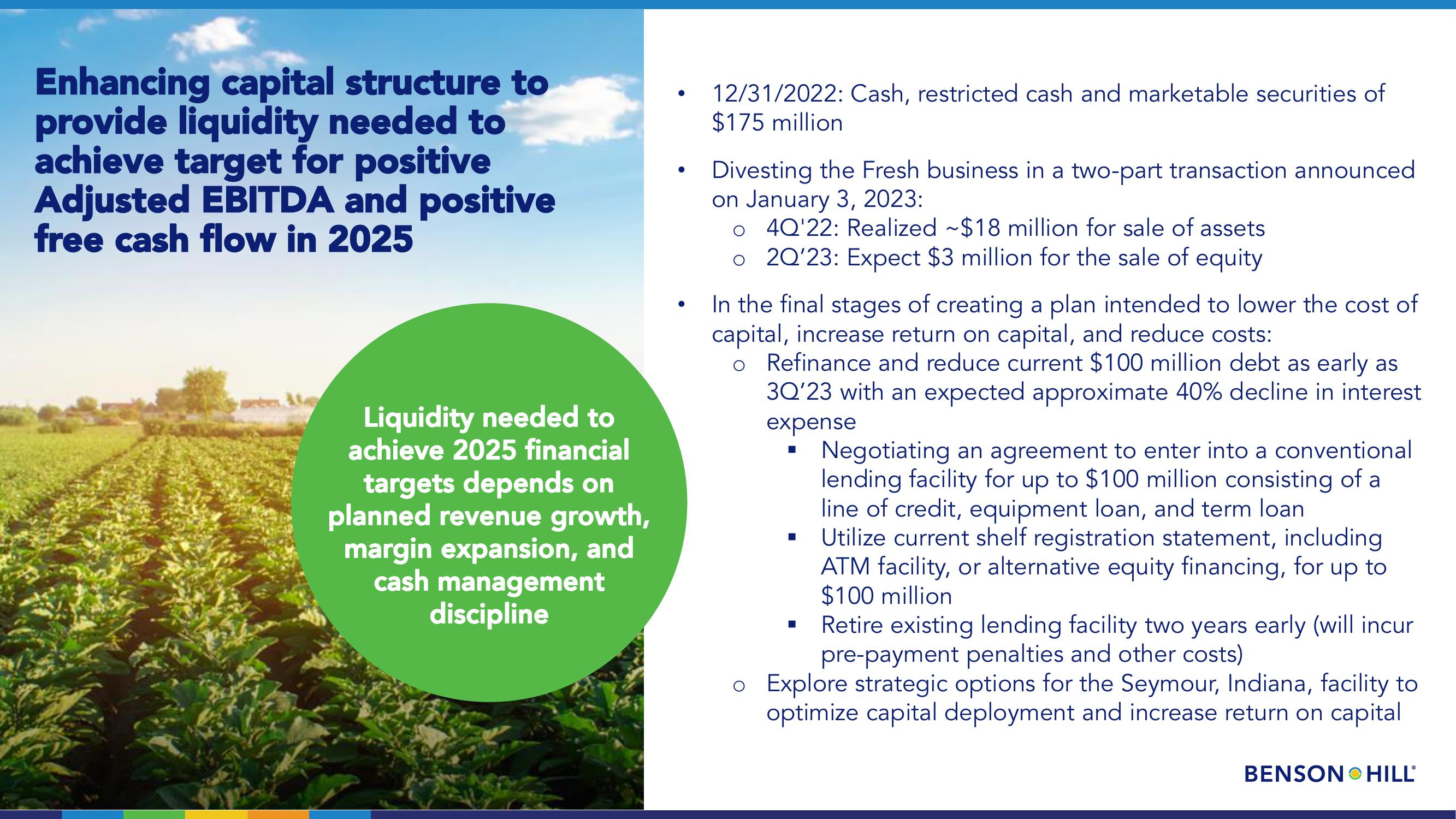

Enhancing capital structure to

provide liquidity needed to

achieve target for positive

Adjusted EBITDA and positive

free cash flow in 2025

Liquidity needed to

achieve 2025 financial

targets depends on

planned revenue growth,

margin expansion, and

cash management

discipline

●

12/31/2022: Cash, restricted cash and marketable securities of

$175 million

Divesting the Fresh business in a two-part transaction announced

on January 3, 2023:

o 4Q'22: Realized ~$18 million for sale of assets

o 20'23: Expect $3 million for the sale of equity

In the final stages of creating a plan intended to lower the cost of

capital, increase return on capital, and reduce costs:

o Refinance and reduce current $100 million debt as early as

3Q'23 with an expected approximate 40% decline in interest

expense

■

■

Negotiating an agreement to enter into a conventional

lending facility for up to $100 million consisting of a

line of credit, equipment loan, and term loan

Utilize current shelf registration statement, including

ATM facility, or alternative equity financing, for up to

$100 million

Retire existing lending facility two years early (will incur

pre-payment penalties and other costs)

o Explore strategic options for the Seymour, Indiana, facility to

optimize capital deployment and increase return on capital

BENSON HILLView entire presentation