J.P.Morgan Investment Banking Pitch Book

KEY TRANSACTION CONSIDERATIONS

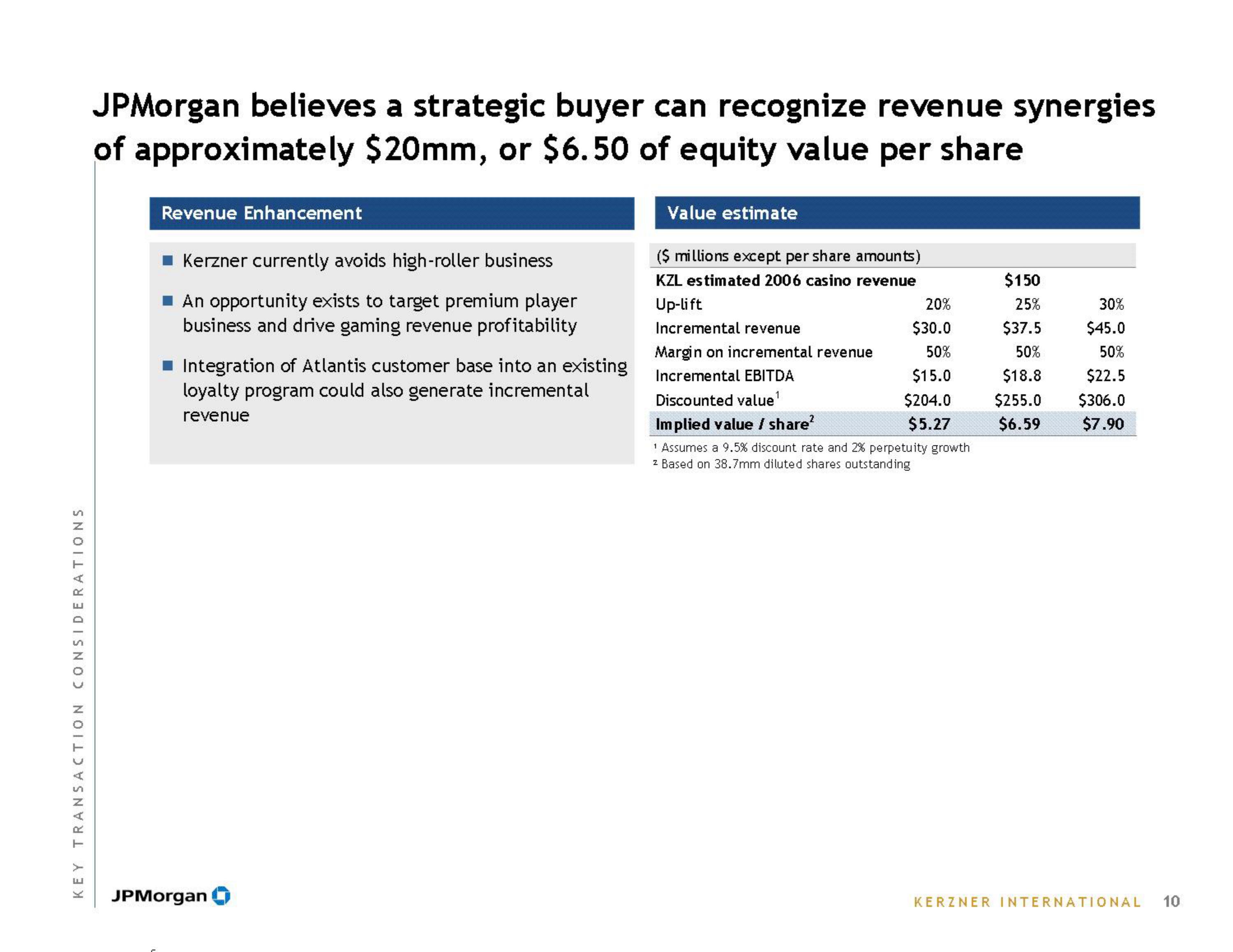

JPMorgan believes a strategic buyer can recognize revenue synergies

of approximately $20mm, or $6.50 of equity value per share

Revenue Enhancement

Kerzner currently avoids high-roller business

An opportunity exists to target premium player

business and drive gaming revenue profitability

Integration of Atlantis customer base into an existing

loyalty program could also generate incremental

revenue

JPMorgan

Value estimate

($ millions except per share amounts)

KZL estimated 2006 casino revenue

Up-lift

20%

$30.0

50%

$15.0

$204.0

$5.27

Incremental revenue

Margin on incremental revenue

Incremental EBITDA

Discounted value¹

Implied value / share²

1 Assumes a 9.5 % discount rate and 2% perpetuity growth

2 Based on 38.7mm diluted shares outstanding

$150

25%

30%

$37.5

$45.0

50%

50%

$18.8

$22.5

$255.0

$306.0

$6.59 $7.90

KERZNER INTERNATIONAL 10View entire presentation