Ares US Real Estate Opportunity Fund III

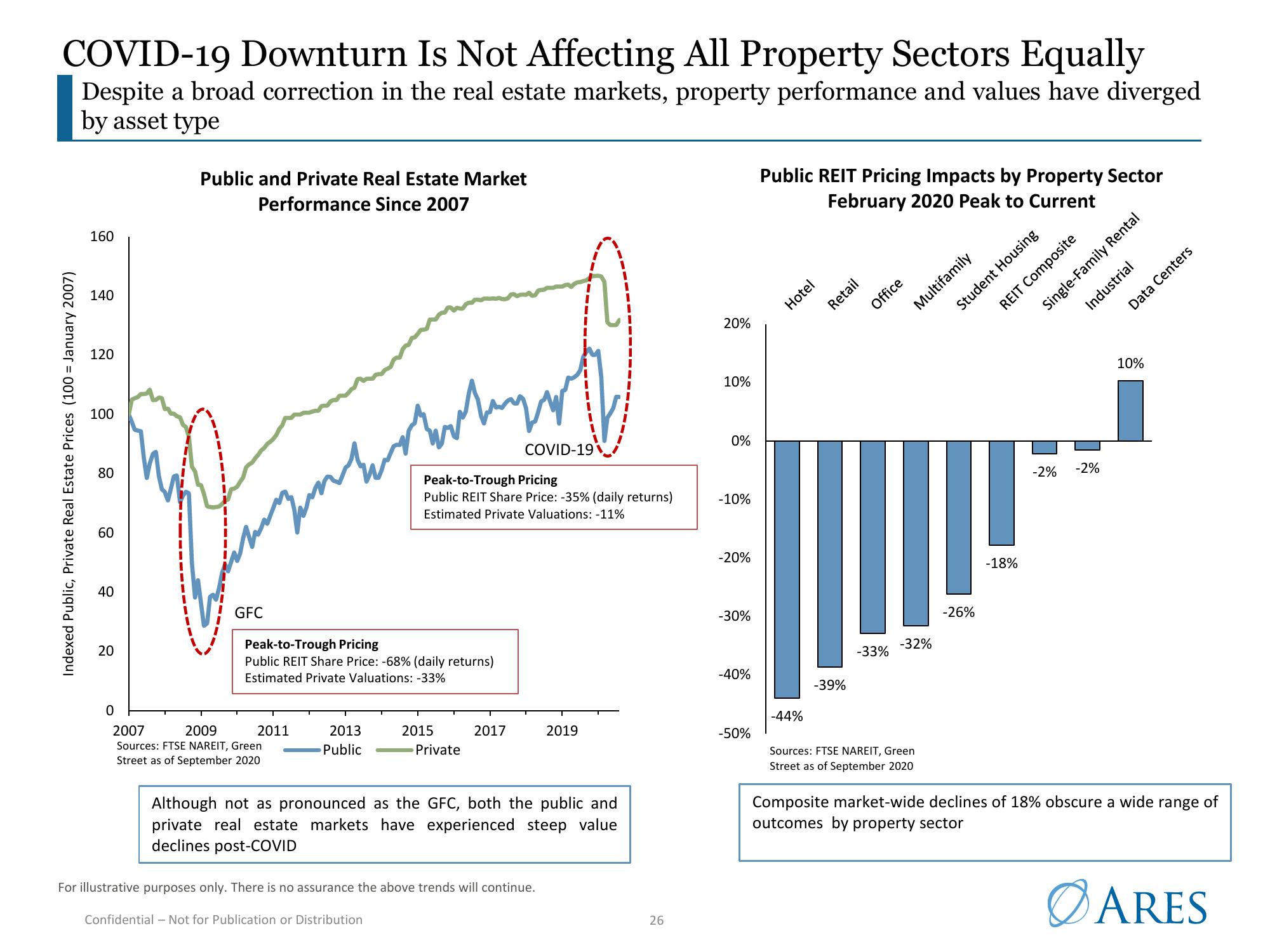

COVID-19 Downturn Is Not Affecting All Property Sectors Equally

Despite a broad correction in the real estate markets, property performance and values have diverged

by asset type

Indexed Public, Private Real Estate Prices (100 = January 2007)

160

140

120

100

80

60

40

20

Public and Private Real Estate Market

Performance Since 2007

GFC

enterertige

Peak-to-Trough Pricing

Public REIT Share Price: -68% (daily returns)

Estimated Private Valuations: -33%

0

2009

2007

Sources: FTSE NAREIT, Green

Street as of September 2020

2011

2013

Public

Peak-to-Trough Pricing

Public REIT Share Price: -35% (daily returns)

Estimated Private Valuations: -11%

COVID-19

2015

Private

Confidential - Not for Publication or Distribution

2017

Although not as pronounced as the GFC, both the public and

private real estate markets have experienced steep value

declines post-COVID

For illustrative purposes only. There is no assurance the above trends will continue.

2019

26

20%

10%

0%

-10%

-20%

-30%

-40%

-50%

Public REIT Pricing Impacts by Property Sector

February 2020 Peak to Current

-44%

Hotel

Retail

-39%

Office

-33%

Multifamily

-32%

Sources: FTSE NAREIT, Green

Street as of September 2020

Student Housing

REIT Composite

-26%

-18%

-2%

-2%

Industrial

Single-Family Rental

Data Centers

10%

Composite market-wide declines of 18% obscure a wide range of

outcomes by property sector

ARESView entire presentation