2011 and Fourth Quarter Results

Q4 2011 earnings review

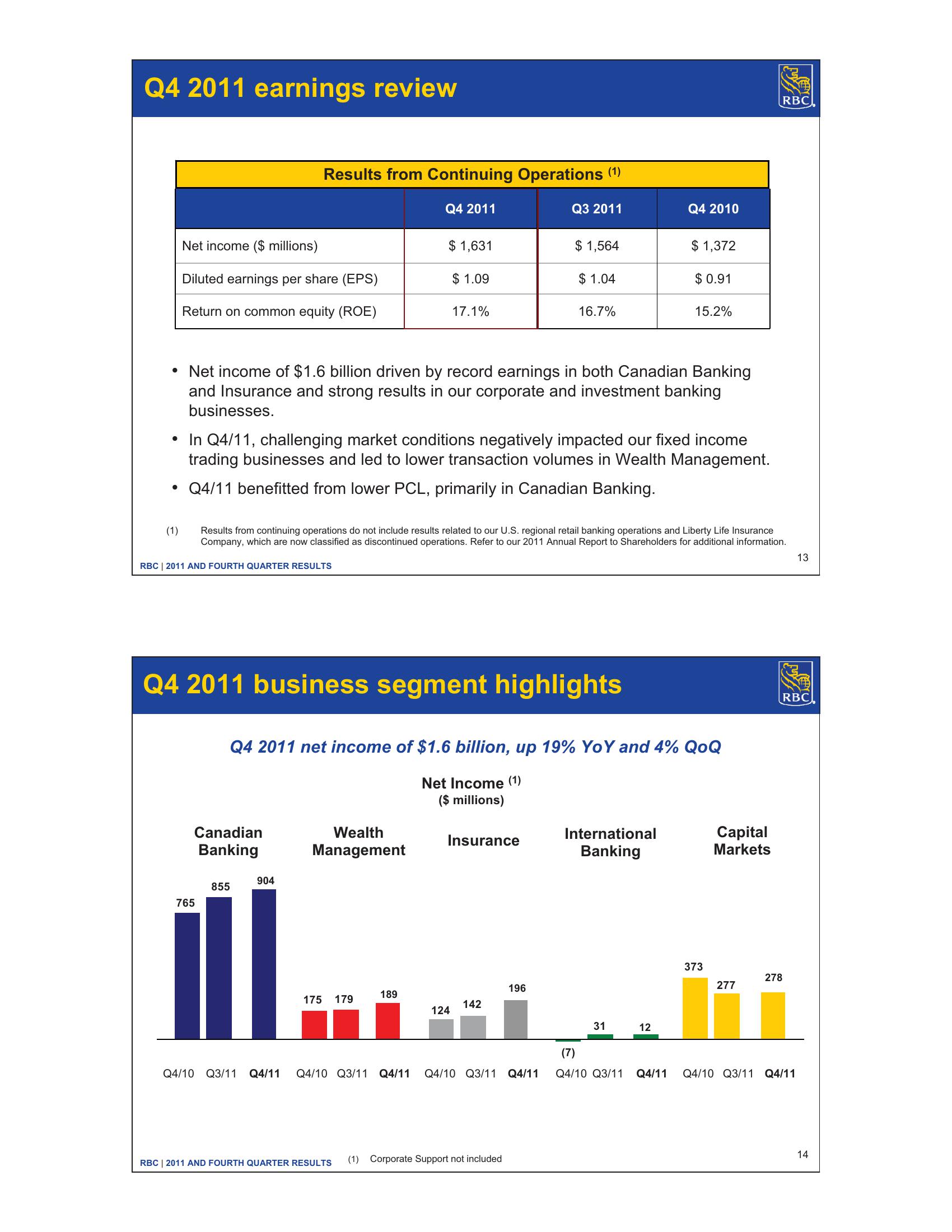

Results from Continuing Operations (1)

Q4 2011

Q3 2011

Q4 2010

Net income millions)

$ 1,631

$ 1,564

$ 1,372

Diluted earnings per share (EPS)

$ 1.09

$ 1.04

$ 0.91

Return on common equity (ROE)

17.1%

16.7%

15.2%

• Net income of $1.6 billion driven by record earnings in both Canadian Banking

and Insurance and strong results in our corporate and investment banking

businesses.

⚫ In Q4/11, challenging market conditions negatively impacted our fixed income

trading businesses and led to lower transaction volumes in Wealth Management.

• Q4/11 benefitted from lower PCL, primarily in Canadian Banking.

(1)

Results from continuing operations do not include results related to our U.S. regional retail banking operations and Liberty Life Insurance

Company, which are now classified as discontinued operations. Refer to our 2011 Annual Report to Shareholders for additional information.

RBC 2011 AND FOURTH QUARTER RESULTS

Q4 2011 business segment highlights

Q4 2011 net income of $1.6 billion, up 19% YoY and 4% QoQ

Canadian

Banking

904

855

765

Wealth

Management

Net Income (1)

($ millions)

Insurance

International

Banking

Capital

Markets

196

175 179

189

142

124

373

278

277

RBC

13

RBC

31

12

(7)

Q4/10 Q3/11 Q4/11 Q4/10 Q3/11 Q4/11 Q4/10 Q3/11 Q4/11

Q4/10 Q3/11 Q4/11 Q4/10 Q3/11 Q4/11

RBC 2011 AND FOURTH QUARTER RESULTS (1) Corporate Support not included

14View entire presentation