KKR Real Estate Finance Trust Results Presentation Deck

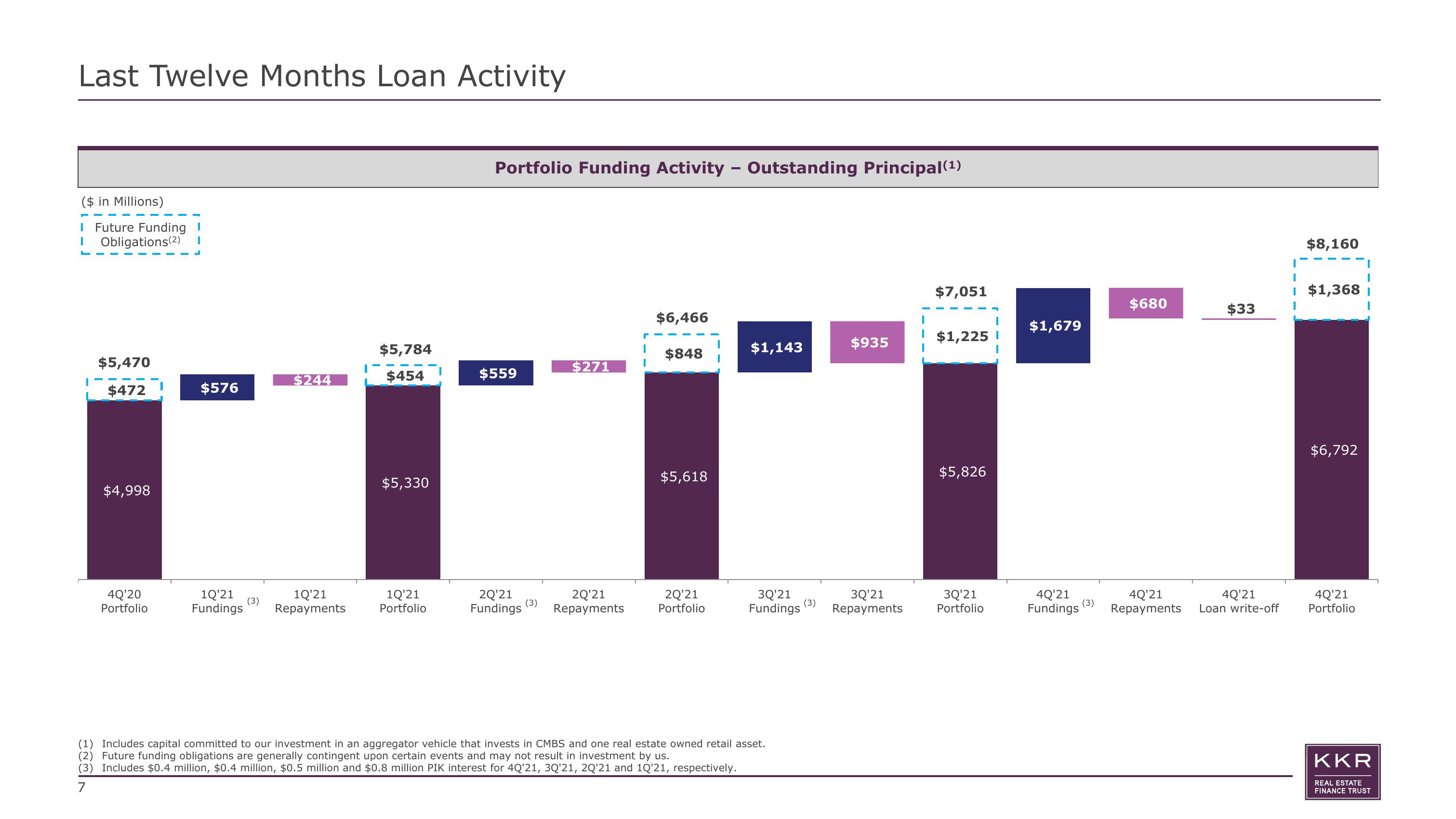

Last Twelve Months Loan Activity

($ in Millions)

I Future Funding I

Obligations (2) I

$5,470

$472

$4,998

4Q'20

Portfolio

$576

$244

1Q¹21

1Q'21

Fundings Repayments

(3)

$5,784

$454

$5,330

1Q'21

Portfolio

Portfolio Funding Activity - Outstanding Principal (¹)

$559

$271

2Q¹21

2Q¹21

Fundings Repayments

(3)

$6,466

$848

$5,618

2Q¹21

Portfolio

$1,143

3Q'21

3Q'21

Fundings Repayments

(1) Includes capital committed to our investment in an aggregator vehicle that invests in CMBS and one real estate owned retail asset.

(2) Future funding obligations are generally contingent upon certain events and may not result in investment by us.

(3) Includes $0.4 million, $0.4 million, $0.5 million and $0.8 million PIK interest for 4Q'21, 3Q'21, 2Q'21 and 1Q'21, respectively.

7

$935

(3)

$7,051

$1,225

$5,826

3Q'21

Portfolio

$1,679

$680

(3)

$33

4Q'21

4Q'21

4Q'21

Fundings Repayments Loan write-off

$8,160

$1,368

$6,792

4Q'21

Portfolio

KKR

REAL ESTATE

FINANCE TRUSTView entire presentation