DTE Electric Investor Presentation Deck

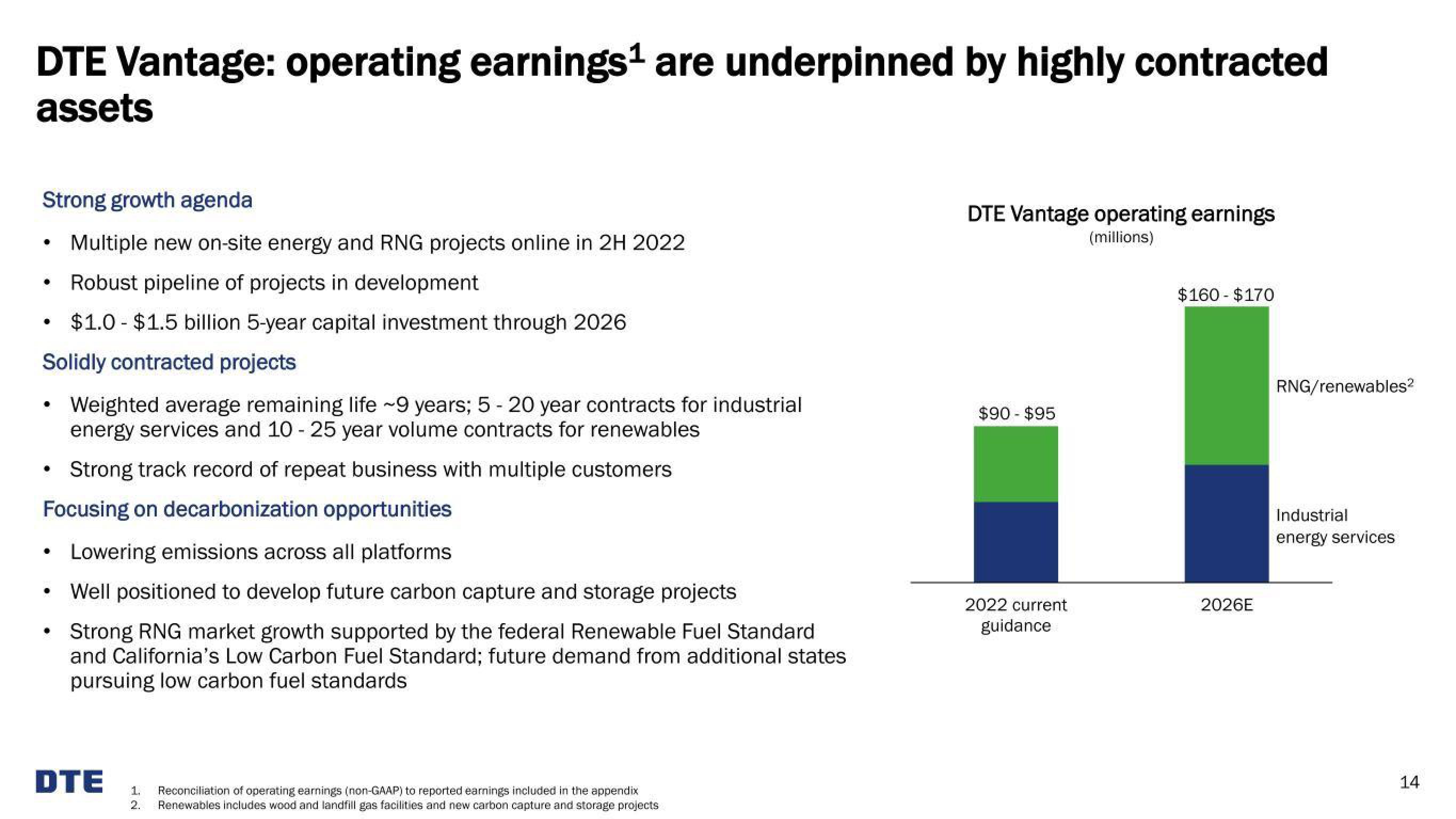

DTE Vantage: operating earnings¹ are underpinned by highly contracted

assets

Strong growth agenda

Multiple new on-site energy and RNG projects online in 2H 2022

Robust pipeline of projects in development

$1.0-$1.5 billion 5-year capital investment through 2026

Solidly contracted projects

•

•

0

Weighted average remaining life ~9 years; 5 - 20 year contracts for industrial

energy services and 10 - 25 year volume contracts for renewables

Strong track record of repeat business with multiple customers

Focusing on decarbonization opportunities

•

•

Lowering emissions across all platforms

Well positioned to develop future carbon capture and storage projects

Strong RNG market growth supported by the federal Renewable Fuel Standard

and California's Low Carbon Fuel Standard; future demand from additional states

pursuing low carbon fuel standards

DTE

1. Reconciliation of operating earnings (non-GAAP) to reported earnings included in the appendix

2. Renewables includes wood and landfill gas facilities and new carbon capture and storage projects

DTE Vantage operating earnings

(millions)

$90 - $95

2022 current

guidance

$160-$170

2026E

RNG/renewables²

Industrial

energy services

14View entire presentation