Antero Midstream Partners Investor Presentation Deck

Antero Midstream Non-GAAP Measures

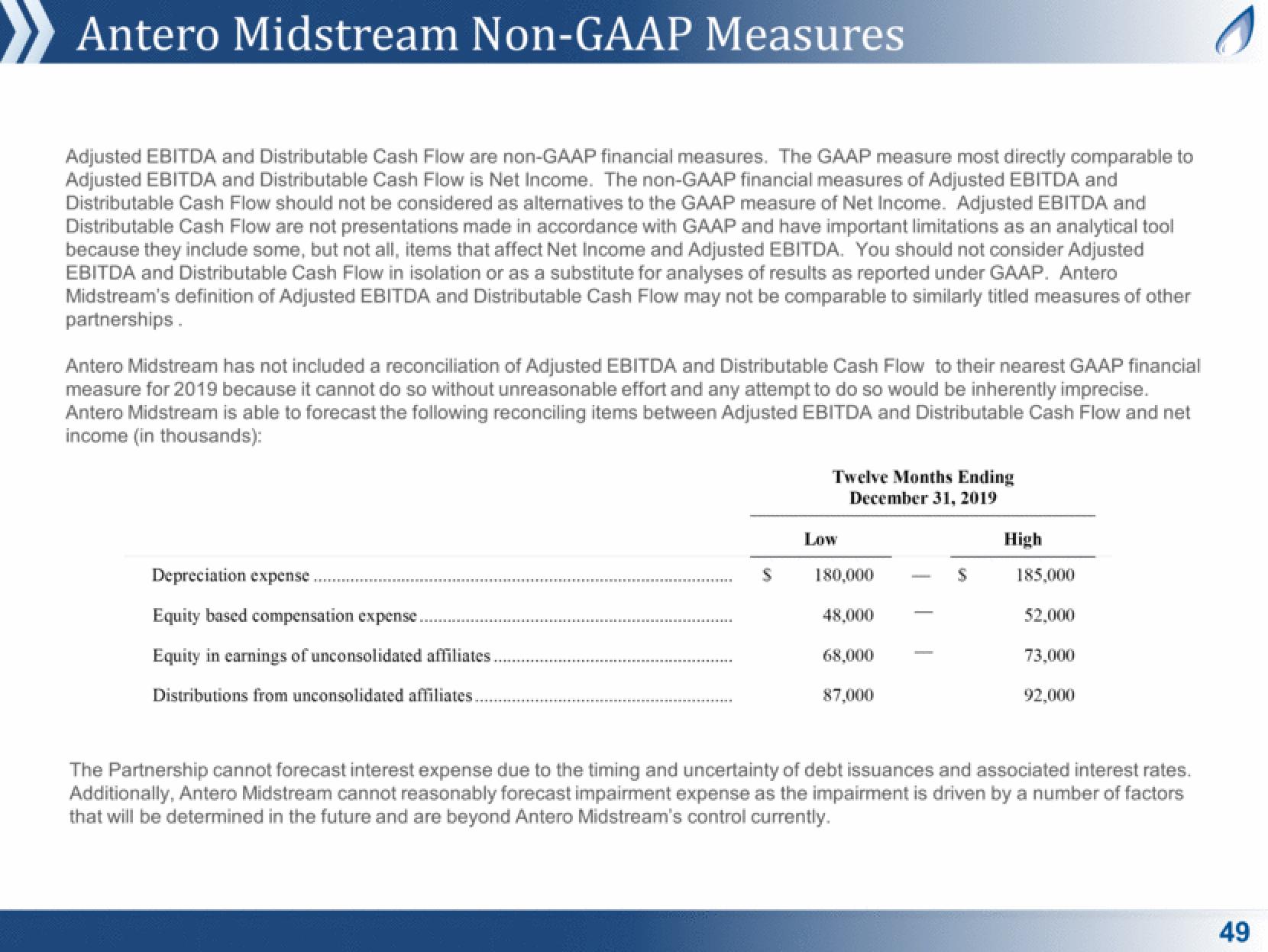

Adjusted EBITDA and Distributable Cash Flow are non-GAAP financial measures. The GAAP measure most directly comparable to

Adjusted EBITDA and Distributable Cash Flow is Net Income. The non-GAAP financial measures of Adjusted EBITDA and

Distributable Cash Flow should not be considered as alternatives to the GAAP measure of Net Income. Adjusted EBITDA and

Distributable Cash Flow are not presentations made in accordance with GAAP and have important limitations as an analytical tool

because they include some, but not all, items that affect Net Income and Adjusted EBITDA. You should not consider Adjusted

EBITDA and Distributable Cash Flow in isolation or as a substitute for analyses of results as reported under GAAP. Antero

Midstream's definition of Adjusted EBITDA and Distributable Cash Flow may not be comparable to similarly titled measures of other

partnerships.

Antero Midstream has not included a reconciliation of Adjusted EBITDA and Distributable Cash Flow to their nearest GAAP financial

measure for 2019 because it cannot do so without unreasonable effort and any attempt to do so would be inherently imprecise.

Antero Midstream is able to forecast the following reconciling items between Adjusted EBITDA and Distributable Cash Flow and net

income (in thousands):

Depreciation expense

Equity based compensation expense..

Equity in earnings of unconsolidated affiliates..

Distributions from unconsolidated affiliates..

S

Twelve Months Ending

December 31, 2019

Low

180,000

48,000

68,000

87,000

High

185,000

52,000

73,000

92,000

The Partnership cannot forecast interest expense due to the timing and uncertainty of debt issuances and associated interest rates.

Additionally, Antero Midstream cannot reasonably forecast impairment expense as the impairment is driven by a number of factors

that will be determined in the future and are beyond Antero Midstream's control currently.

s

49View entire presentation