Antofagasta Investor Update

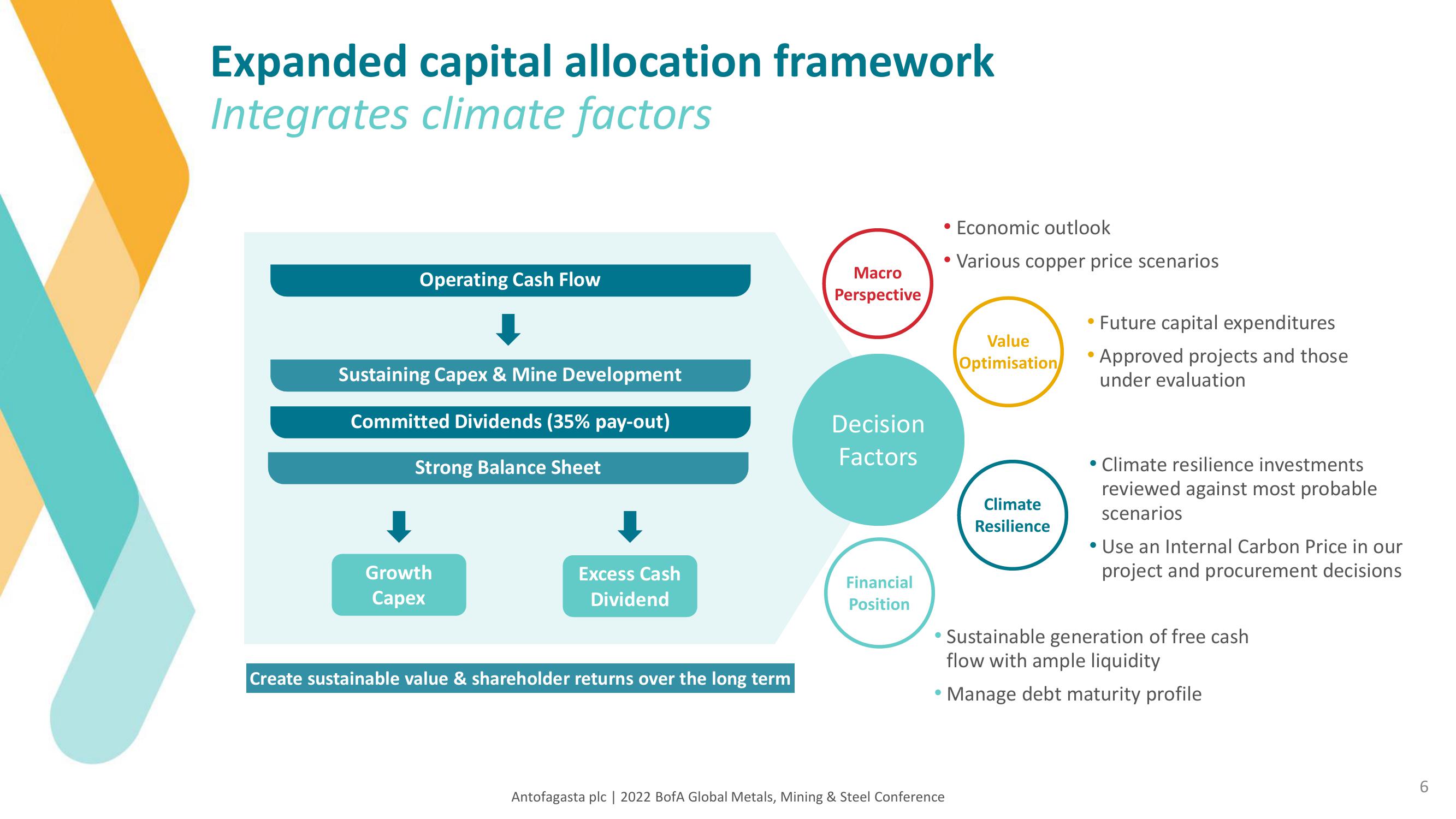

Expanded capital allocation framework

Integrates climate factors

Operating Cash Flow

Sustaining Capex & Mine Development

Committed Dividends (35% pay-out)

Strong Balance Sheet

Growth

Capex

Excess Cash

Dividend

Create sustainable value & shareholder returns over the long term

Macro

Perspective

Decision

Factors

Financial

Position

•

Economic outlook

• Various copper price scenarios

●

Value

Optimisation

Antofagasta plc | 2022 BofA Global Metals, Mining & Steel Conference

Climate

Resilience

• Future capital expenditures

Approved projects and those

under evaluation

●

●

Climate resilience investments

reviewed against most probable

scenarios

• Use an Internal Carbon Price in our

project and procurement decisions

Sustainable generation of free cash

flow with ample liquidity

●

• Manage debt maturity profile

6View entire presentation