LionTree Investment Banking Pitch Book

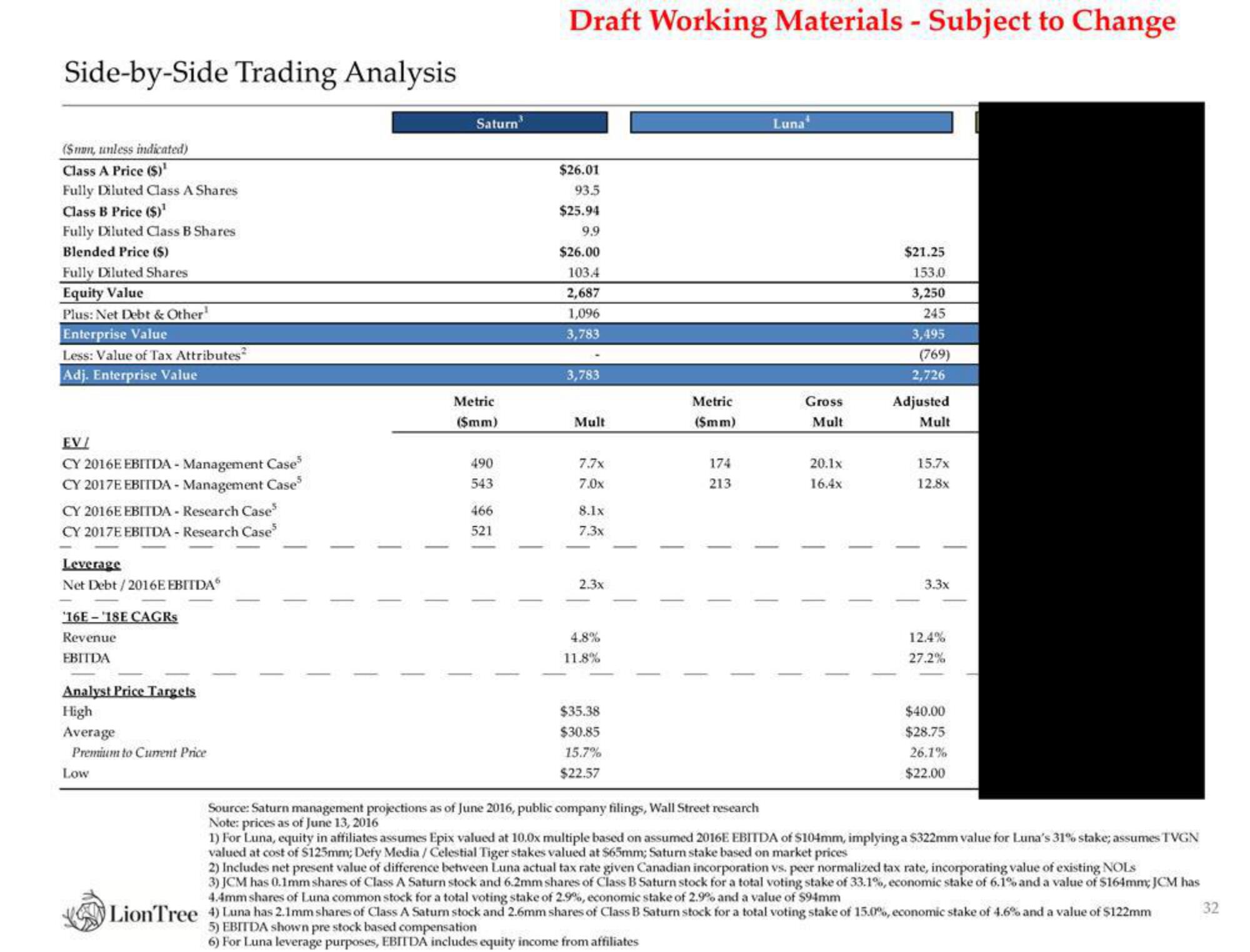

Side-by-Side Trading Analysis

(Suwn, unless indicated)

Class A Price ($)¹

Fully Diluted Class A Shares

Class B Price ($)¹

Fully Diluted Class B Shares

Blended Price ($)

Fully Diluted Shares

Equity Value

Plus: Net Debt & Other¹

Enterprise Value

Less: Value of Tax Attributes²

Adj. Enterprise Value

EV/

CY 2016EEBITDA- Management Case

CY 2017E EBITDA - Management Case

CY 2016E EBITDA- Research Case³

CY 2017E EBITDA- Research Case

Leverage

Net Debt/2016E EBITDA*

'16E-'18E CAGRs

Revenue

EBITDA

Analyst Price Targets

High

Average

Premium to Curent Price

Low

Saturn

Metric

($mm)

490

543

466

521

Draft Working Materials - Subject to Change

$26.01

93.5

$25.94

9.9

$26.00

103.4

2,687

1,096

3,783

3,783

Mult

7.7x

7.0x

8.1x

7.3x

2.3x

4.8%

11.8%

$35.38

$30.85

15.7%

$22.57

Metric

($mm)

174

213

Luna

Gross

Mult

20.1x

16.4x

$21.25

153.0

3,250

245

3,495

(769)

2,726

Adjusted

Mult

15.7x

12.8x

3.3x

12.4%

27.2%

$40.00

$28.75

26.1%

$22.00

Source: Saturn management projections as of June 2016, public company filings, Wall Street research

Note: prices as of June 13, 2016

1) For Luna, equity in affiliates assumes Epix valued at 10.0x multiple based on assumed 2016E EBITDA of $104mm, implying a $322mm value for Luna's 31% stake; assumes TVGN

valued at cost of $125mm; Defy Media / Celestial Tiger stakes valued at $65mm; Saturn stake based on market prices

2) Includes net present value of difference between Luna actual tax rate given Canadian incorporation vs. peer normalized tax rate, incorporating value of existing NOLS

3) JCM has 0.1mm shares of Class A Saturn stock and 6.2mm shares of Class B Saturn stock for a total voting stake of 33.1%, economic stake of 6.1% and a value of $164mm; JCM has

4.4mm shares of Luna common stock for a total voting stake of 2.9%, economic stake of 2.9% and a value of $94mm

32

LionTree 4) Luna has 2.1mm shares of Class A Saturn stock and 2.6mm shares of Class B Saturn stock for a total voting stake of 15.0%, economic stake of 4.6% and a value of $122mm

5) EBITDA shown pre stock based compensation

6) For Luna leverage purposes, EBITDA includes equity income from affiliatesView entire presentation