Tudor, Pickering, Holt & Co Investment Banking

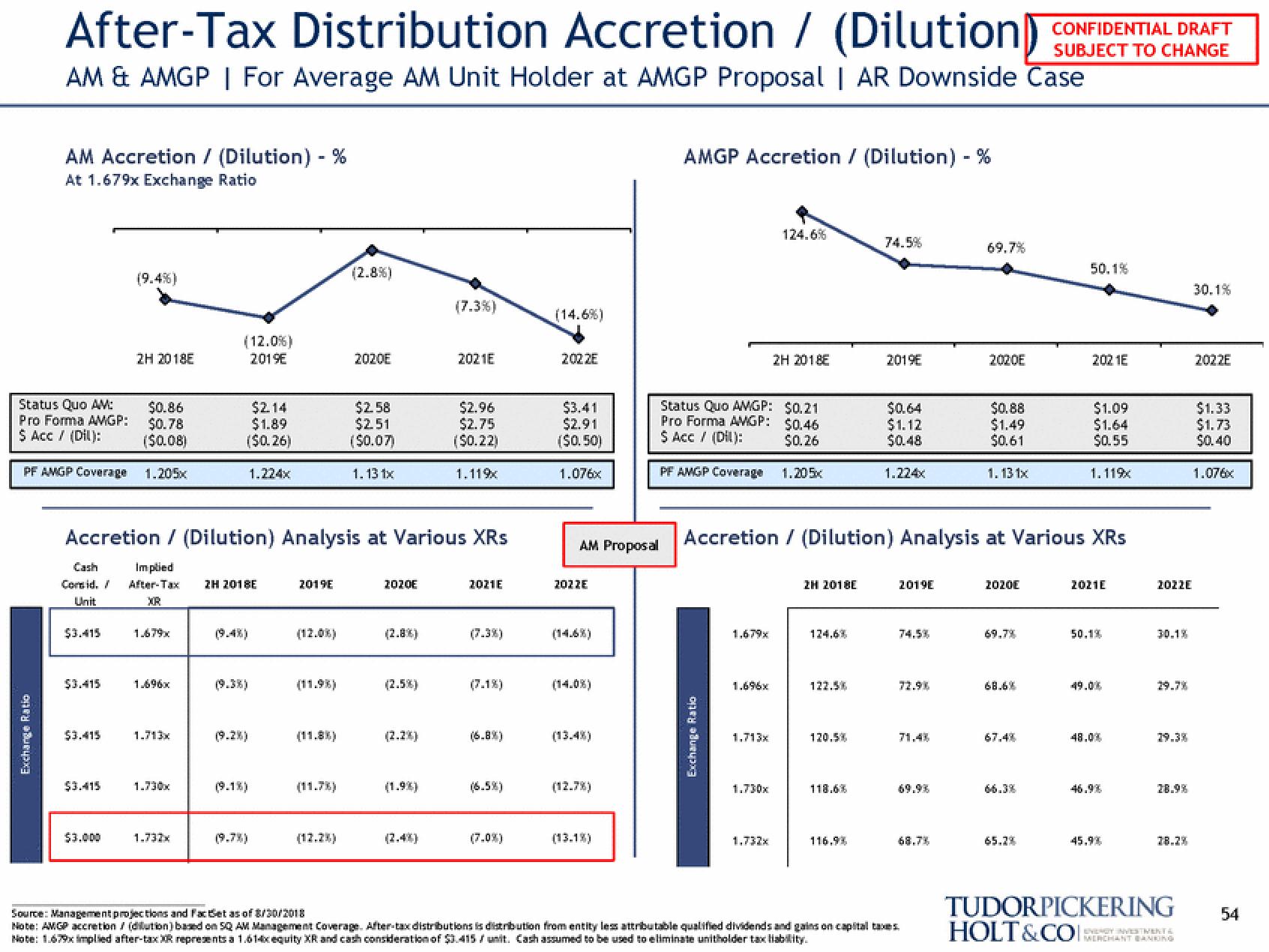

After-Tax Distribution Accretion / (Dilution)

AM & AMGP | For Average AM Unit Holder at AMGP Proposal | AR Downside Case

AM Accretion / (Dilution) - %

At 1.679x Exchange Ratio

Status Quo AM:

Pro Forma AMGP:

$ Acc / (Dil):

Exchange Ratio

$0.86

$0.78

($0.08)

PF AMGP Coverage 1.205x

$3.415

$3.415

$3.415

(9.4%)

$3.415

2H 2018E

$3.000

1.679x

1.696x

1.713x

1.730x

(12.0%)

201⁹E

Accretion / (Dilution) Analysis at Various XRs

Cash Implied

Comid. / After-Tax 2H 2018E

Unit

XR

1.732x

$2.14

$1.89

($0.26)

1.224x

(9.3%)

(9.2%)

(9.1%)

2019E

(12.0%)

(11.9%)

(2.8%)

(12.2%)

2020E

$2.58

$2.51

($0.07)

1.13 1x

2020E

(2.8%)

(2.5%)

(2.2%)

(7.3%)

(1.9%)

2021E

$2.96

$2.75

($0.22)

1.119

2021E

(6.5%)

(7.0%)

(14.6%)

202 ZE

$3.41

$2.91

($0.50)

1.076x

AM Proposal

2022E

(13.4%)

(13.1%)

AMGP Accretion / (Dilution) - %

PF AMGP Coverage

Status Quo AMGP: $0.21

Pro Forma AMGP: $0.46

$ Acc / (Dil):

$0.26

ange Ratio

1.679x

1.696x

1.713x

124.6%

1.730x

2H 2018E

1.732x

1.205x

2H 2018E

124.6%

122.5%

120.5%

118.6%

74.5%

116.9%

2019E

Accretion / (Dilution) Analysis at Various XRs

$0.64

$1.12

$0.48

1.224x

2019E

74.5%

72.98

71.4%

68.7%

69.7%

Source: Management projections and FacBet as of 8/30/2018

Note: AMGP accretion / (dilution) based on SQ AM Management Coverage. After-tax distributions is distribution from entity less attributable qualified dividends and gains on capital taxes.

Note: 1.679x implied after-tax XR represents a 1.61-4x equity XR and cash consideration of $3.415 / unit. Cash assumed to be used to eliminate unitholder tax liability.

2020E

$0.88

$1.49

$0.61

1.131x

2020E

69.7%

68.6%

67.4%

66.3%

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

65.2%

50.1%

202 1E

$1.09

$1.64

$0.55

1.11%

2021E

50.1%

49.00

45.9%

2022E

30.1%

29.7%

29.3%

28.2%

TUDORPICKERING

HOLT&COI:

EVERGY INVESTIMENT &

MERCHANT BANKING

30.1%

2022E

$1.33

$1.73

$0.40

1.076x

54View entire presentation