Pathward Financial Results Presentation Deck

ASSET QUALITY

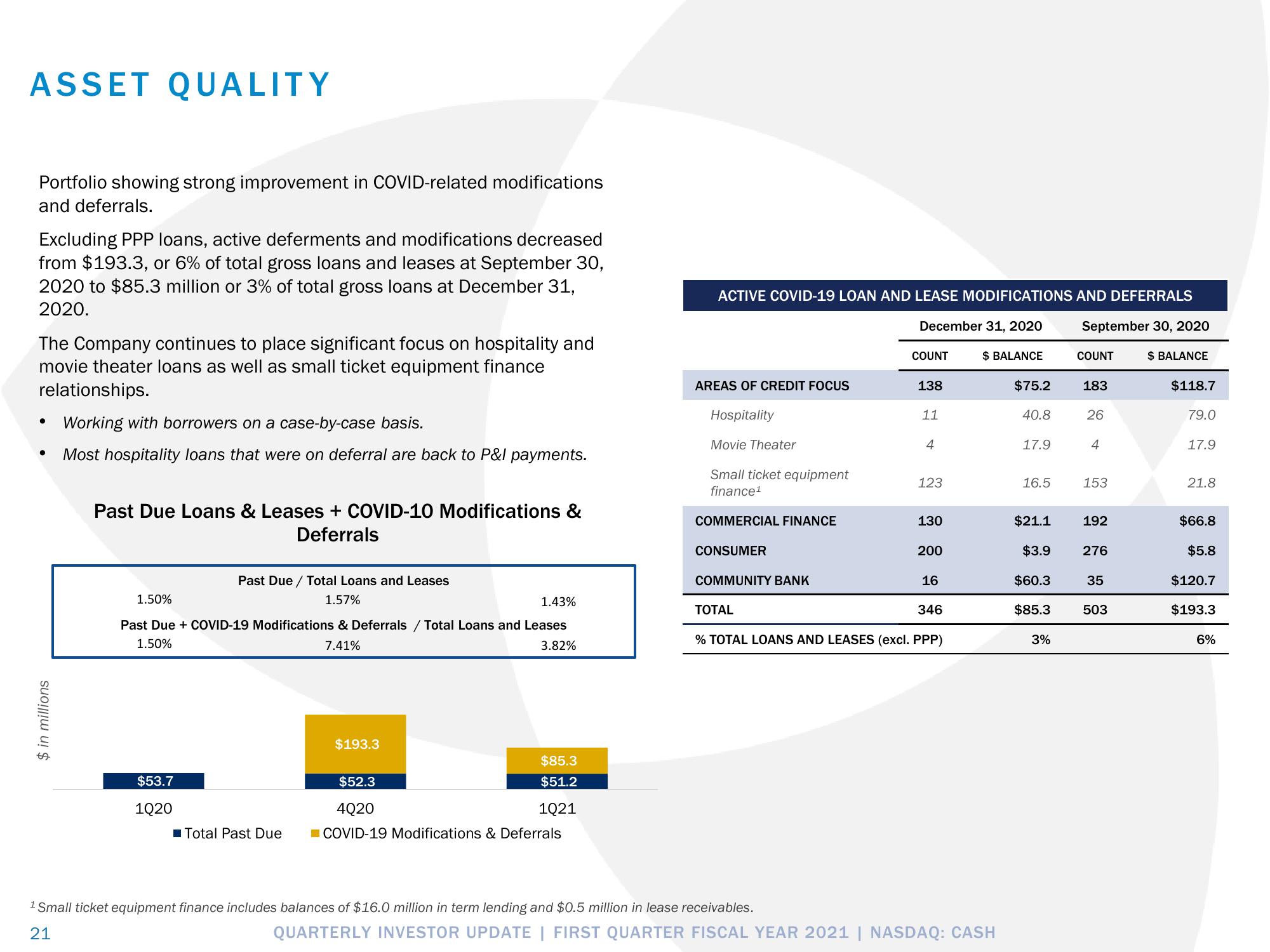

Portfolio showing strong improvement in COVID-related modifications

and deferrals.

Excluding PPP loans, active deferments and modifications decreased

from $193.3, or 6% of total gross loans and leases at September 30,

2020 to $85.3 million or 3% of total gross loans at December 31,

2020.

The Company continues to place significant focus on hospitality and

movie theater loans as well as small ticket equipment finance

relationships.

●

●

$ in millions

Working with borrowers on a case-by-case basis.

Most hospitality loans that were on deferral are back to P&l payments.

Past Due Loans & Leases + COVID-10 Modifications &

Deferrals

Past Due / Total Loans and Leases

1.57%

1.50%

1.43%

Past Due + COVID-19 Modifications & Deferrals / Total Loans and Leases

1.50%

7.41%

3.82%

$53.7

1020

Total Past Due

$193.3

$85.3

$51.2

1021

$52.3

4Q20

COVID-19 Modifications & Deferrals

ACTIVE COVID-19 LOAN AND LEASE MODIFICATIONS AND DEFERRALS

September 30, 2020

December 31, 2020

AREAS OF CREDIT FOCUS

Hospitality

Movie Theater

Small ticket equipment

finance¹

COMMERCIAL FINANCE

CONSUMER

COMMUNITY BANK

TOTAL

COUNT

¹ Small ticket equipment finance includes balances of $16.0 million in term lending and $0.5 million in lease receivables.

21

138

11

130

200

16

346

% TOTAL LOANS AND LEASES (excl. PPP)

4

123

$ BALANCE

QUARTERLY INVESTOR UPDATE | FIRST QUARTER FISCAL YEAR 2021 | NASDAQ: CASH

$75.2

40.8

17.9

16.5

$21.1

$3.9

$60.3

$85.3

3%

COUNT

183

26

4

153

192

276

35

503

$ BALANCE

$118.7

79.0

17.9

21.8

$66.8

$5.8

$120.7

$193.3

6%View entire presentation