Disney Shareholder Engagement Presentation Deck

Disney has a strong, highly rated, investment grade balance sheet

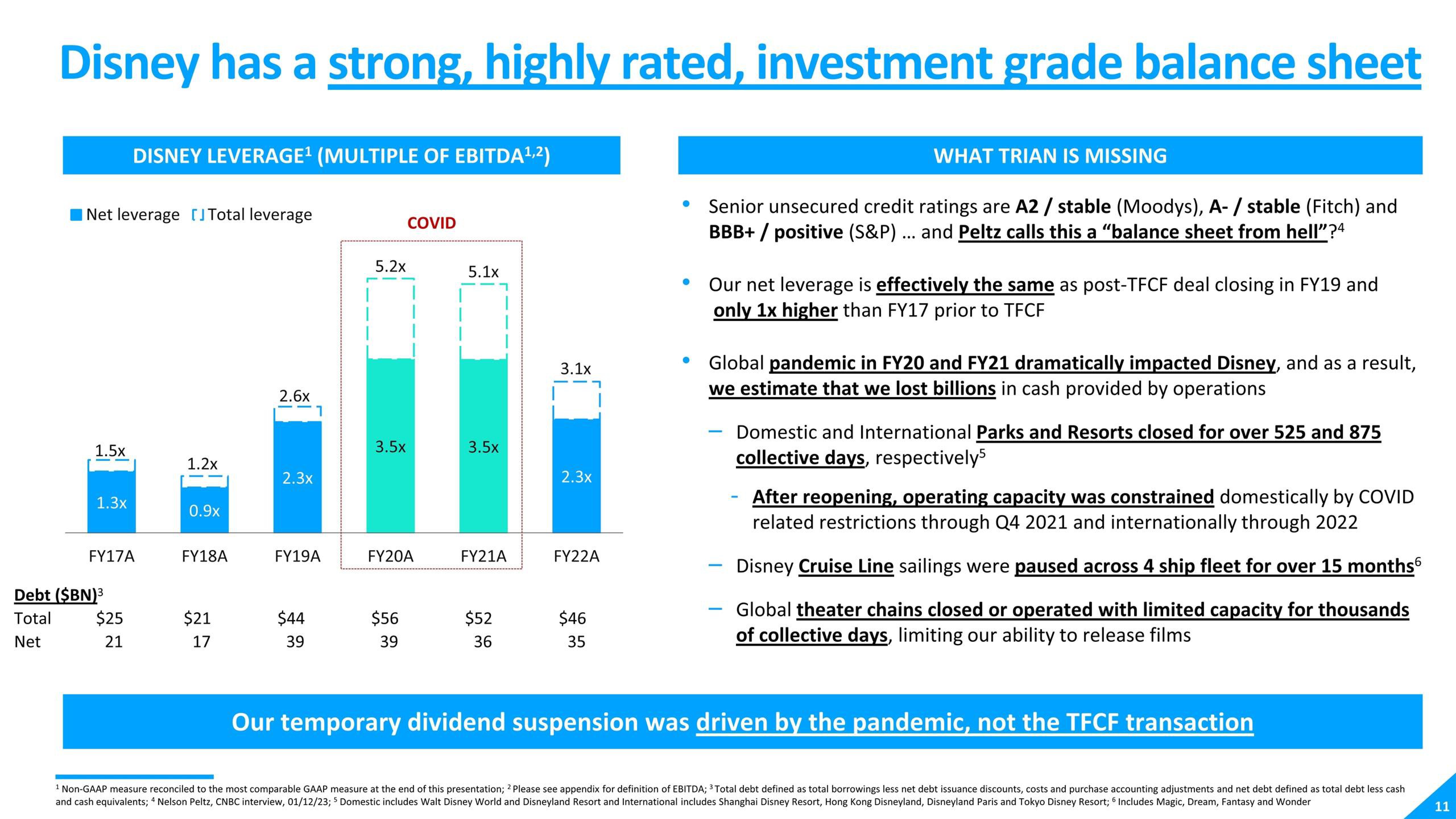

Net leverage [] Total leverage

1.5x

1.3x

DISNEY LEVERAGE¹ (MULTIPLE OF EBITDA ¹,²)

FY17A

Debt ($BN)³

Total

Net

$25

21

1.2x

0.9x

FY18A

$21

17

2.6x

-1

2.3x

FY19A

$44

39

5.2x

3.5x

COVID

FY20A

$56

39

5.1x

3.5x

FY21A

$52

36

3.1x

2.3x

FY22A

$46

35

●

WHAT TRIAN IS MISSING

Senior unsecured credit ratings are A2 / stable (Moodys), A-/stable (Fitch) and

BBB+ / positive (S&P) ... and Peltz calls this a “balance sheet from hell"?4

Our net leverage is effectively the same as post-TFCF deal closing in FY19 and

only 1x higher than FY17 prior to TFCF

Global pandemic in FY20 and FY21 dramatically impacted Disney, and as a result,

we estimate that we lost billions in cash provided by operations

Domestic and International Parks and Resorts closed for over 525 and 875

collective days, respectively5

After reopening, operating capacity was constrained domestically by COVID

related restrictions through Q4 2021 and internationally through 2022

Disney Cruise Line sailings were paused across 4 ship fleet for over 15 months6

Global theater chains closed or operated with limited capacity for thousands

of collective days, limiting our ability to release films

Our temporary dividend suspension was driven by the pandemic, not the TFCF transaction

1 Non-GAAP measure reconciled to the most comparable GAAP measure at the end of this presentation; 2 Please see appendix for definition of EBITDA; ³ Total debt defined as total borrowings less net debt issuance discounts, costs and purchase accounting adjustments and net debt defined as total debt less cash

and cash equivalents; 4 Nelson Peltz, CNBC interview, 01/12/23; 5 Domestic includes Walt Disney World and Disneyland Resort and International includes Shanghai Disney Resort, Hong Kong Disneyland, Disneyland Paris and Tokyo Disney Resort; 6 Includes Magic, Dream, Fantasy and Wonder

11View entire presentation