dLocal Results Presentation Deck

Adjusted

EBITDA

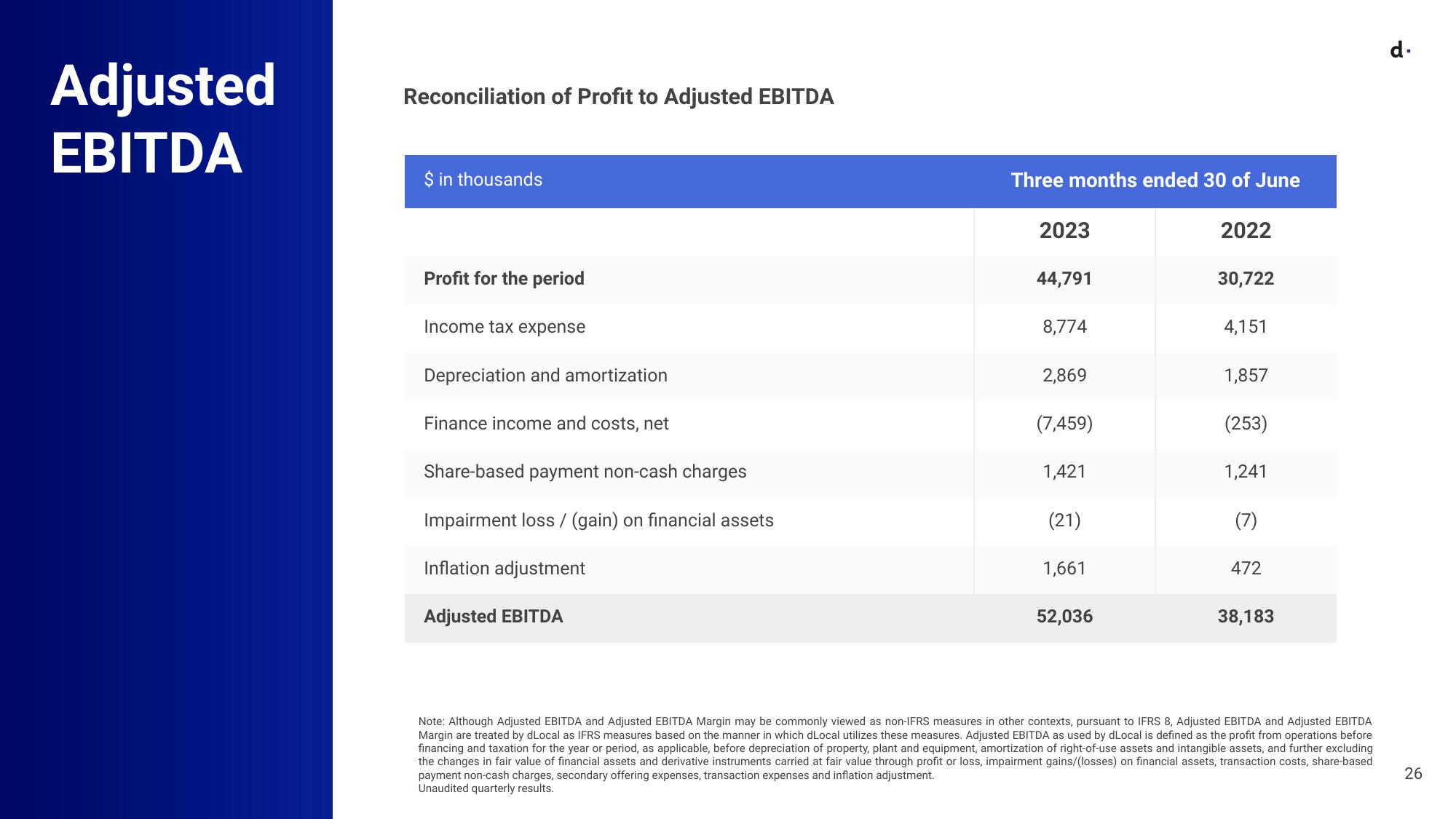

Reconciliation of Profit to Adjusted EBITDA

$ in thousands

Profit for the period

Income tax expense

Depreciation and amortization

Finance income and costs, net

Share-based payment non-cash charges

Impairment loss/ (gain) on financial assets

Inflation adjustment

Adjusted EBITDA

Three months ended 30 of June

2023

44,791

8,774

2,869

(7,459)

1,421

(21)

1,661

52,036

2022

30,722

4,151

1,857

(253)

1,241

(7)

472

38,183

Note: Although Adjusted EBITDA and Adjusted EBITDA Margin may be commonly viewed as non-IFRS measures in other contexts, pursuant to IFRS 8, Adjusted EBITDA and Adjusted EBITDA

Margin are treated by dLocal as IFRS measures based on the manner in which dLocal utilizes these measures. Adjusted EBITDA as used by dLocal is defined as the profit from operations before

financing and taxation for the year or period, as applicable, before depreciation of property, plant and equipment, amortization of right-of-use assets and intangible assets, and further excluding

the changes in fair value of financial assets and derivative instruments carried at fair value through profit or loss, impairment gains/(losses) on financial assets, transaction costs, share-based

payment non-cash charges, secondary offering expenses, transaction expenses and inflation adjustment.

Unaudited quarterly results.

d.

26View entire presentation