Ocado Investor Day Presentation Deck

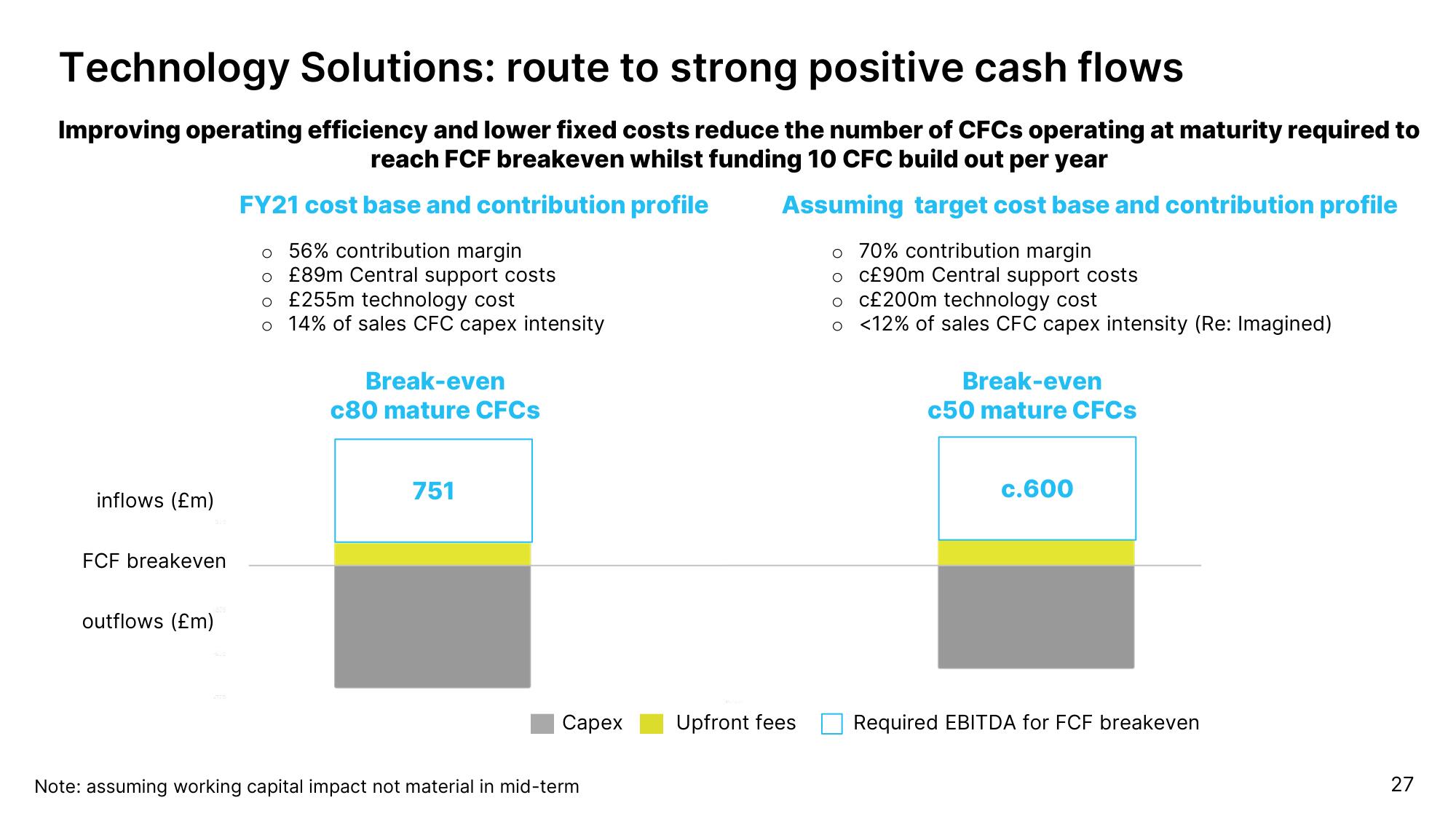

Technology Solutions: route to strong positive cash flows

Improving operating efficiency and lower fixed costs reduce the number of CFCs operating at maturity required to

reach FCF breakeven whilst funding 10 CFC build out per year

FY21 cost base and contribution profile

Assuming target cost base and contribution profile

O

56% contribution margin

o £89m Central support costs

o £255m technology cost

o 14% of sales CFC capex intensity

inflows (£m)

FCF breakeven

outflows (£m)

Break-even

c80 mature CFCs

751

Capex

Note: assuming working capital impact not material in mid-term

Upfront fees

o 70% contribution margin

O c£90m Central support costs

o c£200m technology cost

o <12% of sales CFC capex intensity (Re: Imagined)

Break-even

c50 mature CFCs

c.600

Required EBITDA for FCF breakeven

27View entire presentation