Confluent IPO Presentation Deck

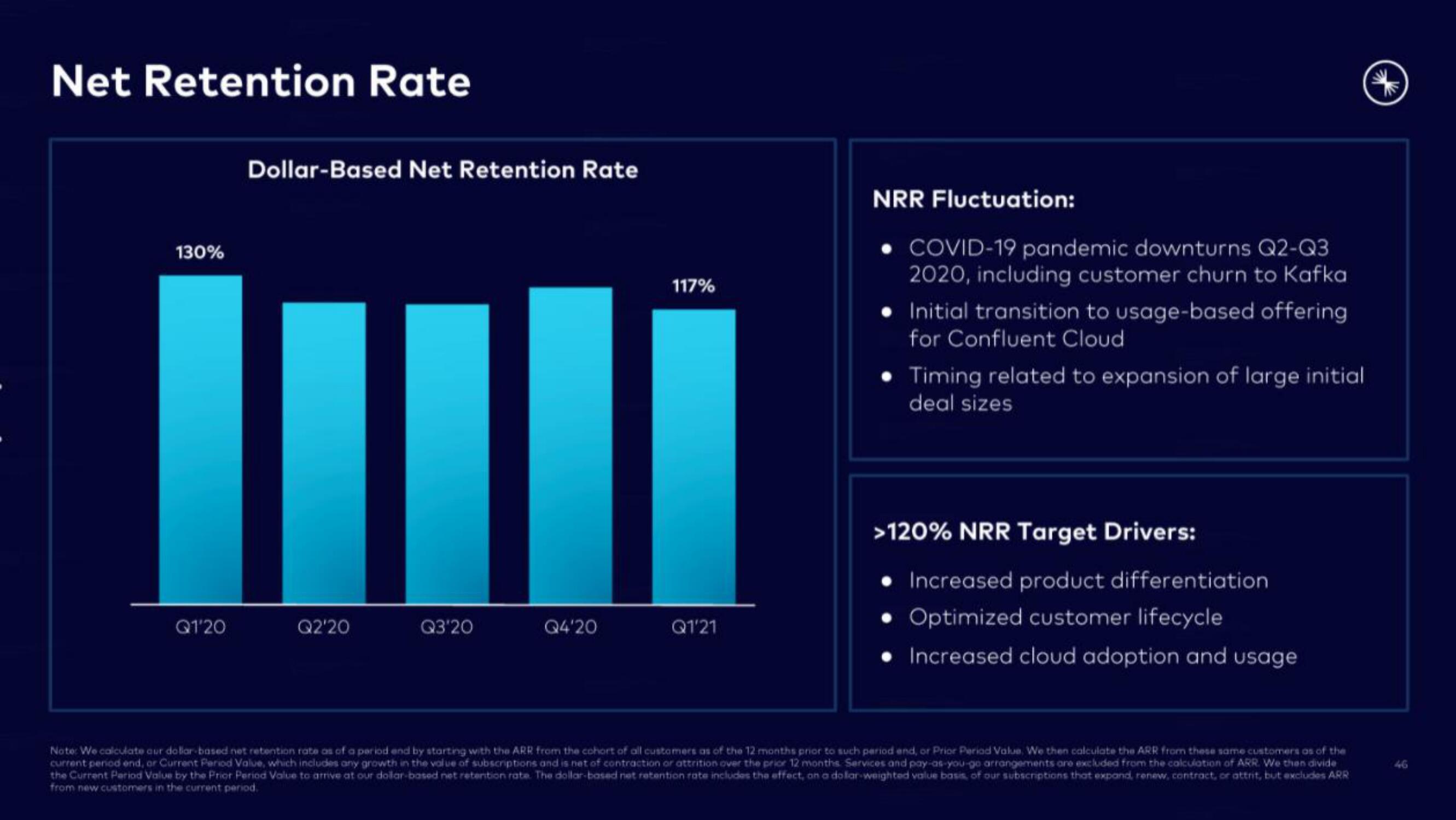

Net Retention Rate

130%

Q1'20

Dollar-Based Net Retention Rate

TIT

Q2'20

Q3'20

117%

Q4'20

Q1'21

NRR Fluctuation:

COVID-19 pandemic downturns Q2-Q3

2020, including customer churn to Kafka

• Initial transition to usage-based offering

for Confluent Cloud

Timing related to expansion of large initial

deal sizes

>120% NRR Target Drivers:

• Increased product differentiation.

• Optimized customer lifecycle

• Increased cloud adoption and usage

Note: We calculate our dollar-based net retention rate as of a period end by starting with the ARR from the cohort of all customers as of the 12 months prior to such period and, or Prior Period Value. We then calculate the ARR from these same customers as of the

current period end, or Current Period Value, which includes any growth in the value of subscriptions and is net of contraction or attrition over the prior 12 months Services and pay-as-you-go arrangements are excluded from the calculation of ARR. We then divide

the Current Period Value by the Prior Period Value to arrive at our dollar-based net retention rate. The dollar-based net retention rate includes the effect, on a dollar-weighted value basis of our subscriptions that expand, renew, contract, or attrit, but excludes ARR

from new customers in the current period.View entire presentation