J.P.Morgan Results Presentation Deck

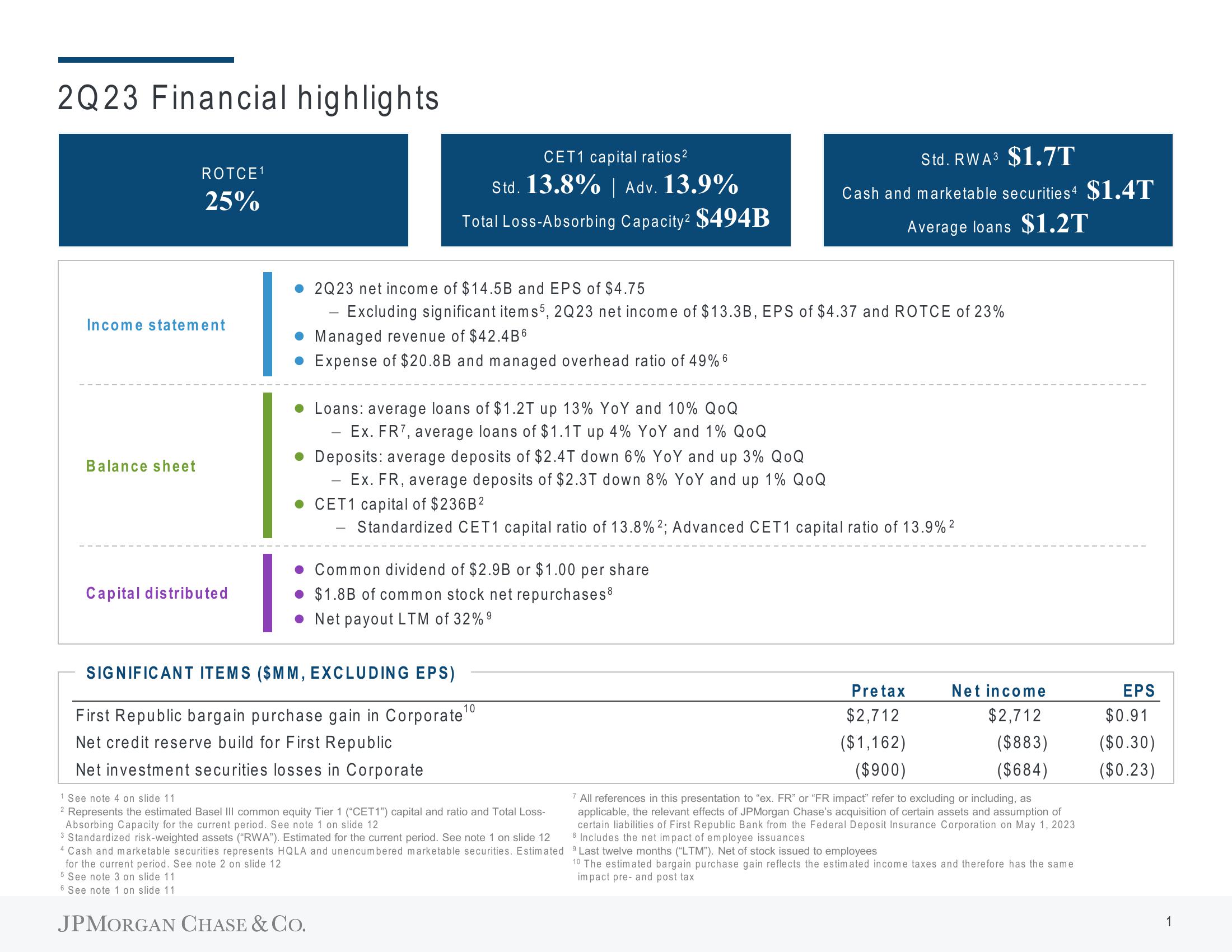

2Q23 Financial highlights

ROTCE¹

25%

Income statement

Balance sheet

Capital distributed

CET1 capital ratios²

Std. 13.8% | Adv. 13.9%

Total Loss-Absorbing Capacity² $494B

2Q23 net income of $14.5B and EPS of $4.75

Excluding significant items 5, 2Q23 net income of $13.3B, EPS of $4.37 and ROTCE of 23%

• Managed revenue of $42.4B6

Expense of $20.8B and managed overhead ratio of 49% 6

Loans: average loans of $1.2T up 13% YoY and 10% QOQ

Ex. FR7, average loans of $1.1T up 4% YoY and 1% QOQ

• Deposits: average deposits of $2.4T down 6% YoY and up 3% QoQ

Ex. FR, average deposits of $2.3T down 8% YoY and up 1% QOQ

CET1 capital of $236B²

Standardized CET1 capital ratio of 13.8% 2; Advanced CET1 capital ratio of 13.9% ²

-

• Common dividend of $2.9B or $1.00 per share

$1.8B of common stock net repurchases8

Net payout LTM of 32% 9

SIGNIFICANT ITEMS ($MM, EXCLUDING EPS)

10

First Republic bargain purchase gain in Corporate ¹0

Net credit reserve build for First Republic

Net investment securities losses in Corporate

JPMORGAN CHASE & CO.

Std. RWA3 $1.7T

Cash and marketable securities4 $1.4T

Average loans $1.2T

1 See note 4 on slide 11

2 Represents the estimated Basel III common equity Tier 1 ("CET1") capital and ratio and Total Loss-

Absorbing Capacity for the current period. See note 1 on slide 12

3 Standardized risk-weighted assets ("RWA"). Estimated for the current period. See note 1 on slide 12

4 Cash and marketable securities represents HQLA and unencumbered marketable securities. Estimated

for the current period. See note 2 on slide 12

5 See note 3 on slide 11.

6 See note 1 on slide 11.

Pretax

$2,712

($1,162)

($900)

Net income

$2,712

($883)

($684)

7 All references in this presentation to "ex. FR" or "FR impact" refer to excluding or including, as

applicable, the relevant effects of JPMorgan Chase's acquisition of certain assets and assumption of

certain liabilities of First Republic Bank from the Federal Deposit Insurance Corporation on May 1, 2023

8 Includes the net impact of employee issuances

Last twelve months ("LTM"). Net of stock issued to employees

10 The estimated bargain purchase gain reflects the estimated income taxes and therefore has the same

impact pre- and post tax

EPS

$0.91

($0.30)

($0.23)

1View entire presentation