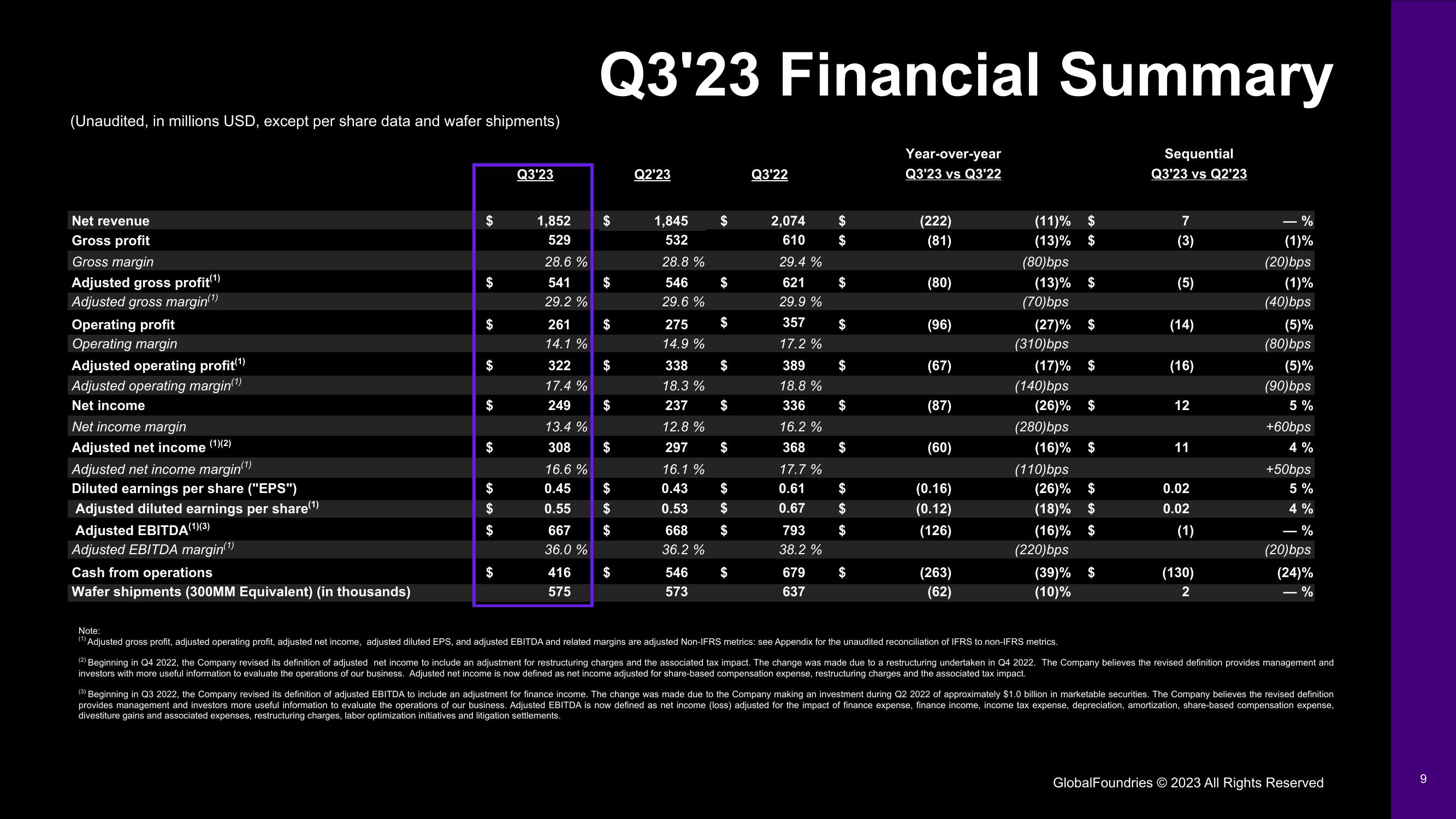

GlobalFoundries Results Presentation Deck

(Unaudited, in millions USD, except per share data and wafer shipments)

Net revenue

Gross profit

Gross margin

Adjusted gross profit(¹)

Adjusted gross margin(¹)

Operating profit

Operating margin

Adjusted operating profit(¹)

Adjusted operating margin(¹)

Net income

Net income margin

Adjusted net income (1)(2)

Adjusted net income margin(¹)

Diluted earnings per share ("EPS")

Adjusted diluted earnings per share(¹)

Adjusted EBITDA (1)(3)

Adjusted EBITDA margin(¹)

Cash from operations

Wafer shipments (300MM Equivalent) (in thousands)

SA

Q3'23

1,852

529

28.6 %

541

29.2 %

261

14.1%

Q3'23 Financial Summary

Sequential

Q3'23 vs Q2'23

416

575

$

$

322

17.4%

249

13.4%

308 $

16.6 %

0.45

0.55

667

36.0 %

$

$

LA LA

$

$

Q2'23

1,845

532

28.8 %

546

29.6 %

275

14.9%

338

18.3%

237

12.8 %

297

16.1 %

0.43

0.53

668

36.2 %

546

573

$

$

SA

SA

SA

LA LA

$

$

Q3'22

2,074

610

29.4%

621

29.9 %

357 $

17.2%

389

18.8 %

336

16.2 %

368

17.7 %

0.61

0.67

793

38.2 %

679

637

$

$

$

$

$

Year-over-year

Q3'23 vs Q3'22

(222)

(81)

(80)

(96)

(67)

(87)

(60)

(0.16)

(0.12)

(126)

(263)

(62)

(11)% $

(13)% $

(80)bps

(13)% $

(70)bps

(27)% $

(310)bps

(17)% $

(140)bps

(26)% $

(280)bps

(16)%

(110)bps

(26)% $

(18)% $

(16)% $

(220)bps

(39)% $

(10)%

Note:

(1) Adjusted gross profit, adjusted operating profit, adjusted net income, adjusted diluted EPS, and adjusted EBITDA and related margins are adjusted Non-IFRS metrics: see Appendix for the unaudited reconciliation of IFRS to non-IFRS metrics.

(2)

$

7

(3)

(5)

(14)

(16)

12

11

0.02

0.02

(1)

(130)

2

%

(1)%

(20)bps

(1)%

(40)bps

(5)%

(80)bps

(5)%

(90)bps

5%

+60bps

4%

+50bps

5%

4 %

%

(20)bps

(24)%

%

Beginning in Q4 2022, the Company revised its definition of adjusted net income to include an adjustment for restructuring charges and the associated tax impact. The change was made due to a restructuring undertaken in Q4 2022. The Company believes the revised definition provides management and

investors with more useful information to evaluate the operations of our business. Adjusted net income is now defined as net income adjusted for share-based compensation expense, restructuring charges and the associated tax impact.

(3) Beginning in Q3 2022, the Company revised its definition of adjusted EBITDA to include an adjustment for finance income. The change was made due to the Company making an investment during Q2 2022 of approximately $1.0 billion in marketable securities. The Company believes the revised definition

provides management and investors more useful information to evaluate the operations of our business. Adjusted EBITDA is now defined as net income (loss) adjusted for the impact of finance expense, finance income, income tax expense, depreciation, amortization, share-based compensation expense,

divestiture gains and associated expenses, restructuring charges, labor optimization initiatives and litigation settlements.

GlobalFoundries © 2023 All Rights Reserved

9View entire presentation