Baird Investment Banking Pitch Book

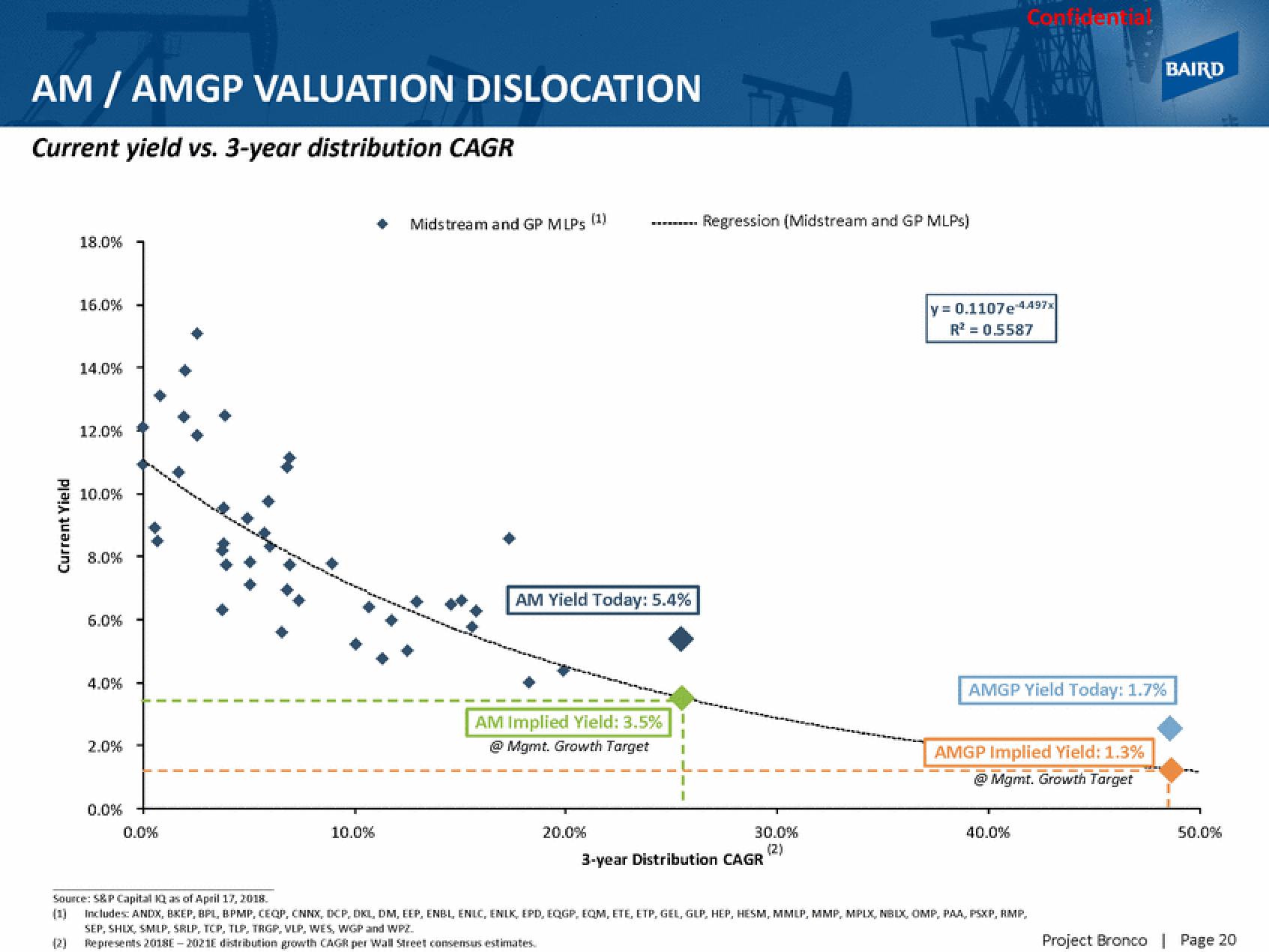

AM / AMGP VALUATION DISLOCATION

Current yield vs. 3-year distribution CAGR

Current Yield

18.0%

16.0%

14.0%

12.0%

10.0%

8.0%

6.0%

4.0%

2.0%

0.0%

**

0.0%

10.0%

Midstream and GP MLPs (1)

AM Yield Today: 5.4%

AM Implied Yield: 3.5%

@ Mgmt. Growth Target

20.0%

Regression (Midstream and GP MLPs)

30.0%

(2)

3-year Distribution CAGR

Confidential

y = 0.1107e-4.497x

R² = 0.5587

AMGP Yield Today: 1.7%

AMGP Implied Yield: 1.3%

@ Mgmt. Growth Target

40.0%

BAIRD

Source: S&P Capital IQ as of April 17, 2018.

Includes: ANDX, BKEP, BPL, BPMP, CEQP, CNNX, DCP, DKL, DM, EEP, ENBL, ENLC, ENLK, EPD, EQGP, EQM, ETE, ETP, GEL, GLP, HEP, HESM, MMLP, MMP, MPLX, NBLX, OMP, PAA, PSXP, RMP.

SEP, SHLX, SMLP, SRLP, TCP, TLP, TRGP, VLP, WES, WGP and WPZ.

Represents 2018-20210 distribution growth CAGR per Wall Street consensus estimates.

50.0%

Project Bronco | Page 20View entire presentation