Netstreit Investor Presentation Deck

Conservative Balance Sheet with Improved Liquidity

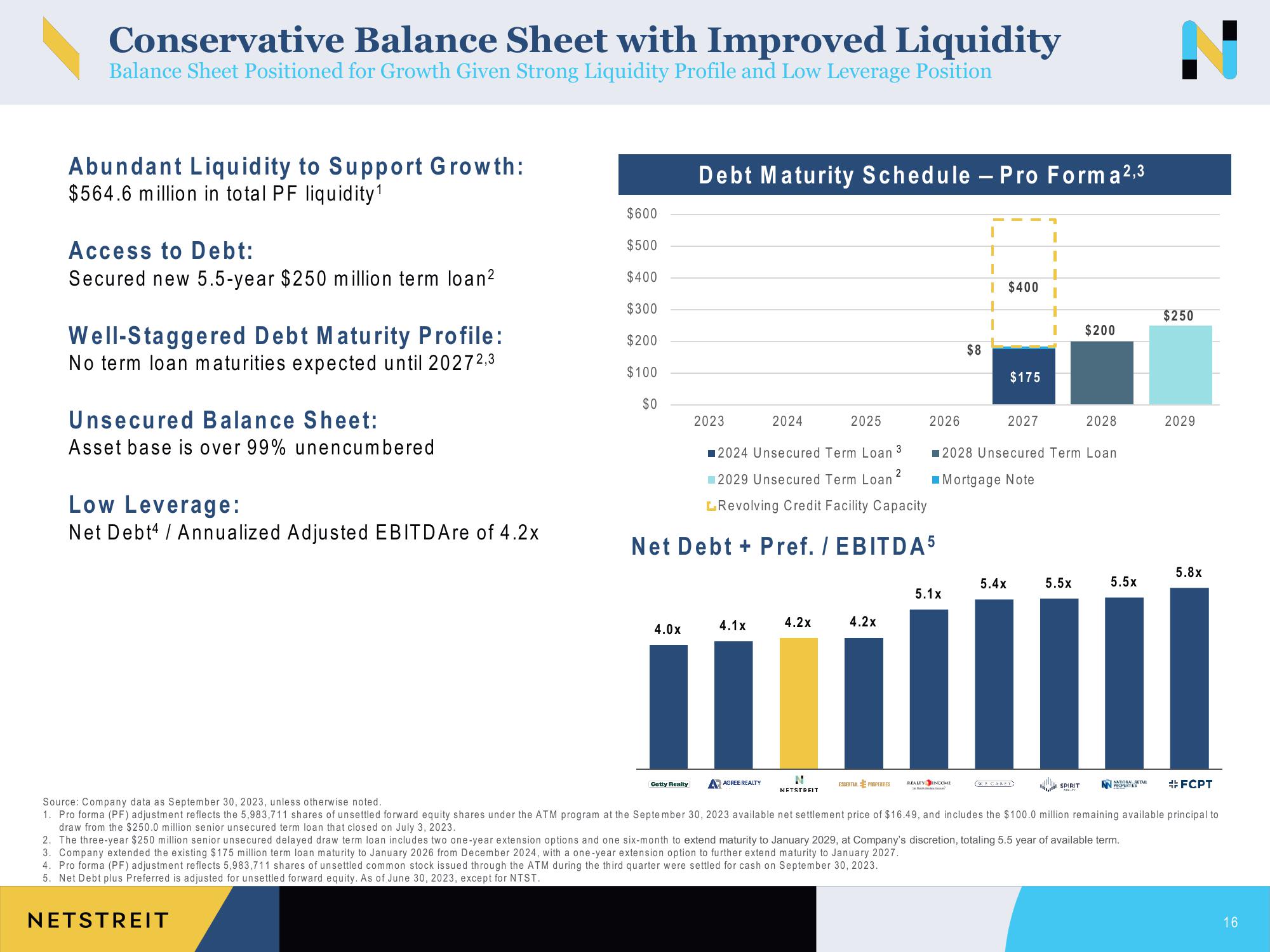

Balance Sheet Positioned for Growth Given Strong Liquidity Profile and Low Leverage Position

Abundant Liquidity to Support Growth:

$564.6 million in total PF liquidity ¹

Access to Debt:

Secured new 5.5-year $250 million term loan²

Well-Staggered Debt Maturity Profile:

No term loan maturities expected until 20272,3

Unsecured Balance Sheet:

Asset base is over 99% unencumbered

Low Leverage:

Net Debt4 / Annualized Adjusted EBITDAre of 4.2x

$600

$500

$400

$300

$200

$100

NETSTREIT

$0

4.0x

Debt Maturity Schedule - Pro Forma ²,3

Getty Realty

2023

2

■2024 Unsecured Term Loan 3

2029 Unsecured Term Loan

LRevolving Credit Facility Capacity

Net Debt + Pref. / EBITDA5

4.1x

2024

AGREE REALTY

4.2x

2025

NETSTREIT

2026

4.2x

5.1x

$8

ESSENTIAL PROPERTIES REALEY INCOME

I $400

$175

2027

5.4x

2028 Unsecured Term Loan

Mortgage Note

I

1

(WP CAREY

5.5x

$200

SPIRIT

2028

5.5x

NN RETAIL

$250

2029

5.8x

FCPT

Source: Company data as September 30, 2023, unless otherwise noted.

1. Pro forma (PF) adjustment reflects the 5,983,711 shares of unsettled forward equity shares under the ATM program at the September 30, 2023 available net settlement price of $16.49, and includes the $100.0 million remaining available principal to

draw from the $250.0 million senior unsecured term loan that closed on July 3, 2023.

2. The three-year $250 million senior unsecured delayed draw term loan includes two one-year extension options and one six-month to extend maturity to January 2029, at Company's discretion, totaling 5.5 year of available term.

3. Company extended the existing $175 million term loan maturity to January 2026 from December 2024, with a one-year extension option to further extend maturity to January 2027.

4. Pro forma (PF) adjustment reflects 5,983,711 shares of unsettled common stock issued through the ATM during the third quarter were settled for cash on September 30, 2023.

5. Net Debt plus Preferred is adjusted for unsettled forward equity. As of June 30, 2023, except for NTST.

16View entire presentation