First Busey Results Presentation Deck

First Busey Corporation | Ticker: BUSE

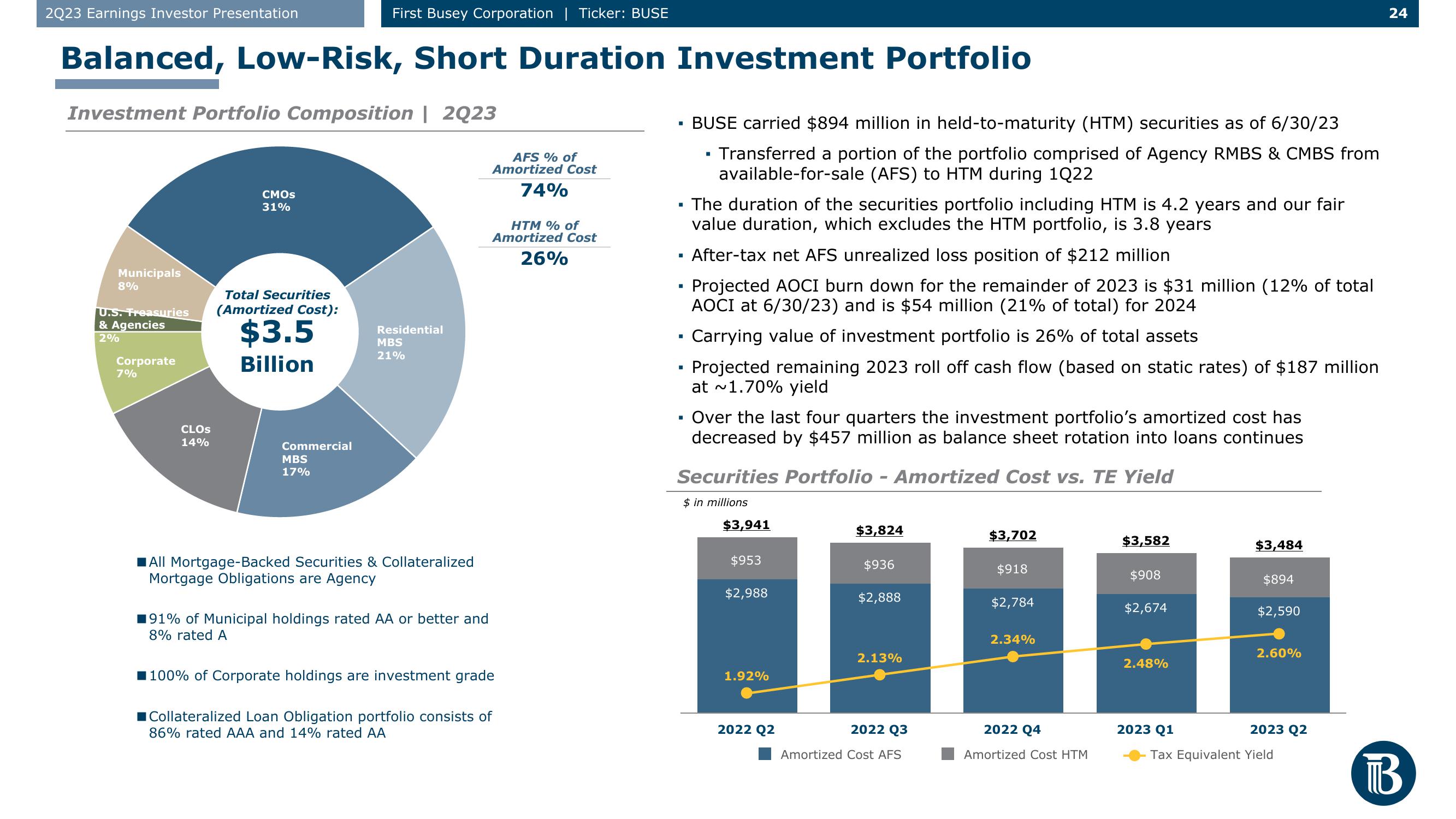

Balanced, Low-Risk, Short Duration Investment Portfolio

Investment Portfolio Composition | 2023

2Q23 Earnings Investor Presentation

Municipals

8%

U.S. Treasuries

& Agencies

2%

Corporate

7%

CLOS

14%

CMOS

31%

Total Securities

(Amortized Cost):

$3.5

Billion

Commercial

MBS

17%

Residential

MBS

21%

All Mortgage-Backed Securities & Collateralized

Mortgage Obligations are Agency

■91% of Municipal holdings rated AA or better and

8% rated A

AFS % of

Amortized Cost

74%

HTM % of

Amortized Cost

26%

100% of Corporate holdings are investment grade

Collateralized Loan Obligation portfolio consists of

86% rated AAA and 14% rated AA

■

■

■

■

BUSE carried $894 million in held-to-maturity (HTM) securities as of 6/30/23

Transferred a portion of the portfolio comprised of Agency RMBS & CMBS from

available-for-sale (AFS) to HTM during 1Q22

■

The duration of the securities portfolio including HTM is 4.2 years and our fair

value duration, which excludes the HTM portfolio, is 3.8 years

After-tax net AFS unrealized loss position of $212 million

Projected AOCI burn down for the remainder of 2023 is $31 million (12% of total

AOCI at 6/30/23) and is $54 million (21% of total) for 2024

Carrying value of investment portfolio is 26% of total assets

Projected remaining 2023 roll off cash flow (based on static rates) of $187 million

at ~1.70% yield

Over the last four quarters the investment portfolio's amortized cost has

decreased by $457 million as balance sheet rotation into loans continues

Securities Portfolio - Amortized Cost vs. TE Yield

$ in millions

$3,941

$953

$2,988

1.92%

2022 Q2

$3,824

$936

$2,888

2.13%

2022 Q3

Amortized Cost AFS

$3,702

$918

$2,784

2.34%

2022 Q4

Amortized Cost HTM

$3,582

$908

$2,674

2.48%

2023 Q1

$3,484

$894

$2,590

2.60%

2023 Q2

Tax Equivalent Yield

24

BView entire presentation