J.P.Morgan Results Presentation Deck

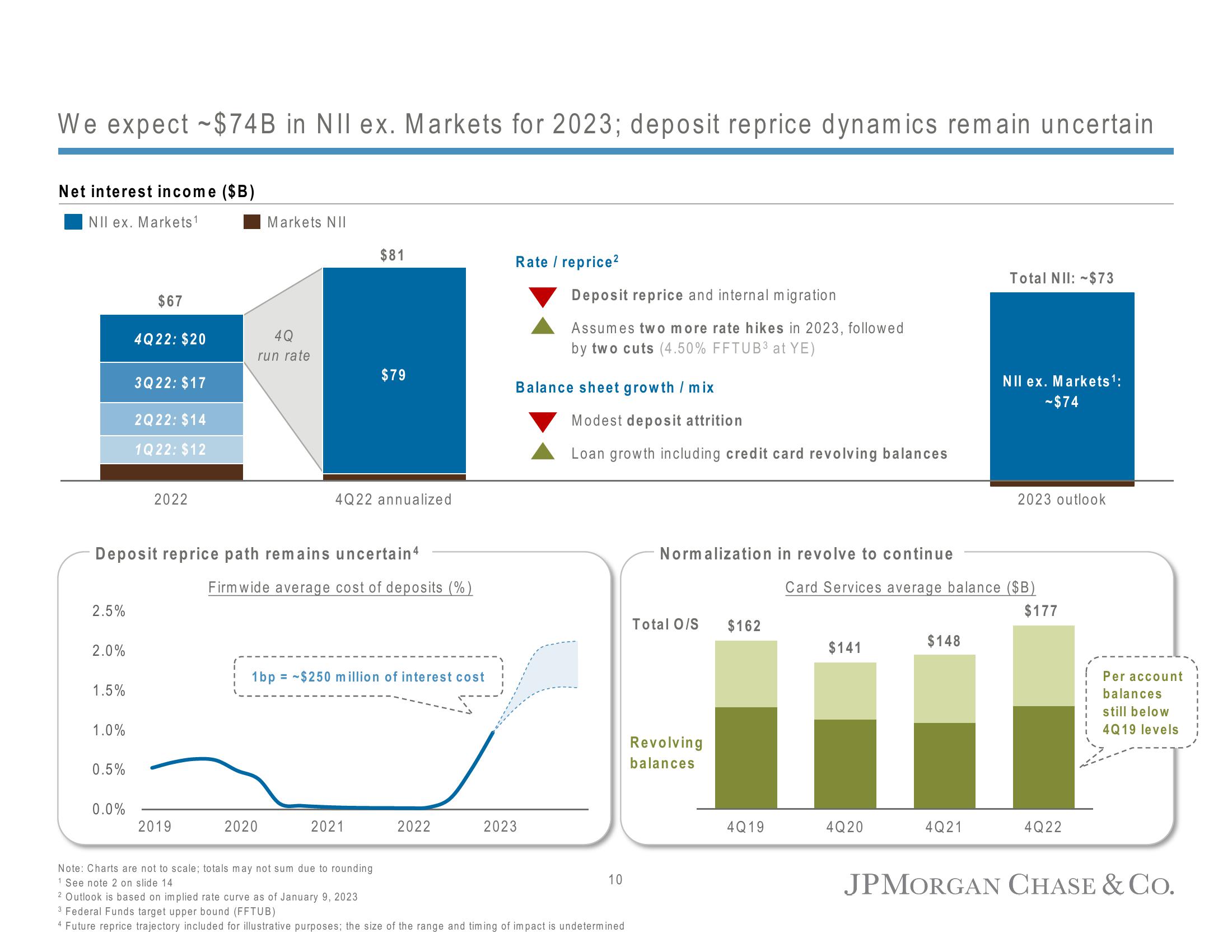

We expect -$74B in NII ex. Markets for 2023; deposit reprice dynamics remain uncertain

Net interest income ($B)

NII ex. Markets ¹

2.5%

2.0%

1.5%

1.0%

0.5%

$67

0.0%

4Q22: $20

3Q22: $17

2Q22: $14

1Q22: $12

2022

Deposit reprice path remains uncertain4

2019

Markets NII

4Q

run rate

$81

2020

$79

4Q22 annualized

Firm wide average cost of deposits (%)

1bp = $250 million of interest cost

2021

2022

Rate / reprice²

Deposit reprice and internal migration

Assumes two more rate hikes in 2023, followed

by two cuts (4.50% FFTUB3 at YE)

Balance sheet growth / mix

2023

Modest deposit attrition

Loan growth including credit card revolving balances

Note: Charts are not to scale; totals may not sum due to rounding

1 See note 2 on slide 14

2 Outlook is based on implied rate curve of January 9, 2023

3 Federal Funds target upper bound (FFTUB)

4 Future reprice trajectory included for illustrative purposes; the size of the range and timing of impact is undetermined

10

Normalization in revolve to continue

Total O/S

Revolving

balances

$162

4Q19

$141

4Q20

Card Services average balance ($B)

$177

$148

Total NII: $73

4Q21

NII ex. Markets ¹:

- $74

2023 outlook

4Q22

Per account

balances

still below

4Q19 levels

JPMORGAN CHASE & Co.View entire presentation