Evercore Investment Banking Pitch Book

McMoRan Situation Analysis

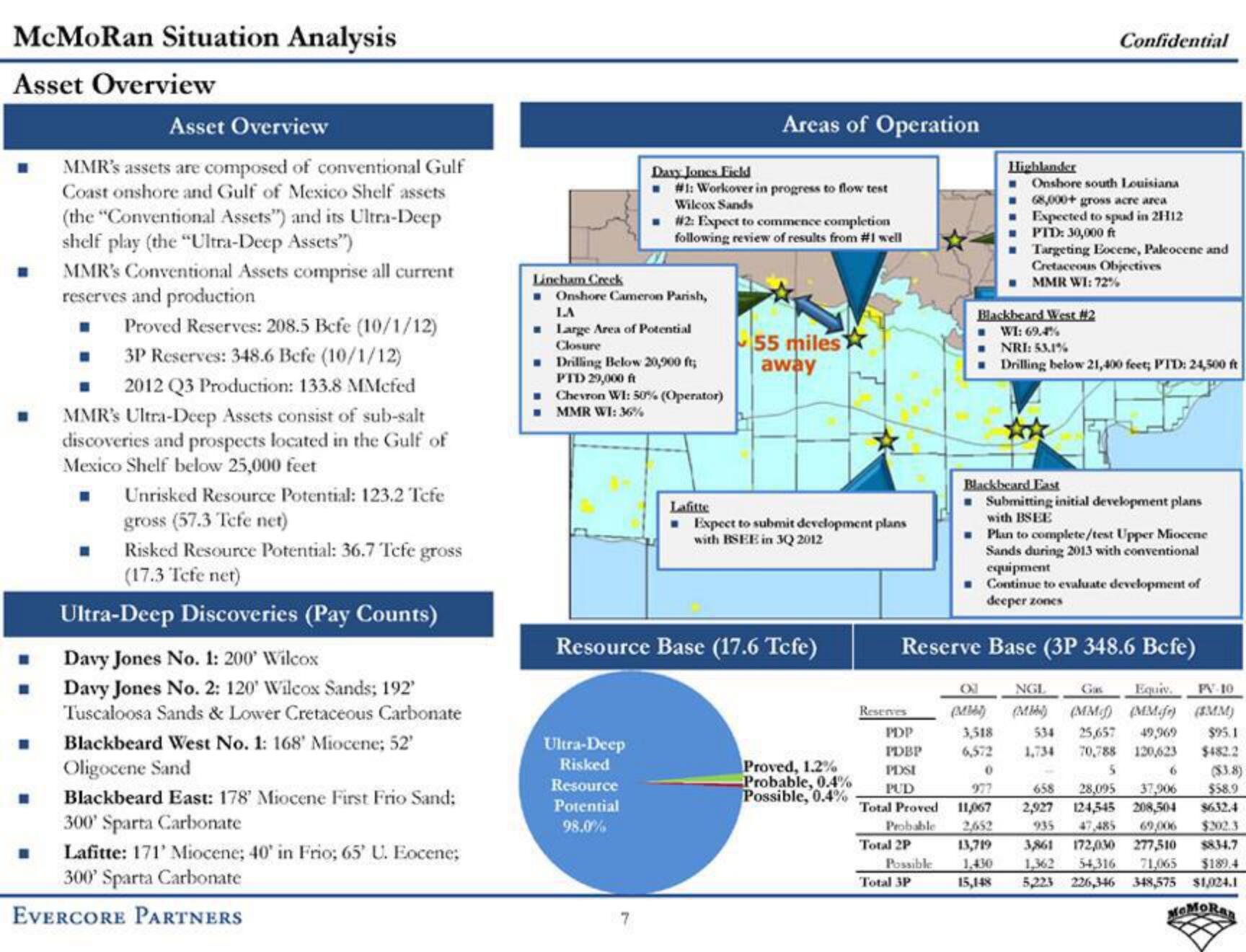

Asset Overview

Asset Overview

MMR's assets are composed of conventional Gulf

Coast onshore and Gulf of Mexico Shelf assets

(the "Conventional Assets") and its Ultra-Deep

shelf play (the "Ultra-Deep Assets")

MMR's Conventional Assets comprise all current

reserves and production

■ Proved Reserves: 208.5 Bcfe (10/1/12)

3P Reserves: 348.6 Befe (10/1/12)

2012 Q3 Production: 133.8 MMcfed

MMR's Ultra-Deep Assets consist of sub-salt

discoveries and prospects located in the Gulf of

Mexico Shelf below 25,000 feet

Unrisked Resource Potential: 123.2 Tefe

gross (57.3 Tefe net)

Risked Resource Potential: 36.7 Tefe gross

(17.3 Tefe net)

Ultra-Deep Discoveries (Pay Counts)

■ Davy Jones No. 1: 200' Wilcox

Davy Jones No. 2: 120' Wilcox Sands; 192'

Tuscaloosa Sands & Lower Cretaceous Carbonate

Blackbeard West No. 1: 168' Miocene; 52'

Oligocene Sand

Blackbeard East: 178' Miocene First Frio Sand;

300' Sparta Carbonate

Lafitte: 171' Miocene; 40' in Frio; 65' U. Eocene;

300' Sparta Carbonate

EVERCORE PARTNERS

Lincham Creek

Davy Jones Field

☐ #1: Workover in progress to flow test

Wilcox Sands

Onshore Cameron Parish,

LA

Large Area of Potential

Closure

Drilling Below 20,900 ft;

PTD 29,000 ft

#2: Expect to commence completion

following review of results from #1 well

■ Chevron Wl: 50% (Operator)

MMR WI: 36%

Ultra-Deep

Risked

Resource

Potential

98.0%

Areas of Operation

Lafitte

55 miles

away

Resource Base (17.6 Tcfe)

Expect to submit development plans

with RSEE in 3Q 2012

Proved, 1.2%

Probable, 0.4%

Possible, 0.4%

Reserves

PDP

PDBP

PDSI

PUD

Total Proved

Probable

Total 2P

Possible

Total 3P

Highlander

Confidential

Onshore south Louisiana

68,000+ gross acre area

Expected to spud in 2H12

PTD: 30,000 ft

Targeting Eocene, Paleocene and

Cretaceous Objectives

MMR WI: 72%

Blackbeard West #2

WI: 69.4%

☐NRI: 53.1%

■ Drilling below 21,400 feet; PTD: 24,500 ft

Blackbeard East

Submitting initial development plans

with BSEE

■ Plan to complete/test Upper Miocene

Sands during 2013 with conventional

equipment

Continue to evaluate development of

deeper zones

Reserve Base (3P 348.6 Bcfe)

0

977

11,067

2,652

13,719

1,430

15,148

OXI NGL Gas Equiv. PV-10

(Mb) (M) (MM) (MMife) (SMM)

3,518

6,572

$95.1

$482.2

534 25,657 49,969

1,734 70,788 120,623

5

6

658 28,095 37,906

2,927 124,545 208,504

935 47,485 69,006

3,861 172,030 277,510

1,362 54,316 71,065 $189.4

5,223 226,346 348,575 $1,024.1

MoMoRan

($3.8)

$58.9

$632.4

$302.3

8834.7View entire presentation