Crowdstrike Investor Day Presentation Deck

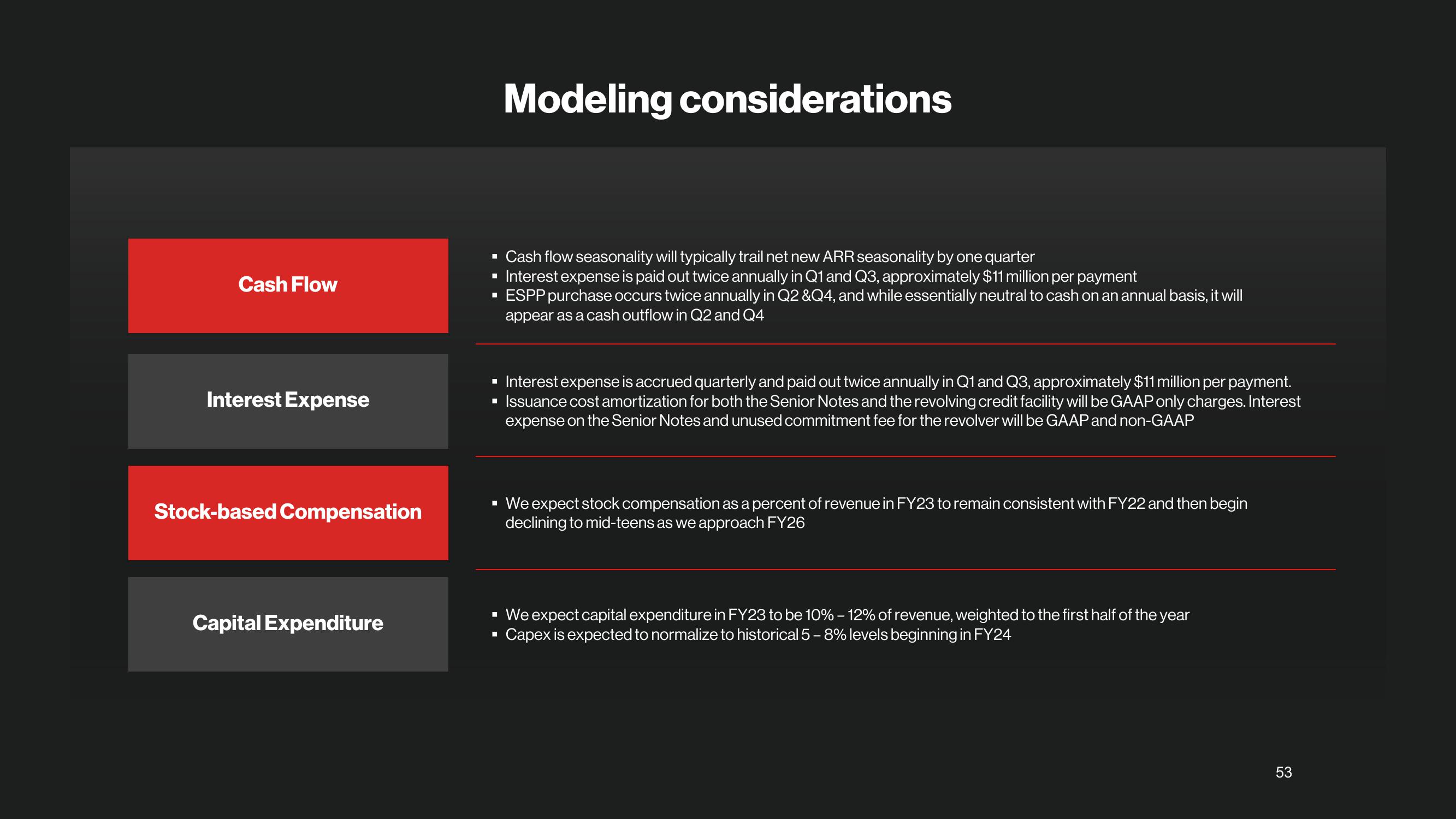

Cash Flow

Interest Expense

Stock-based Compensation

Capital Expenditure

Modeling considerations

▪ Cash flow seasonality will typically trail net new ARR seasonality by one quarter

I

Interest expense is paid out twice annually in Q1 and Q3, approximately $11 million per payment

▪ ESPP purchase occurs twice annually in Q2 &Q4, and while essentially neutral to cash on an annual basis, it will

appear as a cash outflow in Q2 and Q4

▪ Interest expense is accrued quarterly and paid out twice annually in Q1 and Q3, approximately $11 million per payment.

▪ Issuance cost amortization for both the Senior Notes and the revolving credit facility will be GAAP only charges. Interest

expense on the Senior Notes and unused commitment fee for the revolver will be GAAP and non-GAAP

▪ We expect stock compensation as a percent of revenue in FY23 to remain consistent with FY22 and then begin

declining to mid-teens as we approach FY26

▪ We expect capital expenditure in FY23 to be 10% -12% of revenue, weighted to the first half of the year

▪ Capex is expected to normalize to historical 5 - 8% levels beginning in FY24

53View entire presentation