Baird Investment Banking Pitch Book

PRO FORMA AMGP CORP. VS PEERS

■

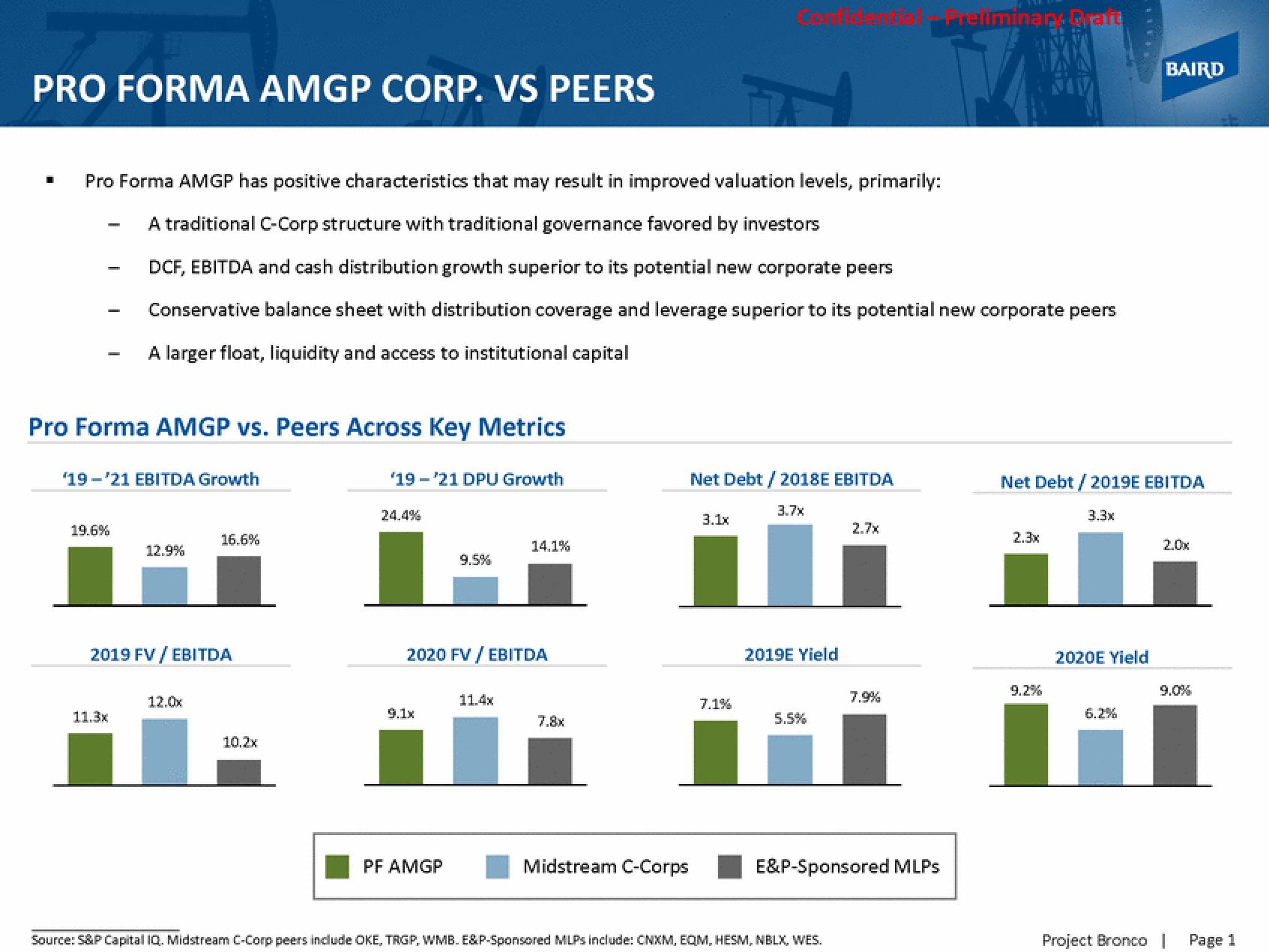

Pro Forma AMGP has positive characteristics that may result in improved valuation levels, primarily:

A traditional C-Corp structure with traditional governance favored by investors

DCF, EBITDA and cash distribution growth superior to its potential new corporate peers

Conservative balance sheet with distribution coverage and leverage superior to its potential new corporate peers

A larger float, liquidity and access to institutional capital

-

Pro Forma AMGP vs. Peers Across Key Metrics

'19'21 EBITDA Growth

19.6%

12.9%

11.3x

2019 FV / EBITDA

16.6%

12.0x

10,2x

'19'21 DPU Growth

24.4%

9.1x

9.5%

2020 FV / EBITDA

PF AMGP

14.1%

11.4x

7.8x

Midstream C-Corps

Net Debt/2018E EBITDA

3.1x

7.1%

3.7x

2019E Yield

5.5%

2.7x

Source: S&P Capital IQ. Midstream C-Corp peers include OKE, TRGP, WMB. E&P-Sponsored MLPS include: CNXM, EQM, HESM, NBLX, WES.

7.9%

E&P-Sponsored MLPs

Treliminar. Draft

2.3x

Net Debt / 2019E EBITDA

9.2%

3.3x

11.

2020E Yield

6.2%

BAIRD

Project Bronco

2,0x

Page 1View entire presentation