LionTree Investment Banking Pitch Book

Saturn Snapshot

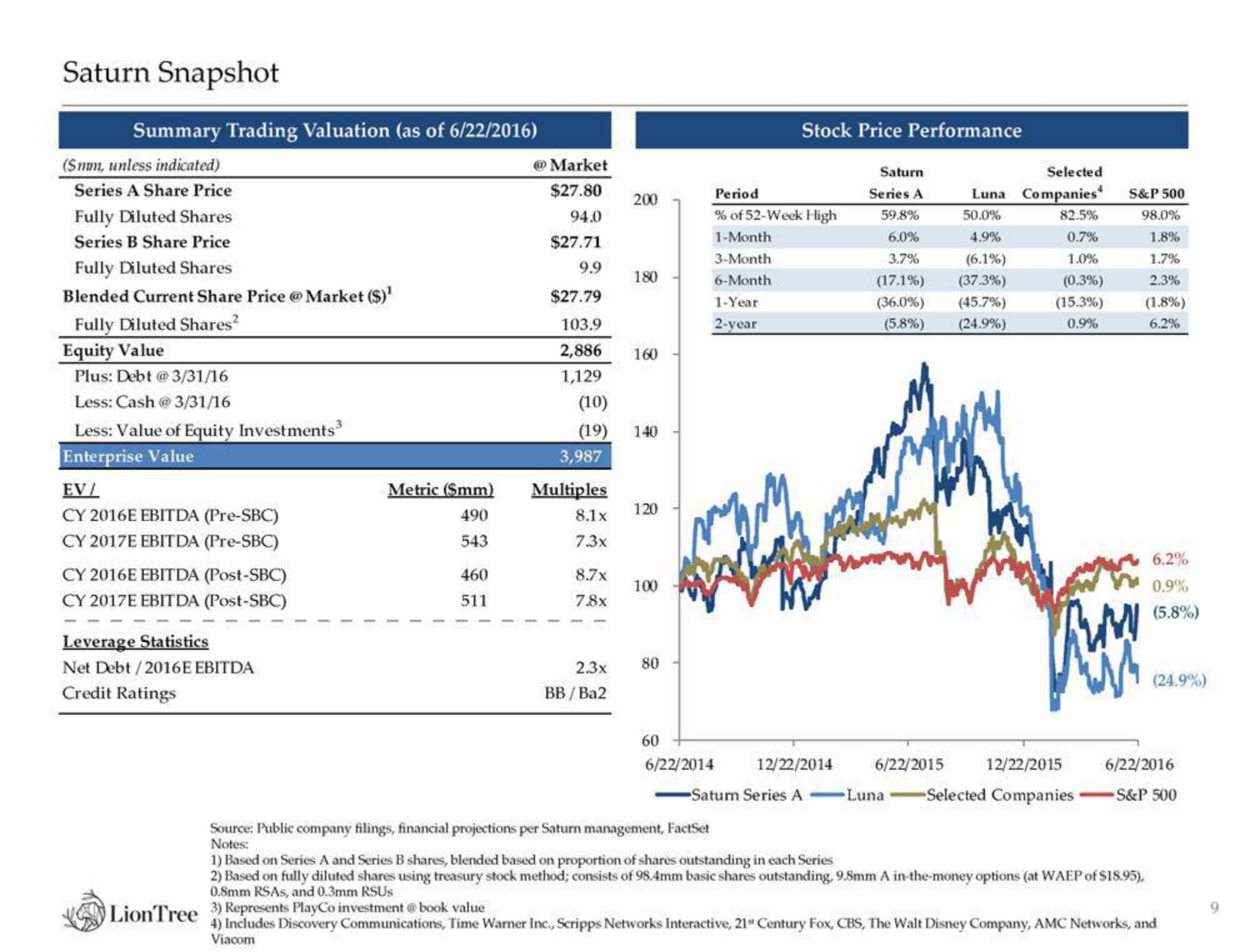

Summary Trading Valuation (as of 6/22/2016)

(Smm, unless indicated)

Series A Share Price

Fully Diluted Shares

Series B Share Price

Fully Diluted Shares

Blended Current Share Price @ Market ($)¹

Fully Diluted Shares²

Equity Value

Plus: Debt @ 3/31/16

Less: Cash @ 3/31/16

Less: Value of Equity Investments

Enterprise Value

EV/

CY 2016E EBITDA (Pre-SBC)

CY 2017E EBITDA (Pre-SBC)

CY 2016E EBITDA (Post-SBC)

CY 2017E EBITDA (Post-SBC)

Leverage Statistics

Net Debt/2016E EBITDA

Credit Ratings

Lion Tree

3

Metric (Smm)

490

543

460

511

@Market

$27.80

94.0

$27.71

9.9

$27.79

103.9

2,886

1,129

3,987

Multiples

8.1x

7.3x

8.7x

7.8x

200

(10)

(19) 140

2.3x

BB/Ba2

180

160

120

100

80

60

6/22/2014

Stock Price Performance

Period

% of 52-Week High

1-Month

3-Month

6-Month

1-Year

2-year

12/22/2014

-Saturn Series A

Source: Public company filings, financial projections per Saturn management, FactSet

Notes:

Saturn

Series A

59.8%

6.0%

3.7%

(17.1%)

(36.0%)

(5.8%)

Selected

Luna Companies

50.0%

4.9%

Luna

(6.1%)

(37.3%)

(45.7%)

(24.9%)

82.5%

0.7%

1.0%

(0.3%)

(15.3%)

0.9%

6/22/2015 12/22/2015

Selected Companies

S&P 500

98.0%

1.8%

1.7%

2.3%

(1.8%)

6.2%

www

6.2%

0.9%

(5.8%)

1) Based on Series A and Series B shares, blended based on proportion of shares outstanding in each Series

2) Based on fully diluted shares using treasury stock method; consists of 98.4mm basic shares outstanding, 9.8mm A in-the-money options (at WAEP of $18.95),

0.8mm RSAs, and 0.3mm RSUs

(24.9%)

6/22/2016

- S&P 500

3) Represents PlayCo investment @book value

4) Includes Discovery Communications, Time Warner Inc., Scripps Networks Interactive, 21st Century Fox, CBS, The Walt Disney Company, AMC Networks, and

ViacomView entire presentation