Baird Investment Banking Pitch Book

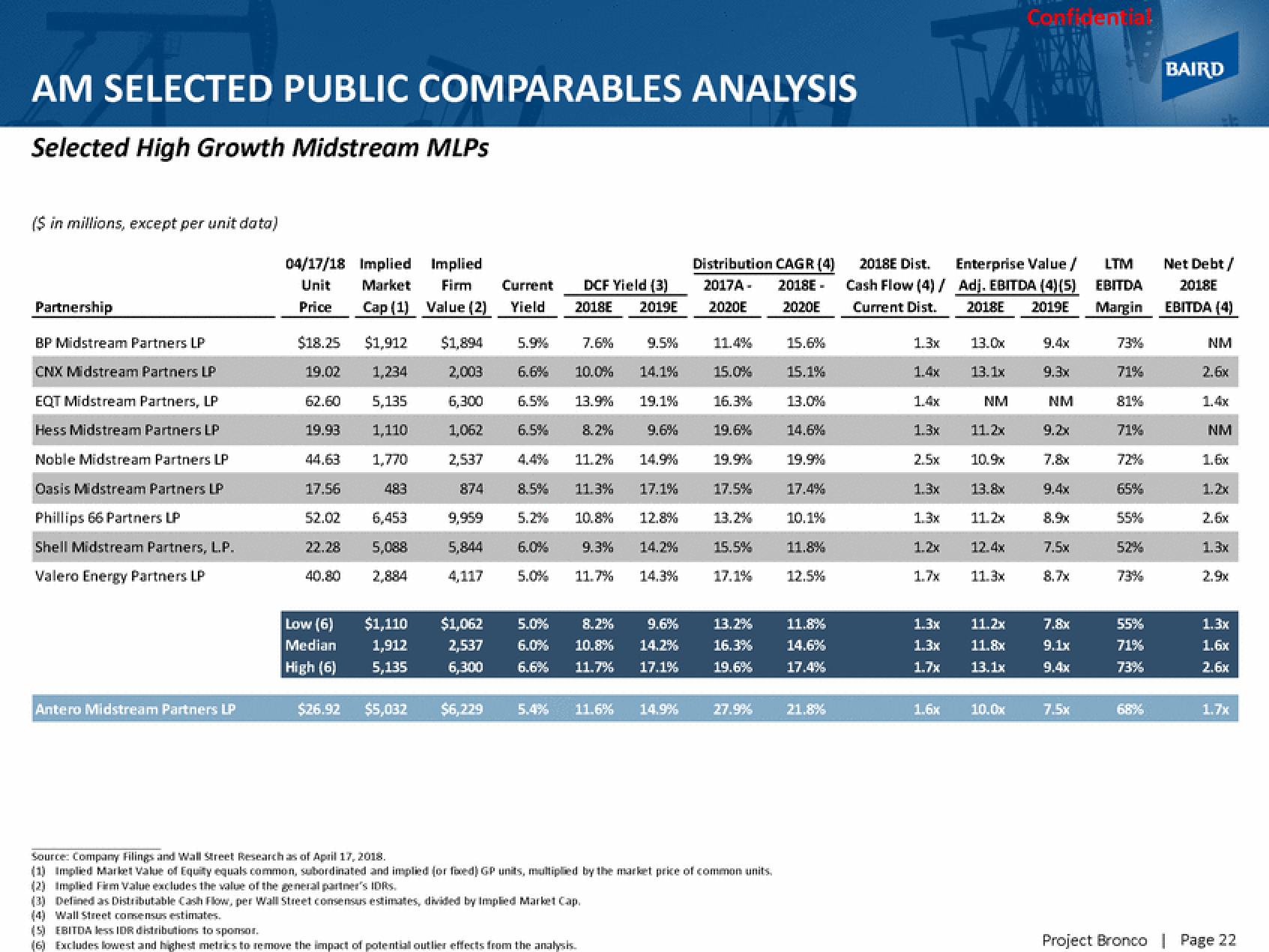

AM SELECTED PUBLIC COMPARABLES ANALYSIS

Selected High Growth Midstream MLPS

($ in millions, except per unit data)

Partnership

BP Midstream Partners LP

CNX Midstream Partners LP

EQT Midstream Partners, LP

Hess Midstream Partners LP

Noble Midstream Partners LP

Oasis Midstream Partners LP

Phillips 66 Partners LP

Shell Midstream Partners, L.P.

Valero Energy Partners LP

Antero Midstream Partners LP

04/17/18 Implied Implied

Unit Market Firm

Cap (1) Value (2)

Price

$18.25

$1,912

19.02

1,234

62.60

5,135

19.93 1,110

44.63

1,770

17.56

483

6,453

52.02

22.28 5,088

40.80

2,884

Low (6)

Median

High (6)

Current

Yield

$1,110

1,912

5,135

$1,894 5.9%

2,003 6.6%

6,300

1,062

2,537

874

DCF Yield (3)

2018E 2019E

7.6% 9.5%

10.0% 14.1%

6.5% 13.9% 19.1%

6.5%

8.2%

9.6%

11.2% 14.9%

8.5%

11.3% 17.1%

9,959 5.2% 10.8% 12.8%

5,844

4,117

6.0% 9.3% 14.2%

5.0% 11.7% 14.3%

$1,062

9.6%

5.0%

2,537 6.0%

6,300 6.6% 11.7% 17.1%

8.2%

10.8% 14.2%

$26.92 $5,032 $6,229 5.4% 11.6% 14.9%

Distribution CAGR (4)

2017A- 2018E-

2020E

2020E

11.4%

15.0%

16.3%

19.6%

19.9%

17.5%

13.2%

15.5%

17.1%

13.2%

16.3%

19.6%

27.9%

Source: Company Filings and Wall Street Research as of April 17, 2018.

(1) Implied Market Value of Equity equals common, subordinated and implied (or foxed) GP units, multiplied by the market price of common units.

(2) Implied Firm Value excludes the value of the general partner's IDRS.

(3) Defined as Distributable Cash Flow, per Wall Street consensus estimates, divided by Implied Market Cap.

(4) Wall Street consensus estimates.

(5) EBITDA less IDR distributions to sponsor.

(6) Excludes lowest and highest metrics to remove the impact of potential outlier effects from the analysis.

15.6%

15.1%

13.0%

14.6%

19.9%

17.4%

10.1%

11.8%

12.5%

11.8%

14.6%

17.4%

21.8%

2018E Dist.

Cash Flow (4) /

Current Dist.

13.0x

1.3x

1.4x 13.1x

NM

11.2x

1.3x

2.5x

10.9x

1.3x 13.8x

1.3x

11.2x

1.2x

12.4x

1.7x 11.3x

1.4x

Enterprise Value /

Adj. EBITDA (4)(5)

2018E 2019E

1.3x 11.2x

1.3x

11.8x

1.7x 13.1x

1.6x

Confidential

10.0x

9.3x

NM

9.2x

9.4x

8.9x

7.5x

8.7x

7.8x

9.1x

9.4x

7.5x

LTM

EBITDA

Margin

73%

71%

81%

71%

72%

65%

55%

52%

73%

55%

71%

73%

68%

BAIRD

Net Debt/

2018E

EBITDA (4)

NM

2.6x

1.4x

NM

1.6x

1.2x

2.6x

1.3x

2.9x

1.3x

1.6x

2.6x

1.7x

Project Bronco | Page 22View entire presentation