Spotify Results Presentation Deck

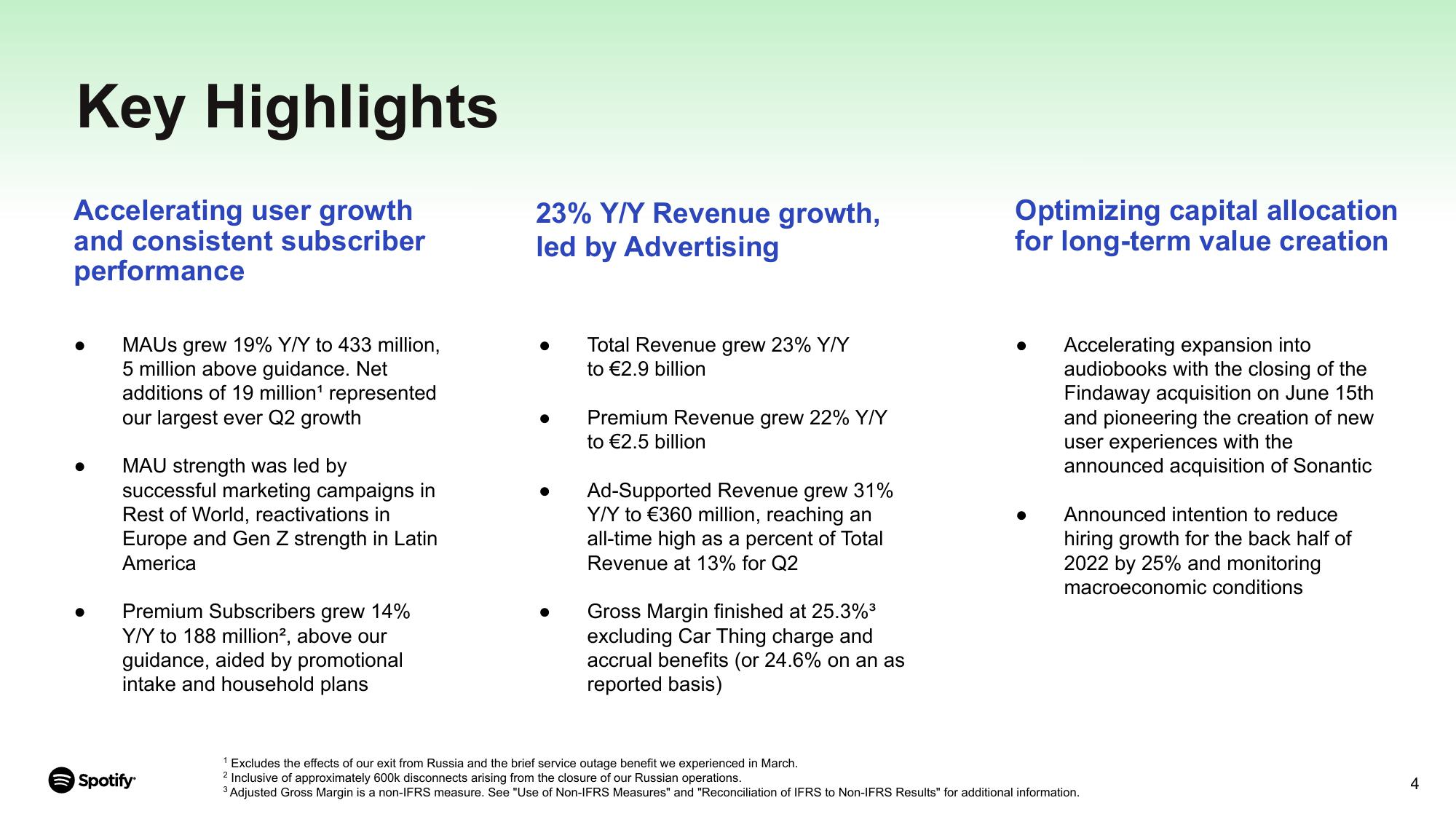

Key Highlights

Accelerating user growth

and consistent subscriber

performance

MAUS grew 19% Y/Y to 433 million,

5 million above guidance. Net

additions of 19 million¹ represented

our largest ever Q2 growth

MAU strength was led by

successful marketing campaigns in

Rest of World, reactivations in

Europe and Gen Z strength in Latin

America

Premium Subscribers grew 14%

Y/Y to 188 million2, above our

guidance, aided by promotional

intake and household plans

Spotify

23% Y/Y Revenue growth,

led by Advertising

Total Revenue grew 23% Y/Y

to €2.9 billion

Premium Revenue grew 22% Y/Y

to €2.5 billion

Ad-Supported Revenue grew 31%

Y/Y to €360 million, reaching an

all-time high as a percent of Total

Revenue at 13% for Q2

Gross Margin finished at 25.3%³

excluding Car Thing charge and

accrual benefits (or 24.6% on an as

reported basis)

Optimizing capital allocation

for long-term value creation

Accelerating expansion into

audiobooks with the closing of the

Findaway acquisition on June 15th

and pioneering the creation of new

user experiences with the

announced acquisition of Sonantic

Announced intention to reduce

hiring growth for the back half of

2022 by 25% and monitoring

macroeconomic conditions

1 Excludes the effects of our exit from Russia and the brief service outage benefit we experienced in March.

2 Inclusive of approximately 600k disconnects arising from the closure of our Russian operations.

³ Adjusted Gross Margin is a non-IFRS measure. See "Use of Non-IFRS Measures" and "Reconciliation of IFRS to Non-IFRS Results" for additional information.

4View entire presentation