Tradeweb Investor Presentation Deck

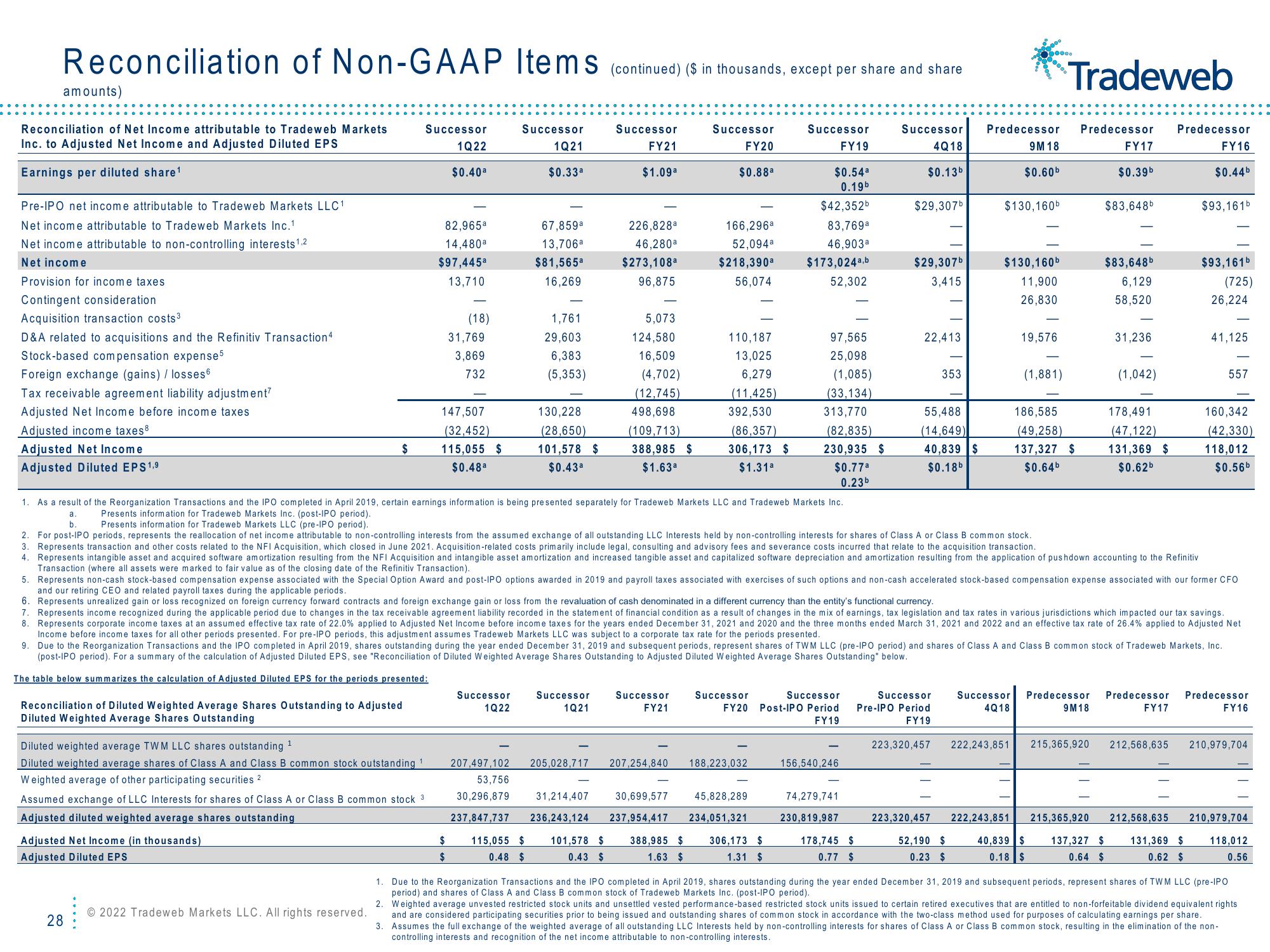

Reconciliation of Non-GAAP Items (continued) ($ in thousands, except per share and share

Successor

FY21

$1.09a

Successor

FY20

$0.88a

amounts)

Reconciliation of Net Income attributable to Tradeweb Markets

Inc. to Adjusted Net Income and Adjusted Diluted EPS

Earnings per diluted share¹

Pre-IPO net income attributable to Tradeweb Markets LLC 1

Net income attributable to Tradeweb Markets Inc.1

Net income attributable to non-controlling interests ¹.2

Net income

Provision for income taxes

Contingent consideration

Acquisition transaction costs 3

D&A related to acquisitions and the Refinitiv Transaction4

Stock-based compensation expense5

Foreign exchange (gains) / losses 6

Tax receivable agreement liability adjustment?

Adjusted Net Income before income taxes.

Adjusted income taxes8

Adjusted Net Income

Adjusted Diluted EPS 1,9

$

Reconciliation of Diluted Weighted Average Shares Outstanding to Adjusted

Diluted Weighted Average Shares Outstanding

Adjusted Net Income (in thousands)

Adjusted Diluted EPS

Successor

1Q22

$0.40a

Diluted weighted average TWM LLC shares outstanding ¹

Diluted weighted average shares of Class A and Class B common stock outstanding

Weighted average of other participating securities 2

Assumed exchange of LLC Interests for shares of Class A or Class B common stock 3

Adjusted diluted weighted average shares outstanding

28

2022 Tradeweb Markets LLC. All rights reserved.

82,965a

14,480a

$97,445a

13,710

(18)

31,769

3,869

732

147,507

(32,452)

115,055 $

$0.48a

Successor

1Q21

$0.33a

Successor

1Q22

207,497,102

53,756

30,296.879

237,847,737

67,859a

13,706a

$81,565a

16,269

1,761

29,603

6,383

(5,353)

$ 115,055 $

$

0.48 $

130,228

(28,650)

101,578 $

$0.43a

226,828a

46,280a

$273,108a

96,875

Successor

1Q21

5,073

124,580

16,509

(4,702)

(12,745)

498,698

(109,713)

388,985 $

$1.63a

101,578 $

0.43 $

Successor

FY21

205,028,717 207,254,840

31,214,407 30,699,577

236,243,124 237,954,417

166,296a

52,094a

$218,390a

56,074

110,187

13,025

6,279

(11,425)

392,530

388,985 $

1.63 $

(86,357)

306,173 $

$1.31a

188,223,032

Successor

FY19

45,828,289

$0.54a

0.19b

$42,352b

83,769a

46,903a

$173,024a,b

52,302

Successor

Successor

FY20 Post-IPO Period

FY19

234,051,321

97,565

25,098

(1,085)

(33,134)

313,770

(82,835)

230,935 $

$0.77a

0.23b

306,173 $

1.31 $

156,540,246

Successor

4Q18

$0.13b

74,279,741

230,819,987

$29,307b

178,745 $

0.77 $

$29,307b

3,415

22,413

353

55,488

(14,649)

40,839 $

$0.18b

1. As a result of the Reorganization Transactions and the IPO completed in April 2019, certain earnings information is being presented separately for Tradeweb Markets LLC and Tradeweb Markets Inc.

Presents information for Tradeweb Markets Inc. (post-IPO period).

a.

b.

Presents information. Tradeweb Markets LLC (pre-IPO period).

2. For post-IPO periods, represents the reallocation of net income attributable to non-controlling interests from the assumed exchange of all outstanding LLC Interests held by non-controlling interests for shares of Class A or Class B common stock.

3. Represents transaction and other costs related to the NFI Acquisition, which closed in June 2021. Acquisition-related costs primarily include legal, consulting and advisory fees and severance costs incurred that relate to the acquisition transaction.

4. Represents intangible asset and acquired software amortization resulting from the NFI Acquisition and intangible asset amortization and increased tangible asset and capitalized software depreciation and amortization resulting from the application of pushdown accounting to the Refinitiv

Transaction (where all assets were marked to fair value as of the closing date of the Refinitiv Transaction).

5. Represents non-cash stock-based compensation expense associated with the Special Option Award and post-IPO options awarded in 2019 and payroll taxes associated with exercises of such options and non-cash accelerated stock-based compensation expense associated with our former CFO

and our retiring CEO and related payroll taxes during the applicable periods.

6. Represents unrealized gain or loss recognized on foreign currency forward contracts and foreign exchange gain or loss from the revaluation of cash denominated in a different currency than the entity's functional currency.

7. Represents income recognized during the applicable period due to changes in the tax receivable agreement liability recorded in the statement of financial condition as a result of changes in the mix of earnings, tax legislation and tax rates in various jurisdictions which impacted our tax savings.

8. Represents corporate income taxes at an assumed effective tax rate of 22.0% applied to Adjusted Net Income before income taxes for the years ended December 31, 2021 and 2020 and the three months ended March 31, 2021 and 2022 and an effective tax rate of 26.4% applied to Adjusted Net

Income before income taxes for all other periods presented. For pre-IPO periods, this adjustment assumes Tradeweb Markets LLC was subject to a corporate tax rate for the periods presented.

9. Due to the Reorganization Transactions and the IPO completed in April 2019, shares outstanding during the year ended December 31, 2019 and subsequent periods, represent shares of TWM LLC (pre-IPO period) and shares of Class A and Class B common stock of Tradeweb Markets, Inc.

(post-IPO period). For a summary of the calculation of Adjusted Diluted EPS, see "Reconciliation of Diluted Weighted Average Shares Outstanding to Adjusted Diluted Weighted Average Shares Outstanding" below.

The table below summarizes the calculation of Adjusted Diluted EPS for the periods presented:

**o.

Tradeweb

Predecessor Predecessor Predecessor

9M 18

$0.60b

223,320,457

$130,160b

$130,160b

11,900

26,830

19,576

(1,881)

186,585

(49,258)

137,327 $

$0.64b

FY17

$0.39b

$83,648b

$83,648b

6,129

58,520

40,839 $

0.18 $

31,236

(1,042)

178,491

(47,122)

131,369 $

$0.62b

Successor Successor Predecessor Predecessor

Pre-IPO Period

4Q18

9M18

FY19

137,327 $

0.64 $

222,243,851 215,365,920 212,568,635

FY17

223,320,457 222,243,851 215,365,920 212,568,635

52,190 $

131,369 $

0.23 $

0.62 $

FY16

$0.445

$93,161b

$93,161b

(725)

26,224

41,125

160,342

(42,330)

118,012

$0.56b

557

Predecessor

FY16

210,979,704

210,979,704

118,012

0.56

3. Assumes the full exchange of the weighted average of all outstanding LLC Interests held by non-controlling interests for shares of Class A or Class B common stock, resulting in the elimination of the non-

controlling interests and recognition of the net income attributable to non-controlling interests.

1. Due to the Reorganization Transactions and the IPO completed in April 2019, shares outstanding during the year ended December 31, 2019 and subsequent periods, represent shares of TWM LLC (pre-IPO

period) and shares of Class A and Class B common stock of Tradeweb Markets Inc. (post-IPO period).

2. Weighted average unvested restricted stock units and unsettled vested performance-based restricted stock units issued to certain retired executives that are entitled to non-forfeitable dividend equivalent rights.

and are considered participating securities prior to being issued and outstanding shares of common stock in accordance with the two-class method used for purposes of calculating earnings per share.View entire presentation